Europe & Africa Market Update

Regional bunker prices have risen over the weekend, and bunkering is still limited by bad weather in Las Palmas.

PHOTO: Cargo ships in the Port of Las Palmas, Spain. Getty Images

PHOTO: Cargo ships in the Port of Las Palmas, Spain. Getty Images

Changes on the day from Friday, to 09.00 GMT today:

- VLSFO prices up in Durban ($34/mt), Rotterdam and Gibraltar ($10/mt)

- LSMGO prices up in Rotterdam ($15/mt), Gibraltar ($14/mt) and Durban ($12/mt)

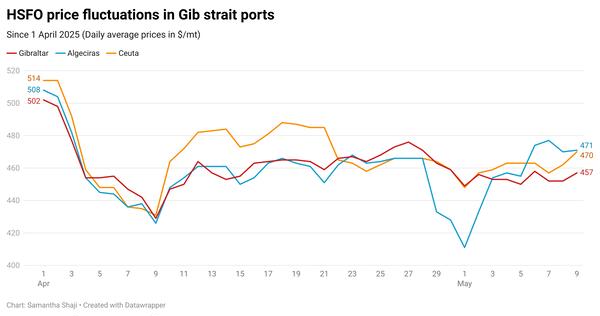

- HSFO prices up in Gibraltar ($9/mt) and Rotterdam ($8/mt)

Suppliers have been struggling to deliver stems at Las Palmas’ outer anchorage since 8 May due to bad weather, according to port agent MH Bland. Delivery of stems at the port’s outer anchorage is currently “subject to weather conditions,” the port agent says. The weather is expected to improve in the coming days, which could allow for bunkering to resume fully. Meanwhile, bunker deliveries are available via ex-pipe at berth or by barge at Las Palmas’ inner anchorage.

Bunker prices across all grades have increased in Rotterdam and Gibraltar over the weekend. A higher-priced LSMGO stem fixed in Rotterdam in the past trading day has contributed to push the port’s benchmark higher. Supply of the grade is normal in Rotterdam, but fixing prompt stems of HSFO and VLSFO has been difficult in recent weeks.

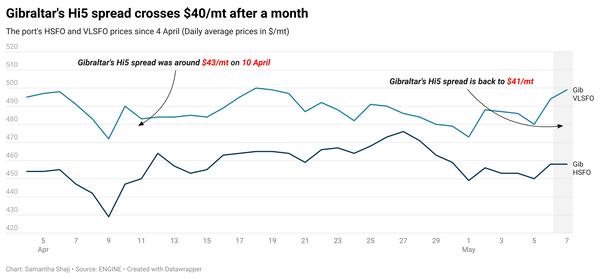

Bunker fuels availability is said to be normal in Gibraltar. The port’s VLSFO price is at $4-7/mt discounts to Algeciras and Las Palmas, and a $17/mt discount to offshore Malta.

Slight congestion has been reported in Gibraltar and Algeciras today, according to MH Bland. Bunkering is going ahead as usual in Ceuta, where 11 vessels are scheduled to arrive today, up from seven on Friday, according to shipping agent Jose Salama & Co.

Brent

The front-month ICE Brent contract has declined by $0.72/bbl on the day from Friday, to $75.55/bbl at 09.00 GMT.

Upward pressure:

Wildfires in Canada’s oil-rich province of Alberta, and Turkey’s refusal to restart Kurdish crude exports from the Ceyhan terminal, have kept substantial quantities of crude oil off the market.

Supply concerns have been further magnified by a Baker Hughes report, which shows a slowdown in US drilling activity despite the Biden administration's plans to replenish its strategic petroleum reserves. The oilfield services provider says the US oil rig count fell by 11 in the latest week to 575 - the lowest since June 2022.

Meanwhile, the International Energy Agency (IEA) has estimated that global crude demand – led by China and India – will surpass production by almost 2 million b/d this year, resulting in a supply deficit in the second half of 2023.

Downward pressure:

Sentiment in the oil market has been clouded by the ongoing US debt-ceiling saga that has yet to produce a positive result. The US Secretary of the Treasury, Janet Yellen, has warned of a 1 June deadline for raising the debt ceiling, and White House economists have forecast crippling effects should the nation default on its debt obligations.

On the other hand, while there have been a few moments of optimism about a demand surge in both China and India and a resultant tightening of supply, the scenario has not materialised as expected.

Recent positioning data indicates that traders are "bearish" on the oil market, ING’s head of commodity strategy Warren Patterson has written in a note.

“… speculators remain negative towards the market with the net speculative long in ICE Brent falling by 6,020 lots over the last reporting week to 106,722 lots as of last Tuesday. This is the smallest position that speculators have held this year,” Patterson added.

By Shilpa Sharma and Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.