East of Suez Fuel Availability Outlook 17 Sep 2024

VLSFO and LSMGO supply is good in Port Klang

LSMGO supply is good across several Japanese ports

LSMGO availability is good in Omani ports

PHOTO: Aerial view of Saudi Arabian port of Jeddah with cargo ships and dry docks. Getty Images

PHOTO: Aerial view of Saudi Arabian port of Jeddah with cargo ships and dry docks. Getty Images

Singapore and Malaysia

VLSFO availability in Singapore remains tight, with lead times extending up to 15 days. Some suppliers can still accommodate stems in as little as six days, but these typically come at a higher cost compared to those with longer lead times.

HSFO supply is also strained, with recommended lead times now exceeding two weeks. In contrast, LSMGO availability is relatively better, with lead times ranging from 5-8 days.

According to the latest data from Enterprise Singapore, Singapore’s residual fuel oil stocks have averaged 5% lower so far this month compared to August. Despite a 4% increase in the port’s net fuel oil imports in September, fuel oil stocks have fallen below 18 million bbls, marking their lowest level since November 2018. Both fuel oil imports and exports have decreased this month, with imports down by 1.23 million bbls and exports down by 1.32 million bbls. Additionally, the port's middle distillate stocks have averaged 3% lower this month.

At Malaysia’s Port Klang, VLSFO and LSMGO supplies are robust, with some suppliers able to offer prompt deliveries for smaller quantities. However, HSFO availability remains limited.

East Asia

Prompt VLSFO availability in Zhoushan is tight, with lead times of 5-7 days, while LSMGO and HSFO have shorter lead times of 3-5 days.

Bunker deliveries resumed at most anchorages in Zhoushan on Tuesday after being suspended since Sunday due to Typhoon Bebinca. However, operations remained halted at the outer Xiazhimen anchorage.

In Shanghai, bunkering resumed briefly on Tuesday, but was suspended again due to the typhoon. Other ports in the Yangtze River Delta, including Lianyungang, Nanjing, Jiaxing, Nantong, and Taicang, have also been impacted by the storm.

In Northern China, the ports of Dalian, Qingdao, and Tianjin have ample VLSFO and LSMGO supplies, though HSFO is limited in Qingdao and Tianjin. Shanghai also has strong VLSFO and LSMGO availability. Fuzhou and Xiamen offer good supplies of VLSFO and LSMGO, while prompt deliveries of both two fuel grades are under pressure in Guangzhou and Yangpu.

In Hong Kong, lead times of around seven days are recommended for all grades, unchanged from the previous week. Wind gusts of 18-21 knots and swells of more than one meter are forecast intermittently throughout the week, which may impact operations there.

In Taiwan, VLSFO and LSMGO supplies in Hualien, Kaohsiung and Keelung ports are stable with lead times of about 2-3 days, similar to last week. Deliveries in Taichung require slightly longer lead times of 3-4 days for both grades.

In South Korean ports, the availability of VLSFO and LSMGO has improved, with recommended lead times now around 2-5 days, compared to 4-10 days last week. HSFO availability has also improved, with lead times decreasing from last week's 12-13 days to 2-5 days now.

High winds and waves are expected to affect the ports of Ulsan, Onsan, Busan, Daesan, Taean, and Yeosu from 20-22 September, which could impact bunker operations at these ports.

VLSFO is available at most Japanese ports, but prompt supply is tight in Nagoya, Yokkaichi, and Oita. The tightness in Nagoya and Yokkaichi is attributed to technical issues at the Chiba refinery, while the closure of Idemitsu Kosan's Yamaguchi refinery in March continues to constrain VLSFO supply in Oita.

HSFO availability is generally good across Japan, although prompt supply is under pressure in Oita. LSMGO supply remains strong in major ports, including Tokyo, Chiba, Yokohama, Kawasaki, Osaka, Kobe, Sakai, Nagoya, Yokkaichi, Mizushima, and Oita.

The Philippine port of Subic Bay and the Vietnamese port of Ho Chi Minh are preparing for inclement weather this week, which is likely to cause intermittent difficulties in bunkering conditions. Similarly, the Thai ports of Koh Sichang and Leam Chabang anticipate adverse weather on 23 September, which could affect bunker operations at these ports.

Oceania

A bunker barge serving Fremantle and Kwinana ports is currently in dry dock. It went into dry dock in early September and will remain there until mid-November, making VLSFO unavailable by barge during this period. However, LSMGO will still be supplied at berth.

The Western Australian port of Kembla will not be affected by the barge dry docking, as bunker deliveries there are made exclusively by truck and ex-pipe.

Melbourne and Geelong in Victoria have ample VLSFO and LSMGO, although prompt HSFO deliveries may be difficult to secure. In Queensland, Brisbane and Gladstone ports offer sufficient VLSFO and LSMGO with lead times of about 7-8 days, but HSFO availability in Brisbane is limited.

In New Zealand, Tauranga and Auckland have a good supply of VLSFO, and Auckland also has a strong LSMGO supply. However, intermittent rough weather in Tauranga this week could potentially impact bunker operations.

South Asia

In Indian ports including Mumbai, Kandla, Tuticorin, Cochin, Chennai, and Haldia, VLSFO and LSMGO supplies are limited. Both grades are subject to availability in Visakhapatnam, while a supplier in Paradip is nearly out of stock for both.

At the Sri Lankan port of Colombo, the availability of all grades is good, with lead times of around four days.

Middle East

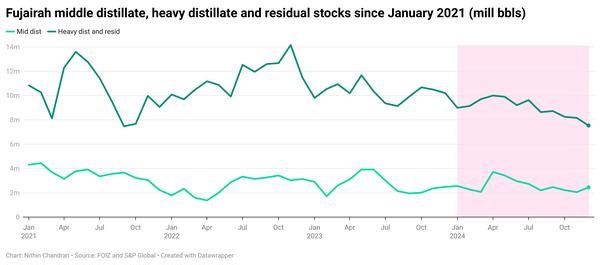

Prompt availability of all fuel grades remains tight in Fujairah, with most suppliers suggesting lead times of about 7-10 days for all grades, similar to last week.

In Iraq's Basrah, VLSFO and LSMGO are readily available, but both grades are nearly depleted in Qatar's Ras Laffan.

The port of Jeddah in Saudi Arabia has an ample supply of LSMGO, though VLSFO availability is limited. In Djibouti, supplies of both VLSFO and HSFO are nearly exhausted, and LSMGO is also constrained. Omani ports, including Sohar, Salalah, Muscat, and Duqm, have sufficient LSMGO to meet prompt demand.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.