Europe & Africa Market Update 27 Nov 2023

Bunker benchmarks in most European and African ports have declined, and rough weather conditions could impact bunkering in Gibraltar this week.

PHOTO: The Europoort area in the Port of Rotterdam. Getty Images

PHOTO: The Europoort area in the Port of Rotterdam. Getty Images

Changes on the day from Friday to 09.00 GMT today:

- VLSFO prices down in Gibraltar ($20/mt), Durban ($14/mt) and Rotterdam ($11/mt)

- LSMGO prices steady in Durban, and down in Gibraltar ($19/mt) and Rotterdam ($13/mt)

- HSFO prices down in Rotterdam ($14/mt) and Gibraltar ($5/mt)

Regional bunker benchmarks have tracked Brent’s downward movement with Gibraltar’s VLSFO witnessing a steep fall over the weekend compared to other regional ports. The price drop has reversed some of the gains Gibraltar's VLSFO made last week.

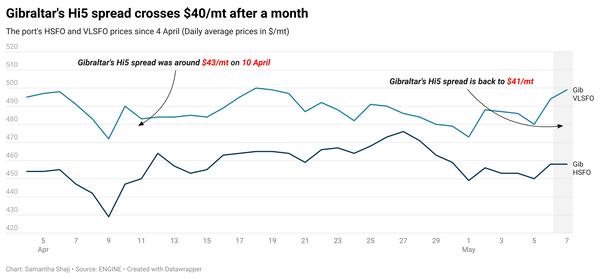

With this decline in prices, Gibraltar's VLSFO premium over Rotterdam has narrowed by $9/mt to $35/mt now. The port's Hi5 spread has also narrowed from $98/mt to $83/mt now.

Strong wind gusts of up to 22 knots have hit Gibraltar this morning, which could impact bunkering in the port. Weather conditions are forecast to remain bad in periods throughout this week, with wind speeds forecast to intensify further and touch 33 knots on Thursday.

Five vessels were waiting to receive bunkers in Gibraltar today, port agent MH Bland said.

Bunker fuel availability is said to be normal across all grades in Gibraltar. Lead times of 3-5 days are recommended for VLSFO and LSMGO, and 4-6 days for HSFO.

In Rotterdam, all fuel grades have declined over the weekend, with the port’s HSFO price shedding the most. The price moves have widened Rotterdam's HSFO discount to Gibraltar by $9/mt to $59/mt now.

Lead times of 5-7 days are recommended for HSFO at the port, a source says.

Meanwhile, weather disruptions continue to hit Malta, with bunkering operations restricted to bunkering area 4 only, MH Bland says. Wind gusts of up to 21 knots are forecast tomorrow as well to limit bunker operations.

Brent:

The front-month ICE Brent contract has moved $1.38/bbl lower on the day from Friday, to trade at $80.19/bbl at 09.00 GMT.

Upward pressure:

The upcoming OPEC+ meeting has lent support to declining Brent prices. The remote meeting is scheduled to take place this Thursday.

The oil market expects OPEC's key producer and de facto leader Saudi Arabia to roll over its current additional voluntary output cut of 1 million b/d into the first quarter of 2024. The group’s top ally Russia is expected to extend export bans as well.

“We believe that the Saudis will roll over this cut and there is a growing possibility that we see a deeper cut from the broader group,” said two commodities market analysts at ING Bank. “In doing this, the group would provide good support to the market going into 2024,” they added.

Meanwhile, several reports suggested that the oil-producer group has made progress “in coming to a deal with Angola and Nigeria,” said ING’s head of commodities strategy Warren Patterson.

Angola and Nigeria agreeing to follow lowered production targets for 2024, backed by an additional 1 million b/d cut by Saudi Arabia, could cause a further supply shortage and push oil prices higher.

Downward pressure:

The delay in holding the joint ministerial meeting by OPEC+ producers has continued to add downward pressure on Brent’s price. Speculations about a dispute over production quotas for 2024 between Saudi Arabia and other OPEC+ producers including Angola and Nigeria have emerged as analysts said the two countries were “not happy with their lower 2024 production targets.”

Meanwhile, the International Energy Agency (IEA) projects a “slight” surplus in oil supply in 2024, even if OPEC+ producers continue to decrease supply next year, IEA’s head of oil markets and industry division Toril Bosoni told Reuters last week.

Crude analysts said that if Angola and Nigeria do not come to a deal with OPEC+, oil will face further downward pressure due to the expected surplus in the market. “Clearly, if we do not see this [production quota agreement], it would put further downward pressure on the market, given the surplus over 1Q24 [first quarter 2024],” ING Bank’s analysts added.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.