East of Suez Market Update 3 Oct 2024

Prices in East of Suez ports have moved down, while VLSFO and LSMGO availability remains tight across several Indian ports.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices down in Zhoushan ($25/mt), Fujairah ($11/mt) and Singapore ($10/mt)

- LSMGO prices down in Singapore ($11/mt), Fujairah and Zhoushan ($6/mt)

- HSFO prices down in Singapore ($5/mt), Zhoushan ($3/mt) and Fujairah ($1/mt)

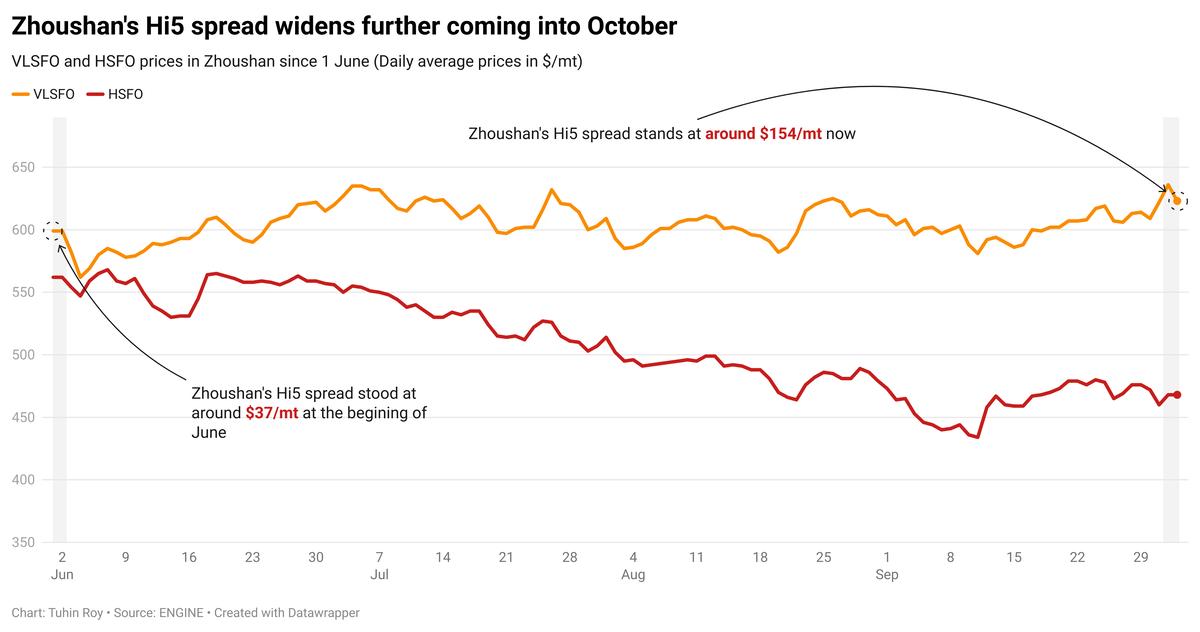

VLSFO benchmarks in East of Suez ports have followed Brent's downward movement, decreasing in the past day. Zhoushan's VLSFO price has dropped by $25/mt, noting the steepest decline among the three major Asian bunker hubs. A lower-priced VLSFO stem fixed in Zhoushan has contributed to this drop. Despite the significant price decline in Zhoushan, its VLSFO premiums over Fujairah and Singapore stand at $39/mt and $33/mt, respectively.

The drop in Zhoushan’s VLSFO price has surpassed the decline in its HSFO benchmark, narrowing the port's Hi5 spread from $176/mt yesterday to $154/mt today. This spread is wider than Singapore’s $122/mt, and it nearly matches Fujairah's Hi5 spread of $155/mt.

VLSFO and HSFO supplies in Zhoushan have tightened, with recommended lead times of 7-10 days. LSMGO is more readily available, with lead times of 3-5 days. Bunkering activity in Zhoushan is currently quiet due to the Golden Week holidays in China.

In India, VLSFO and LSMGO supplies remain limited in ports such as Mumbai, Kandla, Tuticorin, Cochin and Chennai. Both grades are available in Visakhapatnam, while suppliers in Paradip and Haldia are nearly out of both grades.

Brent

The front-month ICE Brent contract has lost $0.61/bbl on the day, to trade at $74.56/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price has found some upward pressure following a significant escalation in the conflict in the Middle East.

Iran launched over 180 missiles across Israel on Tuesday, the Israel Defense Forces (IDF) claimed. The Iranian attack came just days after Israeli military actions in Beirut, which resulted in the deaths of senior Hezbollah leader Hassan Nasrallah and other prominent leaders of the Iran-aligned militant group.

Israeli Prime Minister Benjamin Netanyahu has vowed to retaliate to Tehran’s airstrike. “Iran made a big mistake tonight [Tuesday] - and it will pay for it,” he said in an official statement on social media platform X (formerly Twitter).

As the OPEC member nation's direct involvement in the Middle Eastern tension opens the door to a wider regional conflict, oil market analysts and traders await Tel Aviv’s response.

“Broader markets, including oil, continue to wait and see how Israel responds to Iran’s recent missile attack,” two analysts from ING Bank said. “There are suggestions that Iranian oil infrastructure could potentially be targeted,” they added.

Downward pressure:

Brent’s price felt downward pressure after the US Energy Information Administration (EIA) reported an unexpected rise in crude stockpiles, contrary to market expectations of a drawdown.

Commercial crude oil inventories in the US increased by 3.89 million bbls to touch 417 million bbls on 27 September, the EIA reported. “[The] swelling US inventories added evidence that the market is well supplied and can withstand any disruptions,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Besides, Brent’s price moved lower after manufacturing PMI in the US, the world's largest oil consumer, came in below expectations in September.

The US Manufacturing Purchasing Managers' Index (PMI) reading stood at 47.2% in September, unchanged from the previous month, the Institute for Supply Management (ISM) reported.

A PMI reading below 50 typically indicates weak economic health and a contraction in the manufacturing sector, which includes production, inventory levels, new orders, etc. It also highlights demand growth concerns, ultimately weighing down on prices of commodities like oil.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.