Europe & Africa Market Update 20 Sep 2023

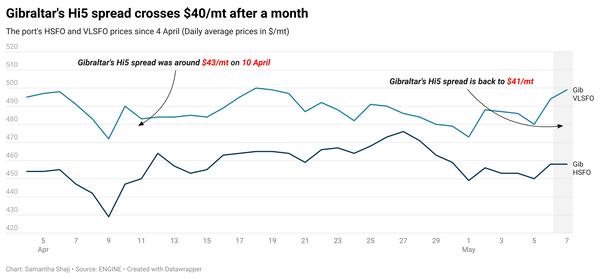

Regional bunker benchmarks have declined with Brent values, and Gibraltar’s Hi5 spread has widened further.

PHOTO: Aerial view of the Bay of Gibraltar. Getty Images

PHOTO: Aerial view of the Bay of Gibraltar. Getty Images

Changes on the day to 09.00 GMT today:

- VLSFO prices down in Rotterdam ($34/mt), Gibraltar ($16/mt) and Durban ($15/mt)

- LSMGO prices down in Rotterdam ($57/mt), Gibraltar ($55/mt) and Durban ($22/mt)

- HSFO prices down in Gibraltar ($28/mt) and Rotterdam ($21/mt)

Bunker benchmarks in major European and African ports have plunged in the past day to reverse some of the gains made in recent days. Gibraltar’s HSFO price drop has outpaced that of its VLSFO, to widen the port’s Hi5 spread from $17/mt yesterday, to $29/mt now.

Gibraltar’s Hi5 spread fell to a record-low of $4/mt at the beginning of this month, but has widened since. Despite the widening of Hi5 spread in Gibraltar, HSFO availability in the port remains very tight as some suppliers are running low on stocks. Tight availability of HSFO could potentially keep the port’s Hi5 spread capped below $50/mt. Lead times of 5-7 days are recommended for the grade, up from 4-6 days last week.

Rotterdam’s LSMGO price has declined steeper compared to the product prices in Durban and Gibraltar. Three LSMGO stems have been fixed in a wide price range of $17/mt in the past day, with one lower-priced stem contributing to drag’s the port’s benchmark lower.

Minimum congestion has been reported in Gibraltar today, port agent MH Bland says. One supplier is experiencing delays of 8-10 hours there. In Ceuta, no backlog has been reported, where 11 vessels are scheduled to arrive for bunkers today, according to shipping agent Jose Salama & Co.

Brent

The front-month ICE Brent contract has lost $2.25/bbl on the day, to trade at $92.90/bbl at 09.00 GMT.

Upward pressure:

Brent futures gained some support after the American Petroleum Institute (API) reported a bigger-than-expected decline in the US commercial crude inventories in the week ended 15 September.

US crude stocks fell by 5.25 million bbls, while analysts expected a fall of 2.67 million bbls, reported Trading Economics citing API data from its Weekly Statistical Bulletin that tracks crude stock builds in the US.

This week’s data “marked the fifth week of declines in the US Crude Oil Inventories in the last six weeks,” said Trading Economics.

Moreover, the Russian government is planning to impose an export duty of $250/mt on all oil products starting 1 October 2023 until 1 June 2024 as a measure to combat fuel supply shortage in the country, Reuters reported citing sources. This move by Russia could push Brent futures higher from current levels in the fourth quarter of 2023.

Downward pressure:

Brent futures lost previous day’s gains as the oil investors focused on the outcomes of the ongoing US Federal Reserve’s (Fed) Federal Open Market Committee (FOMC) meeting.

Oil investors are awaiting the US Fed’s interest rate decision, which could have a direct effect on global oil demand.

"The oil rally is taking a little break as every trader awaits a pivotal Fed decision that might tilt the scales of whether the US economy has a soft or hard landing," said OANDA’s senior market analyst Ed Moya.

Another cycle of rate hikes in the US would make dollar-denominated commodities like oil costlier for non-dollar holders. Higher interest rates discourage borrowing and spending, which leads to a decline in economic activity and fuel demand.

By Nithin Chandran and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.