Europe & Africa Market Update 18 Sep 2024

Bunker benchmarks in most European and African ports have declined with Brent, and prompt HSFO availability is very tight in Las Palmas.

Changes on the day to 09.00 GMT today:

- VLSFO prices down in Durban ($11/mt), Rotterdam ($5/mt) and Gibraltar ($3/mt)

- LSMGO prices down in Rotterdam ($13/mt), Durban ($7/mt) and Gibraltar ($5/mt)

- HSFO prices down in Gibraltar ($4/mt) and Rotterdam ($1/mt)

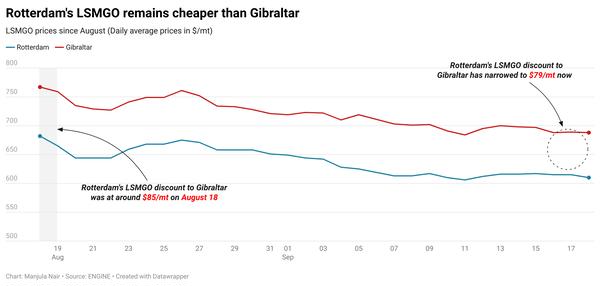

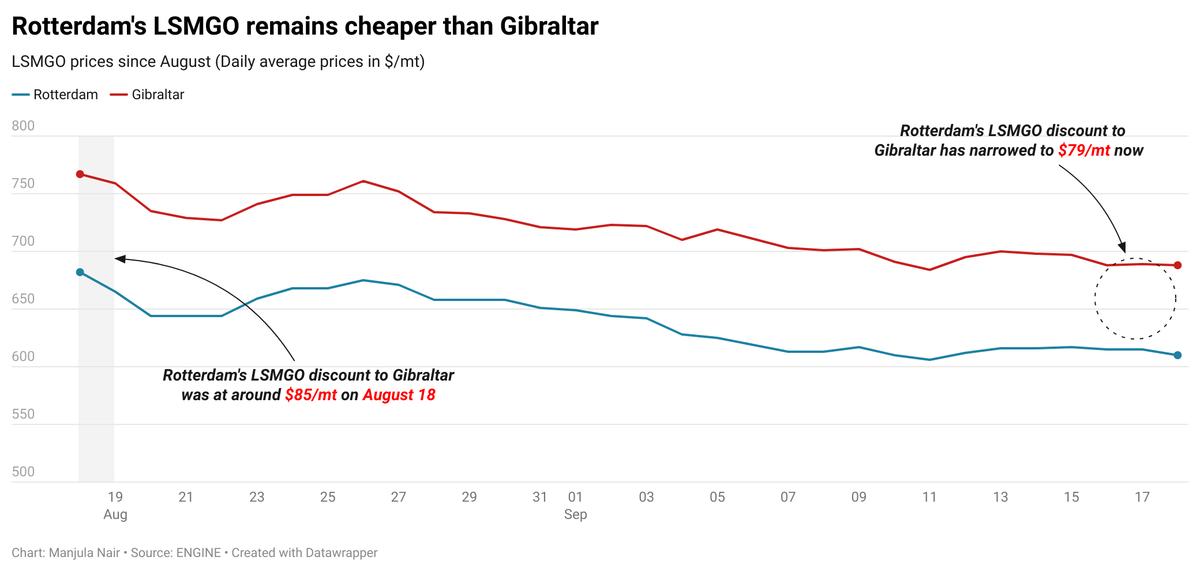

Rotterdam’s LSMGO price has come down sharply in the past day. The price drop has widened Rotterdam’s LSMGO discount to Gibraltar by $8/mt to $79/mt now, but it is still slightly narrower compared to $85/mt a month ago.

Prompt HSFO supply is very tight in the Canary Islands’ port of Las Palmas, a trader said. Two HSFO suppliers in Las Palmas don’t have any product available at the moment, the trader added. As a result, lead times for the grade have stretched from 3–5 days seen last week, to 5–7 days now in the Canary Islands' port of Las Palmas. HSFO supply in Tenerife, also located in the Canary Islands, is currently fine.

Prompt HSFO supply is also slightly tight in Gibraltar, with lead times increasing from 3–5 days last week to 5–7 days now. One out of the two suppliers in the port has limited HSFO available, adding to the supply pressure for the grade, a source said.

Brent

The front-month ICE Brent contract has inched $0.03/bbl lower on the day, to trade at $72.79/bbl at 09.00 GMT.

Upward pressure:

The US Federal Reserve (Fed) is expected to cut key interest rates for the first time in over four years later today. Brent’s price has found some support from this as the move is expected to boost oil demand growth.

“The prospect of oil demand being stimulated by a Fed rate cut helped boost sentiment,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

A 25-basis point cut will be ideal for oil prices, according to market analysts. Lower interest rates make dollar-denominated commodities like oil more affordable for holders of other currencies.

“The single biggest influence on crude sentiment is the US Federal Reserve’s rate cut decision [expected] later today,” VANDA Insights’ founder and analyst Vandana Hari said.

Renewed geopolitical tensions in the Middle East have provided additional support to Brent’s price. Iran-aligned Hezbollah armed group accused the Israel Defense Forces (IDF) yesterday, of plotting an attack in Lebanon, which caused several civilian casualties, Bloomberg reports.

This news has raised supply disruption concerns in the oil-rich region and “fears of an all-out war in the region,” Hynes said.

Downward pressure:

Brent’s price faced some headwinds following a surprise build in US crude stocks. Commercial crude oil inventories in the US rose by 1.96 million bbls in the week that ended 13 September, according to the American Petroleum Institute (API) estimates.

This week’s data surprised the oil market as analysts expected a decline of 100,000 bbls. A surge in US crude stocks can dampen oil demand growth and put downward pressure on Brent’s price.

“Crude traded softer after a weekly build in US crude and fuel stocks, reported by the API, helped offset sustained tensions in the Middle East,” analysts from Saxo Bank noted.

Meanwhile, oil market traders’ focus remains on Fed chairman Jerome Powell’s decision to whether cut interest rates by 25 or 50 basis points, as the latter can raise concerns of a possible recession. An aggressive rate cut could indicate underlying fears of an economic recession in the US, according to market analysts.

“The size of today’s expected rate cut, and the subsequent comments should provide the [oil] market with more insights, as it has the potential to ramp up or cool down recession fears,” Saxo Bank’s analysts added.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.