Latin America’s transition away from HSFO to VLSFO

Recently pricing in the bunker market has been heavily disrupted, particularly in Singapore and Europe, because of logistical issues associated with switching over supply infrastructure to the new low sulphur fuels from HSFO. However, thus far, globally volumes sold and the proportion of volumes sold by fuel type, have remained relatively stable, except for Latin America.

However, thus far, globally volumes sold and the proportion of volumes sold by fuel type, have remained relatively stable, except for Latin America.

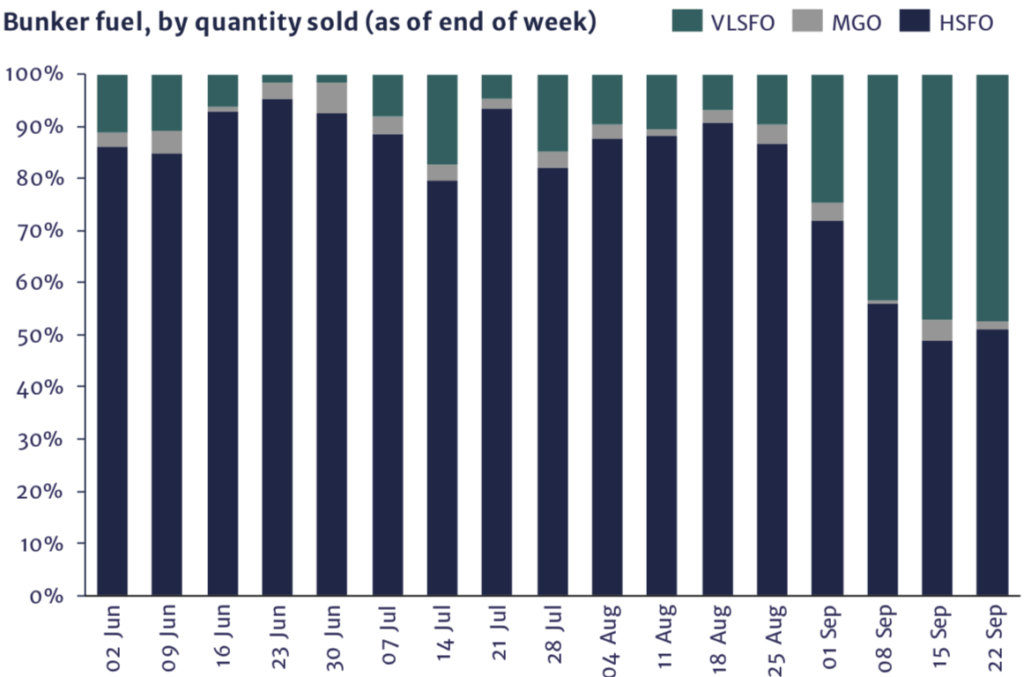

By monitoring Integr8’s proprietary bunker quality datasets, we are seeing the first real signs of the market adapting for IMO 2020, based on physical sales. This is being observed in Latin America, with an increase in the volumes of VLSFO being sold since the end of August.

Due to the low sulphur nature of much of Latin America’s crude oil, the supply of fuel oil in the region has often been less than 0.5% sulphur, even when a premium for low sulphur fuel oil bunkers was not available.

However, we are now witnessing suppliers in Latin America doing a very good job of separating low sulphur streams from high sulphur streams to produce greater volumes of VLSFO. The ability to separate streams (in the refinery and further down the supply chain) has been discussed at length by oil market ex- perts, but this is the first real market evidence that suppliers are successfully doing this.

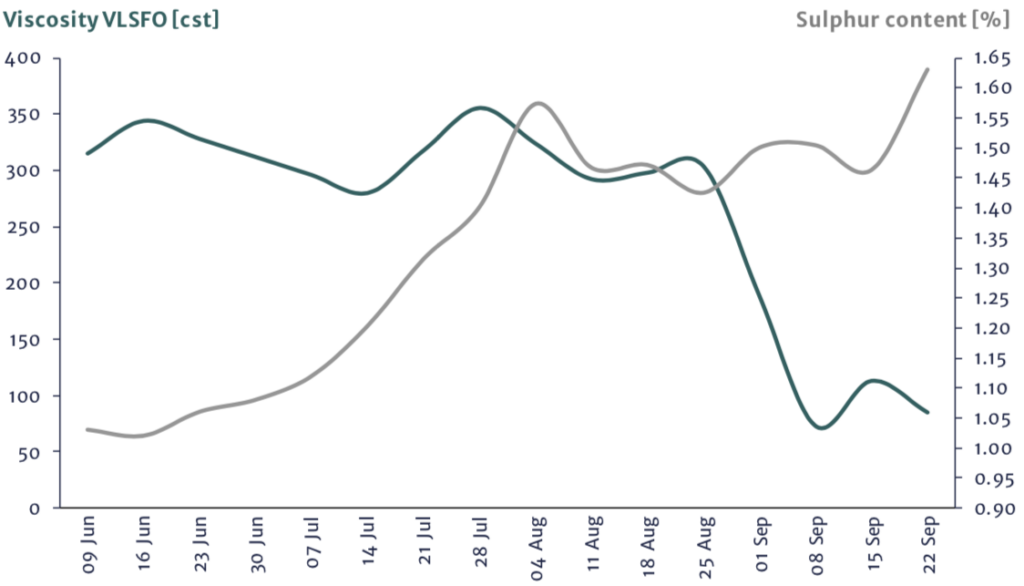

Indeed, a rise in the average sulphur levels of HSFO being sold is an indicator of streams being segregated in a way they were not previously. The average sulphur level of HSFO bunkers in Latin America was 1.0% in June 2019, but in the first few weeks of September 2019 the average sulphur level had risen to 1.5%. Indeed, a rise in the average sulphur levels of HSFO being sold is an indicator

Meanwhile, analysis of the viscosity, pour point and Aluminium + Silicon of VLSFO type fuel being sold in June and September 2019 in Latin America sug- gests that VGO (rather than distillate) is also being blended with straight run low sulphur fuel oil to meet the growing demand for VLSFO.

What we are seeing is in keeping with what we are hearing about suppliers’ plans. The key regional supplier Petrobras will reportedly stop selling HSFO from 1st October, to shift to VLSFO.

Integr8’s proprietary datasets allow us to monitor in a timely manner changes occurring in the bunker market. This has never been more important than at the current moment in time. The change occurring in Latin America is the most dramatic IMO 2020 effect we have seen so far. However, the rest of the global market will now begin to move as well.

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.