Europe & Africa Market Update

Bunker prices in European and African ports have declined, and prompt LSMGO availability is tight in Amsterdam.

PHOTO: Oil storage tanks in the Port of Amsterdam, Netherlands. Getty Images

PHOTO: Oil storage tanks in the Port of Amsterdam, Netherlands. Getty Images

Changes on the day to 09.00 GMT today:

- VLSFO prices down in Rotterdam ($19/mt), Durban and Gibraltar ($8/mt)

- LSMGO prices down in Durban ($16/mt), Rotterdam ($15/mt) and Gibraltar ($13/mt)

- HSFO prices down in Gibraltar ($22/mt) and Rotterdam ($8/mt)

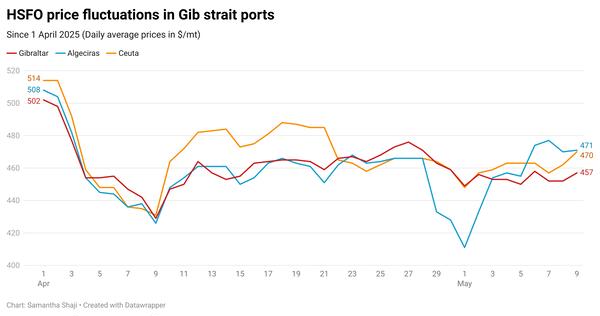

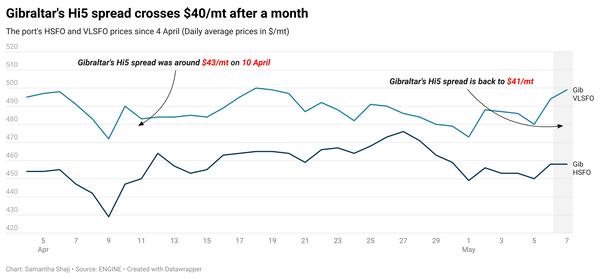

Bunker benchmarks in European and African ports have tracked Brent’s decline. Gibraltar’s HSFO has declined by $22/mt in the past day, while its VLSFO price made a modest decline of $4/mt. The price moves have widened the port’s Hi5 spread from yesterday’s $52/mt to $70/mt.

Securing LSMGO stems for prompt dates can be difficult in Amsterdam. Two suppliers are unable to supply the grade due to a lack of product availability. One supplier can only supply LSMGO for delivery dates in the second week of June, a source says. Product availability is slightly better at in the nearby ports of Rotterdam and Antwerp.

Amsterdam’s LSMGO has been indicated at around $700/mt today. This is about $20/mt above the front-month ICE Low Sulphur Gasoil Futures, which normally trades at a premium over LSMGO.

Some congestion has been reported in Gibraltar, where 11 vessels are scheduled to arrive today, up from yesterday’s six vessels, port agent MH Bland. One supplier is experiencing delays of 8-12 hours due to a bunker barge not being ready, MH Bland says.

Meanwhile, minimal congestion has been reported in Algeciras and Ceuta.

Brent

The front-month ICE Brent contract has shed $1.61/bbl on the day, to $75.59/bbl at 09.00 GMT.

Upward pressure:

Conflicting statements from oil producers before the OPEC+ meeting on 4 June have created uncertainty regarding potential supply cuts.

"The voluntary production cuts in April caught the market off guard. This time, investors are extremely cautious before the final decision is announced," said analysts from Haitong Futures in a note.

Downward pressure:

Brent futures have come down after concerns about the tentative US debt ceiling pact created risk-on sentiment in the market.

Investors are also waiting for Chinese manufacturing and services data to be released this week to examine the chances of a fuel oil demand recovery in the world’s largest oil-importing country.

“Chinese equities have been pretty disappointing, as is true of most cyclical exposures, notably oil,” said SPI Asset Management’s Stephen Innes.

On the other hand, OPEC will welcome Iran’s complete return to the oil market after sanctions are lifted, said OPEC Secretary General Haitham Al Ghais said according to the Iranian Oil Ministry’s website SHANA. Iran can bring on significant production volumes in short periods, added the Secretary-General.

"We believe that Iran is a responsible player amongst its family members, the countries in the OPEC group. I’m sure there will be good work together, in synchronization, to ensure that the market will remain balanced as OPEC has continued to do over the past many years," SHANA's English-language website cited him saying.

By Nithin Chandran and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.