Europe & Africa Fuel Availability Outlook 10 Jul 2024

HSFO supply tightens in Rotterdam

Poor bunker demand off Malta

VLSFO is tight in Nacala and Maputo

PHOTO: The Port of Hamburg with the Elbe River. Getty Images

PHOTO: The Port of Hamburg with the Elbe River. Getty Images

Northwest Europe

HSFO supply has tightened in Rotterdam and in the wider ARA hub, with traders recommending lead times of 5-7 days, up from 3-5 days last week. Some suppliers are unsure when the replenishment cargoes will arrive to ease supply of the grade, a trader told ENGINE. Overall, bunker demand has been low in the ARA hub.

Availability of VLSFO and LSMGO remains normal in the ARA hub, with lead times unchanged at 3-5 days.

The ARA’s independently held fuel oil stocks have averaged 8% lower coming into July than across June, according to Insights Global data.

The region has imported 177,000 b/d of fuel oil in July so far, down from 235,000 b/d of fuel oil imported in June, according to data from cargo tracker Vortexa. The ARA imported low-sulphur fuel oil (LSFO) and HSFO in a 69/31 ratio coming into July, which is similar to the 65/35 ratio in June.

The ARA hub’s independent gasoil inventories — which include diesel and heating oil — have declined by 2% coming into July. The region has imported 709,000 b/d of gasoil so far this month, a significant increase from the 356,000 b/d imported in June, according to Vortexa data.

According to GAC Hot Port News, a port officers' strike in the French ports of Fos, Lavera, and Marseilles began on 2 July and is expected to last indefinitely. The strike has had no impact on bunkering so far in the French ports, a trader told ENGINE.

All grades remain in good supply for prompt delivery in the German port of Hamburg. A trader recommends lead times of 3-5 days across all grades, which has been consistent in the past several weeks.

Off Skaw, bunker fuel is available mostly for non-prompt delivery dates. All three grades are available for lead times of 7–10 days. Adverse weather is forecast off Skaw on Wednesday, which may cause bunkering disruptions in the area.

Mediterranean

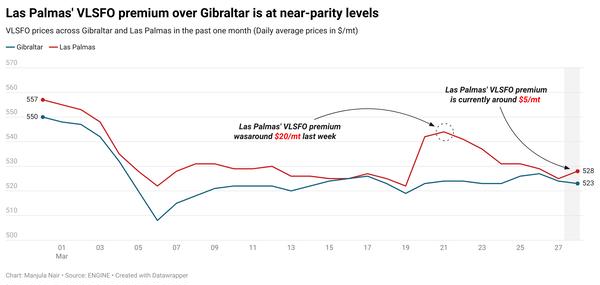

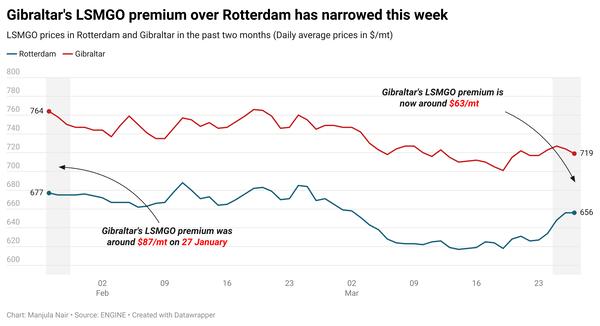

Bunker fuel availability is normal in Gibraltar, with lead times consistent over the last few weeks at 3-5 days. Despite good supply, demand has been muted, a trader said. Bunkering was proceeding normally on Wednesday, but wind gusts of up to 21 knots are forecast for Friday and may impact bunkering.

The Canary Islands’ port of Las Palmas continues to face subdued bunker demand, a trader told ENGINE. Lead times remain unchanged from last week’s 3-5 days. Availability is normal across all grades.

Demand has been poor in other Mediterranean ports like Piraeus, Malta Offshore and Istanbul, a trader said.

Availability is normal in the Greek port of Piraeus, where lead times of 3–4 days are recommended across all grades, a trader said. Weather-induced bunkering disruptions may occur between Wednesday and last through the weekend in the port area, a source said.

Demand is low off Malta despite good availability across all three bunker grades. Lead times are similar to Piraeus, with a trader recommending 3–4 days for optimal coverage from suppliers. Rough weather is forecast for Friday and Saturday, which could impact bunkering in the area, according to a source.

Availability is said to be normal in Turkey’s Istanbul port, a trader said. Securing prompt delivery may not be difficult in the port, with traders recommending lead times of 3–4 days for all grades. Bunkering may be impacted between Wednesday and Saturday due to adverse weather conditions forecast in the area.

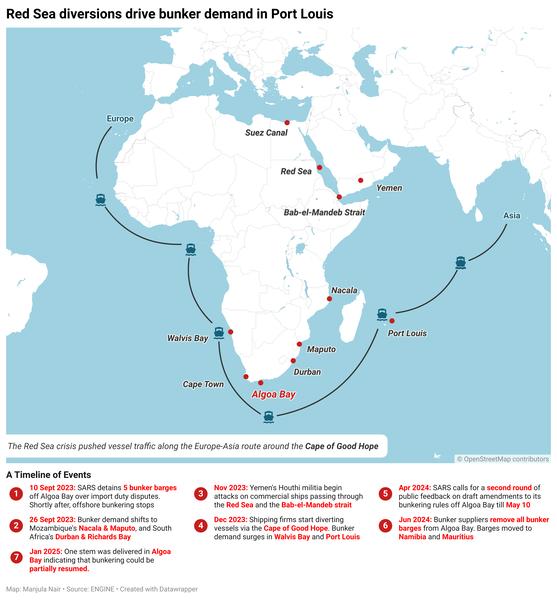

Africa

LSMGO availability continues to be tight for prompt supply in Durban, with lead times of up to two weeks recommended by traders. VLSFO availability is slightly better in Durban and Richards Bay, with traders recommending relatively shorter lead times of 7–10 days.

Meanwhile, South African ports have been facing congestion and backlogs due to stormy weather this week. High swells are forecast in Cape Town until Saturday, while Port Elizabeth's container terminal is experiencing heavy congestion, says South Africa’s Transnet National Ports Authority (TNPA). The TNPA has deployed vessels on standby to assist ships wherever needed.

Strong gale-force wind gusts of up to 50 knots have been forecast in certain South African port areas this week, according to a recent update from the TNPA. Swells of more than three metres disrupted vessel traffic in Cape Town and several other South African ports on Wednesday.

Port Elizabeth, located in South Africa's eastern province, is witnessing congestion at one of its terminals, while Cape Town on the southwest coast has a backlog of three vessels at berth today, the TNPA stated.

There has not been any impact on bunkering so far and no diversion of bunker demand has been noticed, a trader told ENGINE.

The global container liner Maersk has issued an advisory about the extreme weather in South Africa. An extreme weather forecast over the next few days, especially between Cape Town and Port Elizabeth, will impact vessel movement and cause delays, the advisory said. It added that the worst impact is expected in Port Elizabeth.

Bunkering is operating smoothly in Mozambique’s Nacala and Maputo ports, a source said.

Nacala is witnessing steady demand across all grades, but HSFO is running very tight in the port. On the other hand, VLSFO and LSMGO availability is good in the port.

In Maputo, the availability of VLSFO and LSMGO is tight, with both grades facing low demand, a source said.

By Manjula Nair

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.