Americas Market Update 26 Jul 2024

Americas bunker prices have mostly gained with Brent, and prompt availability is tight in Houston.

PHOTO: Oil refinery in Texas City, Texas, located just south of Houston on Galveston Bay. Getty Images

PHOTO: Oil refinery in Texas City, Texas, located just south of Houston on Galveston Bay. Getty Images

Changes on the day, to 08.00 CDT (13.00 GMT) today:

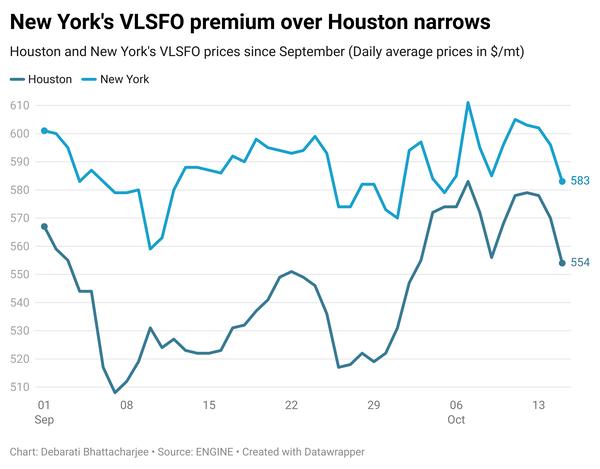

- VLSFO prices up in New York ($19/mt), Houston ($11/mt), Los Angeles ($10/mt) and Balboa ($7/mt), and unchanged in Zona Comun

- LSMGO prices up in New York ($24/mt), Balboa ($22/mt), Zona Comun ($17/mt), Los Angeles ($13/mt) and Houston ($12/mt)

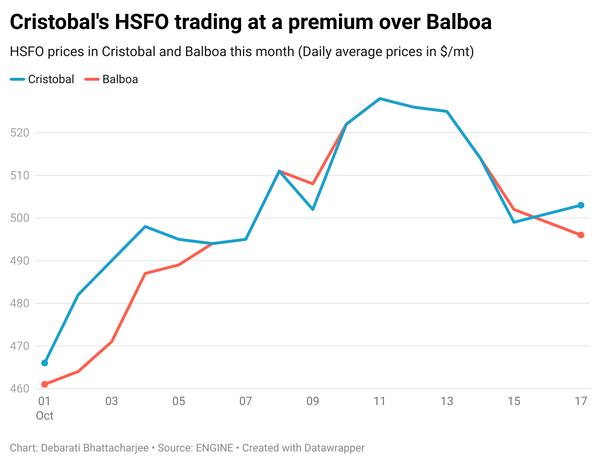

- HSFO prices up in New York ($16/mt), Houston ($14/mt), Los Angeles ($9/mt) and Balboa ($6/mt)

Port Bolivar’s LSMGO price has increased by $21/mt in the past day, while Houston’s LSMGO price has increased by $12/mt. This has flipped Houston’s $6/mt LSMGO price premium over Port Bolivar's to a $3/mt discount now.

Prompt VLSFO and LSMGO are more readily available in Port Bolivar than they are in Houston. Most suppliers in Houston are fully booked until the first week of August.

In Canada’s Montreal, LSMGO price has dropped by $4/mt in the past day. Meanwhile, New York’s LSMGO price has gained by $24/mt. Despite the price drop, Montreal’s LSMGO is still trading at a $30/mt premium over New York.

The port of St. Eustatius in the Caribbean is currently experiencing strong wind gusts of 29 knots, making bunker deliveries difficult there. The weather is expected to remain rough until Saturday morning.

Brent

The front-month ICE Brent contract moved $1.12/bbl higher on the day, to trade at $81.62/bbl at 08.00 CDT (13.00 GMT) today.

Upward pressure:

Brent moved higher after the OPEC Secretariat confirmed that Russia, Iraq, and Kazakhstan submitted compensation plans for producing above their crude oil quotas in the first half of 2024. These countries will balance their excess production over the next 15 months, concluding in September 2025.

Commercial crude oil inventories in the US decreased by 3.74 million barrels to 436 million barrels in the week ending July 19. The decline in stocks occurred amid an increase in US crude oil exports, which rose by 222,000 barrels per day to 4.19 million barrels per day that week. This has put upward pressure on the Brent price.

Canadian wildfires are threatening oil production, contributing to rising prices. Imperial Oil has reduced non-essential staff at its Kearl oil sands site near Fort McMurray as a precaution. Earlier this month, Suncor temporarily cut production and evacuated non-essential workers from its Firebag site due to a nearby fire. With two-thirds of Canada’s five million barrels per day production coming from the oil sands, analysts are increasingly concerned about significant production cuts due to the worsening wildfire situation.

“While wildfires have already forced some producers to curtail production, these fires still threaten a large amount of supply,” Reuters quoted ING Group analysts.

Downward pressure:

Expectations of a Gaza ceasefire deal, which could ease Middle East tensions and alleviate supply concerns, have put downward pressure on the Brent crude price.

US Vice President Kamala Harris has urged Israeli Prime Minister Benjamin Netanyahu to assist in reaching a ceasefire, taking a firmer stance than President Joe Biden.

Additionally, concern about oil demand in China has further dragged the benchmark down. China's apparent oil demand fell by 8.1% year-on-year to 13.66 million b/d in June, according to ANZ Research analysts.

By Debarati Bhattacharjee and Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.