Europe & Africa Market Update

Bunker prices in most European and African ports have decreased, and fixing prompt VLSFO stems can be slightly difficult in Rotterdam.

PHOTO: Oil storage tanks in the bunkering hub of Rotterdam, Netherlands. Getty Images

PHOTO: Oil storage tanks in the bunkering hub of Rotterdam, Netherlands. Getty Images

Changes on the day to 09.00 GMT today:

- VLSFO prices down in Durban ($16/mt), Rotterdam ($8/mt) and Gibraltar ($5/mt)

- LSMGO prices up in Durban ($6/mt), and down in Rotterdam ($28/mt) and Gibraltar ($19/mt)

- HSFO prices down in Gibraltar ($23/mt) and Rotterdam ($13/mt)

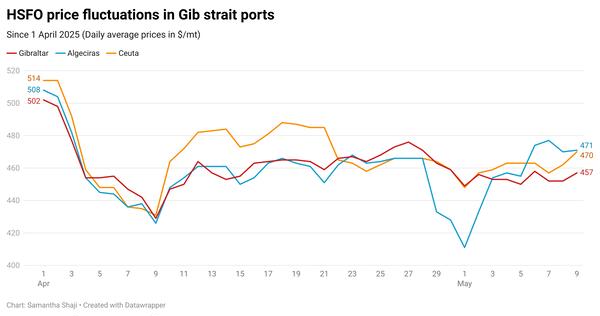

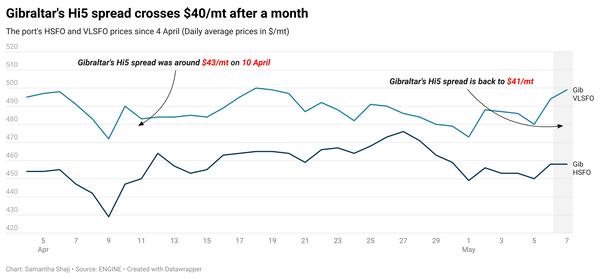

Bunker prices across grades have dropped in Gibraltar and Rotterdam in the past day. A steeper fall in Gibraltar’s HSFO price has narrowed its premium by $10/mt to $64/mt. Fuel availability is said to be normal in the British Overseas Territory.

However, securing prompt delivery of VLSFO can be slightly difficult in Algeciras, where one supplier is fully booked for prompt dates, according to a source.

Fixing prompt VLSFO stems can be difficult in Rotterdam as some suppliers are running low on stocks, a second source says. Availability of HSFO and LSMGO is said to be better. A lower-priced HSFO stem fixed in Rotterdam, in the past day, contributed in dragging the port’s benchmark lower.

Minimal congestion has been reported in Gibraltar, Algeciras and Ceuta today, according to MH Bland.

Bunkering is progressing normally in South Africa’s Algoa Bay, where a vessel is currently being fuelled at anchorage, according to Durban-based Rennies Ships Agency.

Rough weather conditions are forecast for Algoa Bay on Thursday and Friday, which could delay operations there.

Brent

The front-month ICE Brent contract has inched upwards by $0.24/bbl on the day, to $75.79/bbl at 09.00 GMT.

Upward pressure:

Nigeria has commissioned the 650,000 b/d Dangote oil refinery, which will begin operations in June. The facility is most likely to process Nigerian crude. However, in recent years, the OPEC member has struggled to meet its production targets due to various factors, including oil theft.

The possibility that Nigeria will have to reduce its crude exports to divert supply to the refinery could further exacerbate concerns about supply tightening.

Meanwhile, seaborne net exports of OPEC nations that implemented production cuts, starting in May, have declined by 1 million b/d over the past two weeks, according to SPI Asset Management’s managing partner Stephen Innes, who cited Kpler data.

Furthermore, a Kpler forecast states Russia's oil production for May will hover at 10.70 million b/d, a decrease of about 350,000 b/d from February's output.

Downward pressure:

The oil market remains cautious as the US Congress is still caught in a debt-ceiling stalemate, with the “hard-deadline” of 1 June just over 10 days away.

Concerns over the world's largest economy defaulting on its debt obligations, coupled with slower-than-expected economic recovery in China, have kept Brent under the weather this month.

“Oil prices have come under significant pressure through Q2, primarily reflecting evidence of increasing Western demand headwinds from a sharp manufacturing slowdown and collateral damage from the US banking sectors,” Stephen Innes wrote in a recent note to clients.

By Shilpa Sharma and Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.