Europe & Africa Market Update 17 Sep 2024

Regional bunker benchmarks have moved in mixed directions, and prompt VLSFO availability remains tight in Durban.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Rotterdam ($4/mt), unchanged in Durban, and down in Gibraltar ($4/mt)

- LSMGO prices down in Gibraltar ($8/mt), Durban ($7/mt) and Rotterdam ($3/mt)

- HSFO prices up in Rotterdam ($4/mt), and down in Gibraltar ($7/mt)

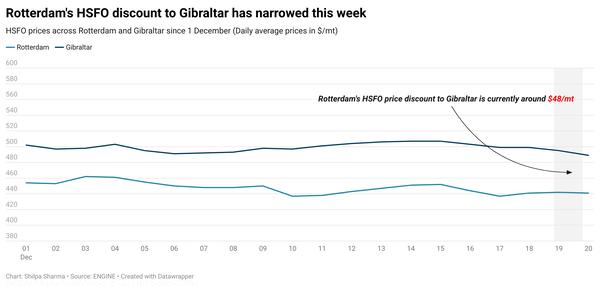

Gibraltar’s HSFO price has countered Brent’s upward movement and shed some in the past day amid downward pressure from some lower-priced firm offers. Meanwhile, Rotterdam’s HSFO has gained some in the past day to narrow its HSFO discount to Gibraltar’s by $11/mt to $69/mt now.

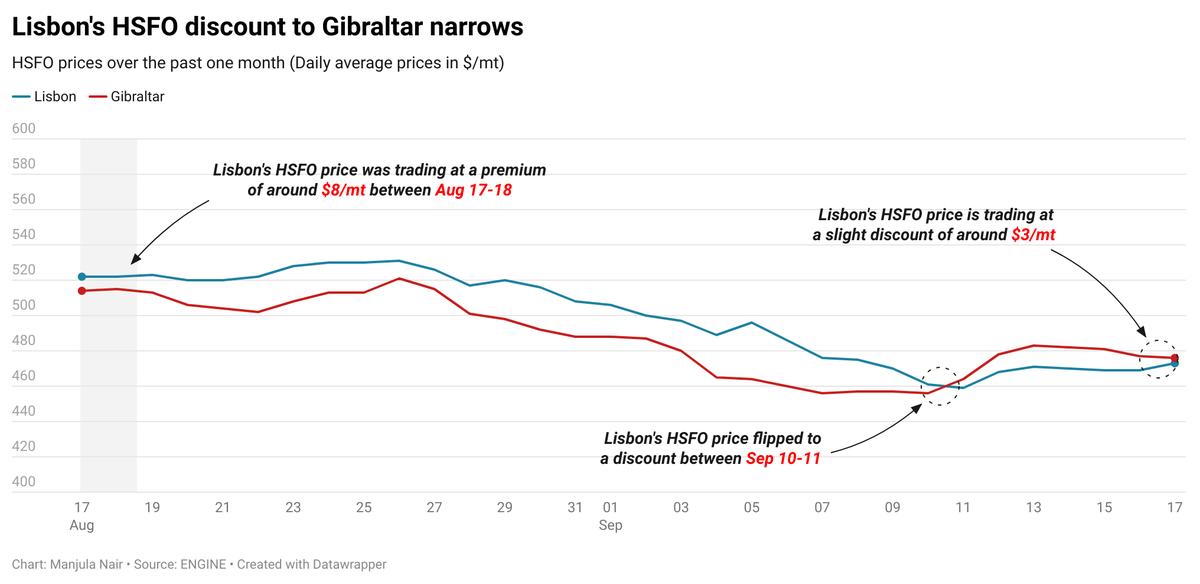

Lisbon's HSFO price discount to Gibraltar's HSFO has narrowed by $10/mt to $6/mt in the past day. Last week, Lisbon’s HSFO price flipped to a discount to Gibraltar's, and it has been trading at a discount since then. However, this discount has been nearly erased now.

Availability across all grades is good in Gibraltar with a trader recommending lead times of 3–5 days for all grades.

VLSFO availability remains tight for prompt delivery dates in South Africa's Durban port. Lead times of 7–10 days are generally recommended to secure the grade. Wind gusts of up to 22 knots are forecast in Durban today, which could complicate bunker deliveries there. Rough weather is also forecast on Thursday, with wind speeds expected to intensify and touch 36 knots. Bunkering in Durban usually gets suspended when wind gusts exceed 25 knots, which could further disrupt operations later in the week.

Brent

The front-month ICE Brent contract has moved $0.49/bbl higher on the day, to trade at $72.82/bbl at 09.00 GMT.

Upward pressure:

Brent’s price has moved higher on hopes of an interest rate cut decision at the two-day US Federal Reserve (Fed) policy meeting that will conclude tomorrow.

Oil market analysts have largely priced in a 25-basis point rate cut which is expected to drive demand growth for oil in the world’s largest crude oil-consuming nation. “[Market] sentiment was also supported by growing expectations of a more aggressive cut to rates by the Fed,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Lower interest rates can support demand growth as it makes dollar-denominated commodities like oil more affordable for holders of other currencies.

Lingering concerns over disruption in oil supply from Libya also provided support to Brent futures, analysts said. “Libyan exports fell to 314kb/d [314,000 b/d] last week, down from 468kb/d [468,000 b/d] during the first five days of the month,” Hynes added.

Libya’s oil production continues to face disruption as the United Nations-mediated talks in Tripoli have “failed to break an impasse” over the leadership of the country’s central bank, the only globally acknowledged depository of its oil revenues, Hynes remarked.

Downward pressure:

The gloomy demand outlook emerging from China has capped some of Brent’s price gains today. Chinese refiners processed about 59.07 million mt (13.91 million b/d) of crude oil in August, down 6.2% from the same period a year ago, market intelligence provider JLC reported citing data from China’s National Bureau of Statistics (NBS).

“Global demand fears are still strong on weak manufacturing data and more fears that China’s economy is slowing,” Price Futures Group’s senior market analyst Phil Flynn said.

China's latest crude throughput data and tepid oil import numbers have heightened demand growth concerns in the global oil market, analysts said. China imported 11.56 million b/d of crude oil last month, down from 12.43 million b/d imported in August 2023.

“The market remains concerned about weak demand in China,” Hynes added.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.