Europe & Africa Market Update 12 Sep 2024

Regional bunker benchmarks in European and African ports have increased with Brent, and Gibraltar could face weather-induced bunkering disruption tomorrow.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Durban ($5/mt), Gibraltar ($4/mt) and Rotterdam ($1/mt)

- LSMGO prices up in Durban ($7/mt) and Gibraltar ($5/mt), and unchanged in Rotterdam

- HSFO prices up in Gibraltar ($12/mt) and Rotterdam ($4/mt)

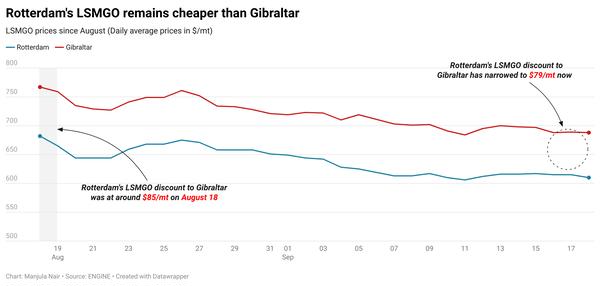

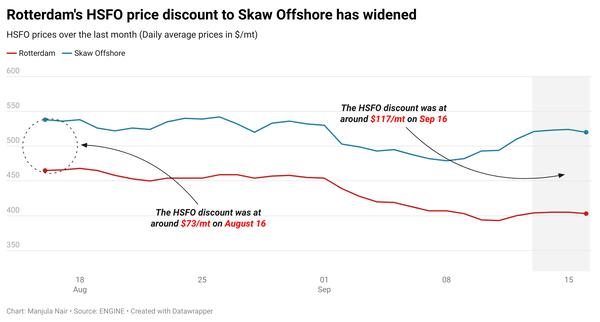

Gibraltar’s HSFO price has gained the most compared to other key regional hubs. The port’s HSFO premium over Rotterdam has widened by $8/mt, to $78/mt now. All grades are well supplied in Gibraltar, with prompt delivery dates available, a trader said. Lead times of 3–5 days are recommended for all grades in Gibraltar.

Slight congestion has been reported in Gibraltar today, with four vessels currently waiting for bunkers, up from one yesterday, a source said. Wind gusts of 20-30 knots are forecast to hit the port area tomorrow. Strong winds are expected to continue till the weekend, which could trigger bunkering disruptions.

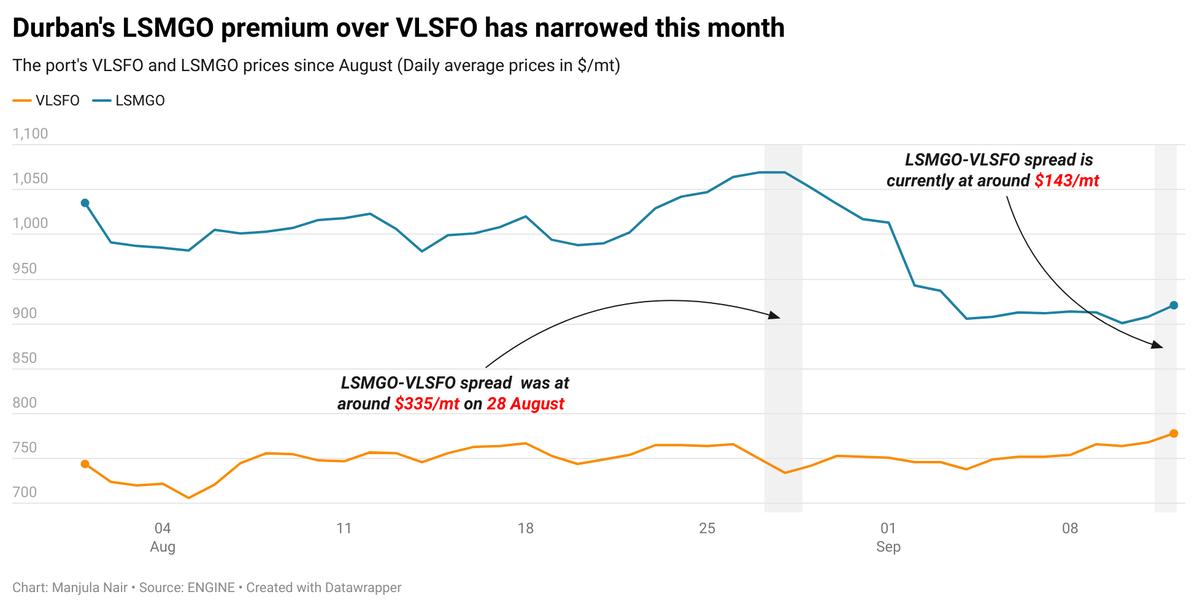

In South Africa’s Durban, LSMGO price has witnessed a steep fall coming into September. As a result, the port’s LSMGO-VLSFO spread has narrowed. LSMGO availability is tight in Durban, with lead times stretched up to two weeks, a trader said.

Meanwhile, a lower-priced non-prompt VLSFO stem fixed at $627/mt in Mauritius’ Port Louis has pushed the benchmark down by $21/mt in the past day. This has widened Port Louis’ VLSFO discount to Durban by $26/mt, to $143/mt now. Lead times of over ten days are recommended for VLSFO and LSMGO grades in Port Louis, according to a trader.

Brent

The front-month ICE Brent contract has gained $0.83/bbl on the day, to trade at $71.28/bbl at 09.00 GMT.

Upward pressure:

Brent’s price erased earlier losses and moved higher on the day as supply disruption fears in the US escalated amid concerns over Hurricane Francine’s impact on oil production in the US Gulf of Mexico.

Offshore oil platforms and refinery operations in the coastal regions were suspended due to the hurricane’s landfall in southern Louisiana on Wednesday, Reuters reports. About 39% of oil output, including three rigs and 171 production platforms in the US Gulf of Mexico remains offline due to the same, the report adds.

“Brent crude trades back above USD 71 [$71/bbl]… supported by Hurricane Francine, which is temporarily impacting crude-production regions in the Gulf of Mexico,” analysts from Saxo Bank noted.

Oil giants Shell, ExxonMobil and Chevron have evacuated workers from port terminals near the coast. “The storm has prompted oil companies to shut in roughly 25% of Gulf crude output,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Brent’s price also found support from the latest US economic data, which showed signs of cooling inflation.

The inflation rate in the US, measured by the change in the Consumer Price Index (CPI), declined to 2.5% on a year-on-year basis in August, down from 2.9% in July, the US Labor Department's Bureau of Labor Statistics (BLS) reported on Wednesday.

The inflation reading is gradually approaching the US Federal Reserve's 2% target. This has raised expectations of an interest rate cut in September. Lower interest rates in the US can boost demand, making dollar-denominated commodities like oil cheaper for holders of other currencies.

Downward pressure:

Looming demand growth fears from top oil consumers, the US and China, have capped some of Brent’s price gains.

Commercial crude oil inventories in the US rose by 833,000 bbls to touch 419 million bbls on 6 September, according to data from the US Energy Information Administration (EIA). Oil market analysts were expecting a drawdown in US crude stocks, “as suggested by the API report earlier in the week showing a 2.79mbbl [2.79 million bbls] decline,” Hynes said.

A rise in US crude stocks can indicate a slowdown in oil demand growth and put downward pressure on Brent’s price.

Additionally, China imported 11.56 million b/d of crude oil in August, down from 12.43 million b/d imported during the same month a year ago, market intelligence provider JLC reported citing data from the General Administration of Customs (GACC).

The decline in Chinese crude imports has suggested a significant slowdown in the country’s oil demand growth, according to oil market analysts. “The crude oil market sentiment remains under pressure as China's economic slowdown shows little sign of improvement, following data showing a further contraction in factory activity,” Saxo Bank’s head of commodity strategy Ole Hansen said.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.