Europe & Africa Market Update

Most regional bunker benchmarks have gained, and Gibraltar’s HSFO premium over Rotterdam has narrowed.

PHOTO: Oil storage tanks in the oil and bunkering hub of Rotterdam, Netherlands. Getty Images

PHOTO: Oil storage tanks in the oil and bunkering hub of Rotterdam, Netherlands. Getty Images

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Durban ($24/mt) and Gibraltar ($3/mt), and down in Rotterdam ($3/mt)

- LSMGO prices up in Durban ($35/mt), Gibraltar ($7/mt) and Rotterdam ($3/mt)

- HSFO prices up in Rotterdam ($2/mt), and down in Gibraltar ($3/mt)

Most bunker benchmarks in European and African ports have risen in the past day.

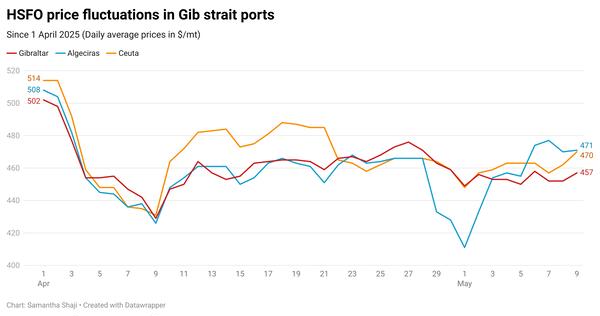

Gibraltar’s HSFO price has declined by $38/mt over the past week, while Rotterdam's benchmark has come down by a modest $11/mt. The price moves have contributed to halve Gibraltar’s HSFO premium over Rotterdam from $68/mt in the past week, to $28/mt.

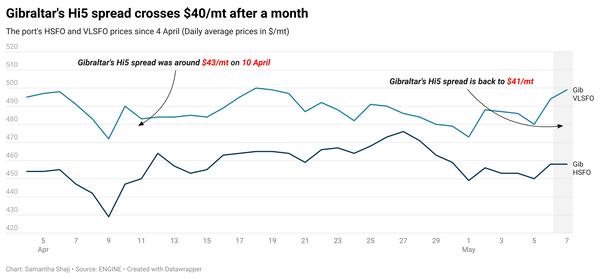

On the other hand, Rotterdam’s VLSFO weekly price drop of $28/mt has outpaced the drop in its HSFO price. As a result, the port’s Hi5 spread has narrowed from last week’s $90/mt to $73/mt now. This is still wider than Gibraltar’s Hi5 spread of $60/mt, but far off than Singapore’s $137/mt.

Prompt HSFO supply is said to be tight in Rotterdam, with recommended lead times ranging between 5-7 days. Tight supply in the port has contributed to keep Rotterdam's HSFO price at relatively elevated levels over the past week.

Securing VLSFO and LSMGO for prompt deliveries off Skaw can be difficult due to tight barge availability, a source says. Product availability is said to be normal, but tight barge availability has stretched out lead times.

Recommended lead times for all grades range between 7-10 days.

Bunkering is progressing smoothly in Algoa Bay today, where two vessels are currently receiving bunkers at anchorage, while three are held up waiting, according to Rennies Ships Agency. But strong wind gusts are forecast to hit the bay from Saturday, which could keep bunkering suspended until Monday.

Brent

The front-month ICE Brent contract has dipped by a marginal $0.15/bbl on the day, to $72.82/bbl at 09.00 GMT.

Upward pressure:

Brent has drawn support from tentative optimism over US oil demand. A contested bill has passed a vote in the US House of Representatives to suspend the country's $31.4 trillion debt ceiling. This will likely mean the US can avoid defaulting on its growing debt and steer clear of an economic meltdown from running out of cash.

US Federal Reserve governor and vice chair nominee Philip Jefferson has indicated that the central bank's interest rate hikes could be paused in June. A rate hike "skip" would counter market expecations of another hike, and could provide the US economy with a bit of breathing space against a backdrop of slow economic growth.

“Oil markets may have been oversold in the last two trading days due to the sluggish Chinese data and debt ceiling concerns. Sentiments rebounded amid the debt bill’s passage in the House and Fed’s rate hike pause signal also offered a rebounding opportunity,” commented CMC Markets analyst Tina Teng.

Downward pressure:

Saudi Arabian oil giant Aramco could cut its official selling prices (OSPs) all crude grades to Asia in July by $1/bbl to a 20-month low, reports Reuters.

Demand indications from the world’s largest oil importer China continue to be mixed after it released weaker-than-expected manufacturing and services data for May, provoking the market to worry about a lag in demand.

US crude oil inventories grew by about 5.2 million bbls last week, according to an estimate from the American Petroleum Institute (API). The build countered the 1.2 million-bbl draw expected by analysts, says Oilprice.com.

By Nithin Chandran and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.