East of Suez Market Update 27 Sep 2024

VLSFO and HSFO prices in East of Suez ports have moved in mixed directions, and VLSFO and LSMGO availability remains good in several Taiwanese ports.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Fujairah ($3/mt), unchanged in Zhoushan, and down in Singapore ($1/mt)

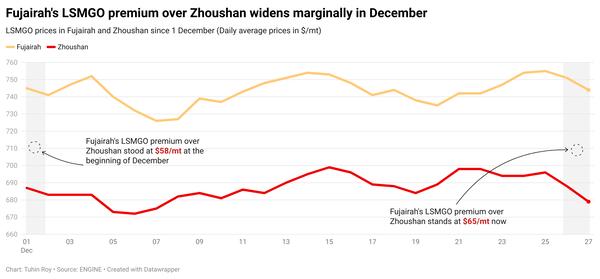

- LSMGO prices up in Zhoushan ($20/mt), Singapore ($16/mt) and Fujairah ($8/mt)

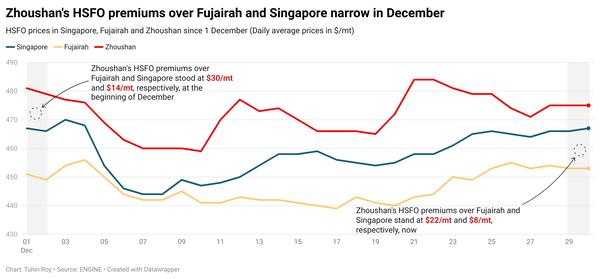

- HSFO prices up in Zhoushan ($2/mt) and Fujairah ($1/mt), and down in Singapore ($1/mt)

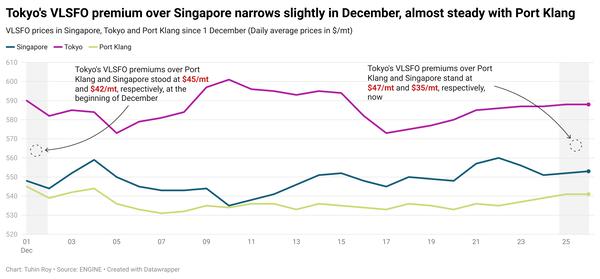

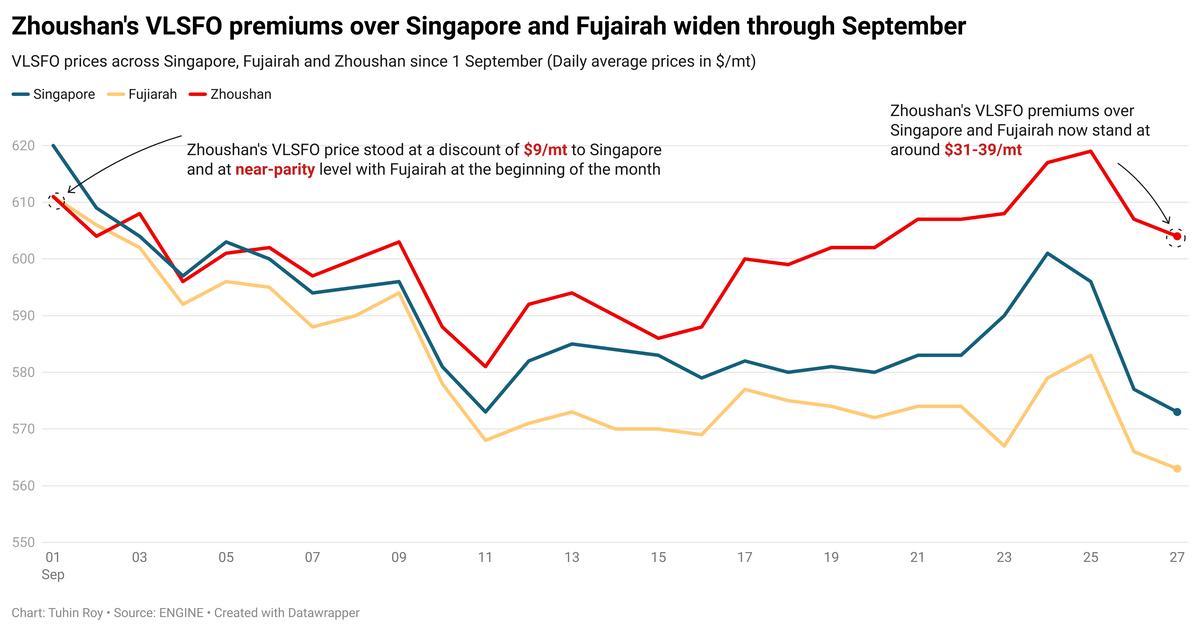

VLSFO prices in East of Suez ports have remained mostly stable over the past day, with no significant fluctuations. Zhoushan continues to price its VLSFO higher than Fujairah and Singapore, with premiums of $39/mt and $31/mt, respectively.

VLSFO and HSFO supplies in Zhoushan have tightened, with several suppliers advising lead times of 7-10 days due to low stock levels. In contrast, LSMGO is more readily available with shorter lead times of 3-5 days. Some suppliers expect a slowdown in bunkering activity in Zhoushan ahead of China’s Golden Week holiday from 1-7 October.

In Hong Kong, lead times for all fuel grades are around seven days, nearly unchanged from last week.

VLSFO and LSMGO supplies in Taiwanese ports, including Hualien, Kaohsiung, Taichung and Keelung, remain stable with prompt lead times of 2-3 days, consistent with the previous week.

Brent

The front-month ICE Brent contract has dipped by $0.18/bbl on the day, to trade at $71.95/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

US commercial crude oil inventories fell sharply by 4.47 million barrels to 413 million barrels on 20 September, according to the US Energy Information Administration (EIA) data released this week. This decline in crude stocks supported Brent futures.

Brent's price gained further support after China's central bank reduced interest rates and injected liquidity into the banking system, to boost the country's economic growth towards its target of approximately 5%.

Downward pressure:

Oil prices felt some downward pressure amid hopes that disruptions in Libyan oil supply could be resolved sooner than anticipated.

Rival factions competing for control of the Central Bank of Libya reached an agreement on Thursday to end their dispute. Representatives from Libya's eastern and western legislative bodies, in UN-mediated talks, signed a deal nominating an interim governor and deputy to resolve the crisis over the central bank's leadership. The country's central bank is the only globally acknowledged depository of its oil revenues.

Additionally, the Organization of Petroleum Exporting Countries (OPEC) and its allies, collectively known as OPEC+, plan to move forward with increasing production by 180,000 b/d each month starting in December, according to a Reuters report. The news has added downward pressure on Brent futures.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.