Americas Market Update 16 Oct 2024

Bunker benchmarks in the Americas ports have taken mixed directions, and bunkering has been suspended in GOLA.

Changes on the day to 08.00 CDT (13.00 GMT) today:

- VLSFO prices up in Houston ($6/mt), unchanged in Los Angeles and Balboa, and down in Zona Comun ($4/mt) and New York ($2/mt)

- LSMGO prices up in Houston ($2/mt), Balboa and Los Angeles ($1/mt), and down in New York ($1/mt)

- HSFO prices up in Houston ($9/mt), Los Angeles and Balboa ($1/mt), and unchanged in New York

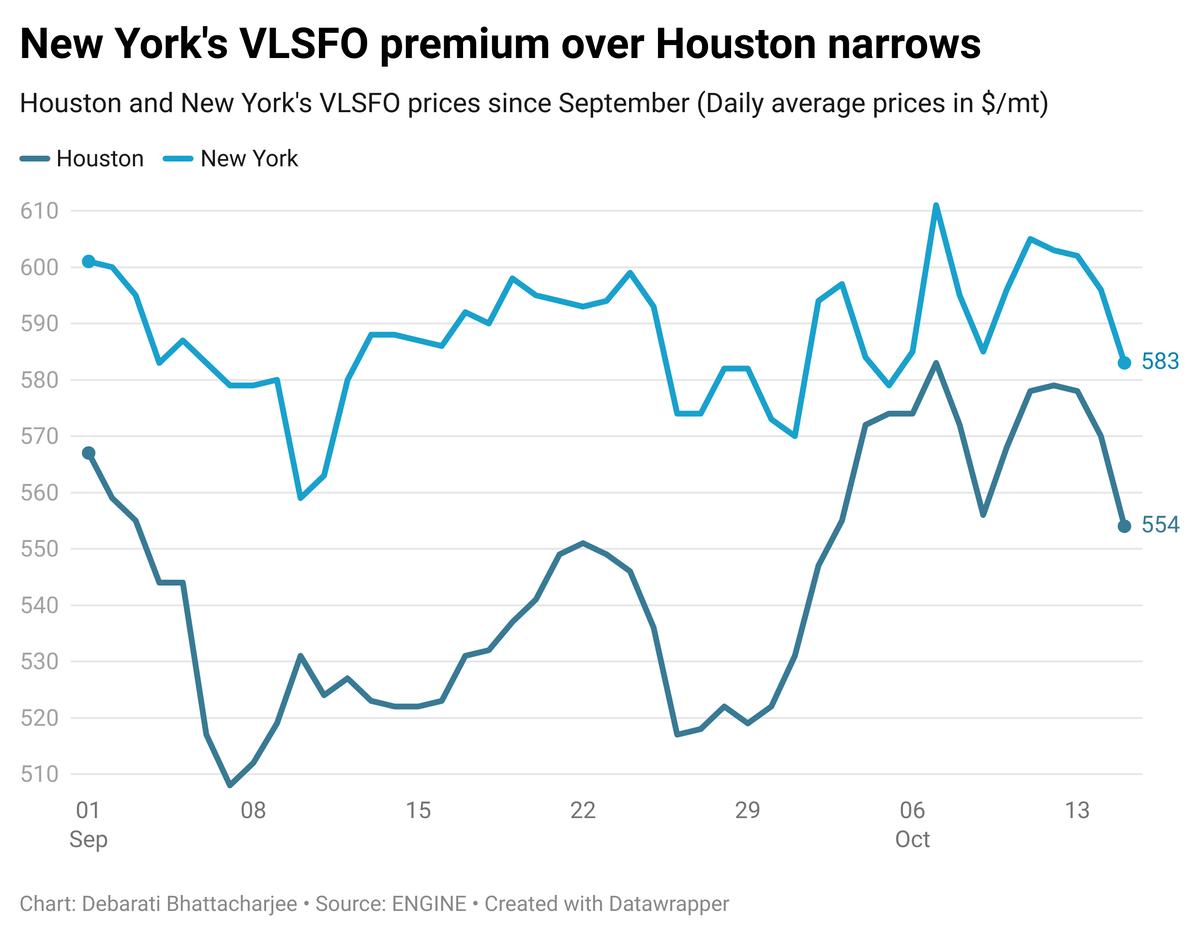

Houston’s VLSFO price has gained in the past day with support from a 500-1,500 mt higher-priced stem. Meanwhile, New York’s VLSFO price has dropped marginally, to narrow its VLSFO price premium over Houston from $35/mt yesterday, to $27/mt now.

Bunkering has been suspended in the Galveston Offshore Lightering Area (GOLA) today due to rough weather conditions. The area is experiencing strong gale-force wind gusts of up to 42 knots, making barge deliveries difficult there.

Bad weather also poses challenges to bunkering in the Bahamas' Freeport. Rough weather conditions are forecast to persist over the coming days in Freeport, which could cause prolonged delays and disruptions in the port, a source says.

The National Hurricane Center (NHC) is monitoring two weather systems formed in the Atlantic basin as of Wednesday, with one showing potential to develop into a tropical depression later this week.

Forecasters indicated that a tropical depression may form as the system approaches the Leeward and Virgin Islands later this week.

Brent

The front-month ICE Brent contract has gained $0.21/bbl on the day, to trade at $74.55/bbl at 08.00 CDT (13.00 GMT) today.

Upward pressure:

Brent's price inched up amid uncertainties about further geopolitical developments in the Middle East.

Oil market traders and analysts are currently on the hook as Israel ramps up its plans to counterstrike Iran’s military facilities.

“The country [Israel] is free to act how it chooses after more than a year battling Iranian proxy groups and fending off two direct long-range attacks from the [Iran] Islamic Republic,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

On the supply front, Brent’s price felt some upward thrust after the International Energy Agency (IEA) reported that global oil supply plunged by 640,000 b/d in September to 102.8 million b/d, primarily caused by political disputes in Libya and field maintenance work in Kazakhstan and Norway.

The report comes one day after OPEC’s monthly oil market report. OPEC's report stated that the 12 core members of the group produced an average of 26.04 million b/d of crude oil in September, about 604,000 b/d lower than their combined production in August.

“For now, oil exports from Iran and neighboring countries are unaffected but the market remains on tenterhooks, awaiting the next developments in the crisis,” Price Futures Group’s senior market analyst Phil Flynn said.

Downward pressure:

Brent’s price shed the previous week’s gains following reports, which suggested that Israel will not target Tehran’s oil and nuclear facilities.

An exclusive report by The Washington Post revealed that Israeli Prime Minister Benjamin Netanyahu’s administration is willing to strike Tehran’s military resources instead.

The news has eased risk premiums and moved Brent’s price lower, according to market analysts. “The [Washington Post] report eased concerns that oil supply would be disrupted, resulting in the diminishing geopolitical risk premium,” Hynes said.

Brent’s price felt more downward pressure after OPEC reduced its world oil demand growth forecast to 1.9 million b/d, with total consumption averaging 104.1 million b/d in 2024, about 106,000 b/d lower than its earlier projection.

“Oil prices dropped after OPEC cut its 2024 demand forecast for the third consecutive time, effectively conceding that China’s economic slowdown and structural shifts, like the rise of electric vehicles, could be sounding the death knell for any more super cycles,” SPI Asset Management’s managing partner Stephen Innes remarked.

By Debarati Bhattacharjee and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.