Europe & Africa Market Update 21 Sep 2023

Regional bunker benchmarks have declined again, and HSFO availability is super tight in Gibraltar.

PHOTO: View from the Rock of Gibraltar, UK to Algeciras, Spain. Getty Images

PHOTO: View from the Rock of Gibraltar, UK to Algeciras, Spain. Getty Images

Changes on the day to 09.00 GMT today:

- VLSFO prices down in Gibraltar ($9/mt), Rotterdam ($6/mt) and Durban ($5/mt)

- LSMGO prices down in Gibraltar ($22/mt), Rotterdam ($8/mt) and Durban ($2/mt)

- HSFO prices down in Rotterdam ($18/mt) and Gibraltar ($1/mt)

Bunker benchmarks in major European and African ports have declined for the second consecutive day. Rotterdam’s HSFO price has dropped by a massive $18/mt, weighed down by a lower-priced indication of $585/mt in the past day.

Meanwhile, Gibraltar’s HSFO has seen a modest price drop, partly because the grade's availability is “super tight” in the port. The price moves have nearly doubled Gibraltar’s HSFO premium over Rotterdam from $19/mt yesterday, to $36/mt now.

Two bunker suppliers have almost run out of HSFO stock in Gibraltar, while only one supplier has a decent amount of supply available. However, the supplier is taking advantage of the tight market by quoting prices unusually high for prompt supply, a source says. One supplier can supply the grade for delivery dates at the end of September.

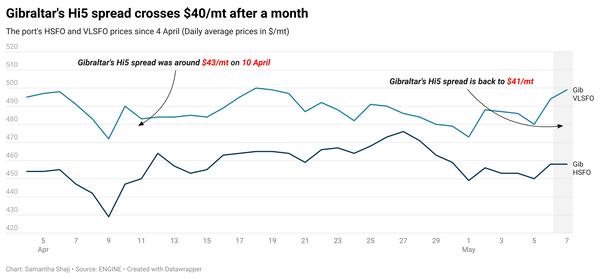

Gibraltar’s Hi5 spread stands at $21/mt, slightly narrower than the spread of $31/mt in Rotterdam.

VLSFO and LSMGO availability is good in Mozambique’s Nacala and Maputo ports, a source says. HSFO is almost out of stock in Nacala, where a replenishment cargo is only expected to arrive after 28 September.

Brent

The front-month ICE Brent contract has shed $0.43/bbl on the day, to trade at $92.47/bbl at 09.00 GMT.

Upward pressure:

Brent futures felt some upward pressure after the US Energy Information Administration (EIA) reported a decrease of 2.14 million bbls in commercial US crude inventories in the week that ended 15 September.

The weekly crude stock draw was mainly due to strong oil exports, the EIA said in its weekly report. The current crude inventory levels in the US stand at 418.47 million bbls, according to the latest figures released by the EIA.

“Brent is still trading well above $90/bbl and a tightening balance suggests that there is still more upside,” said analysts at ING.

Downward pressure:

The recent surge in Brent futures has been capped amid concerns that the US Federal Reserve’s (Fed) could hike interest rates in future.

The US Fed kept its interest rates unchanged during the two-day-long Federal Open Market Committee (FOMC) meeting on 19-20 September. However, oil market analysts have perceived this move as a hawkish pause, leaving room for future rate hikes.

“The Fed kept rates unchanged at yesterday’s FOMC meeting as widely expected. However, it was still seen as a hawkish pause, which put some pressure on risk assets,” which includes oil, said ING’s head of commodities strategy Warren Patterson.

By Nithin Chandran and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.