Europe & Africa Market Update 15 Oct 2025

Fuel prices in major European and African ports have moved in mixed directions, and Belgian ports face high levels of congestion.

IMAGE: Bunkering of vessel in the Port of Antwerp. Port of Antwerp

IMAGE: Bunkering of vessel in the Port of Antwerp. Port of Antwerp

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Gibraltar ($10/mt) and Rotterdam ($9/mt)

- LSMGO prices unchanged in Rotterdam, and down in Gibraltar ($3/mt)

- HSFO prices up in Durban ($11/mt) and Gibraltar ($6/mt), and down in Rotterdam ($6/mt)

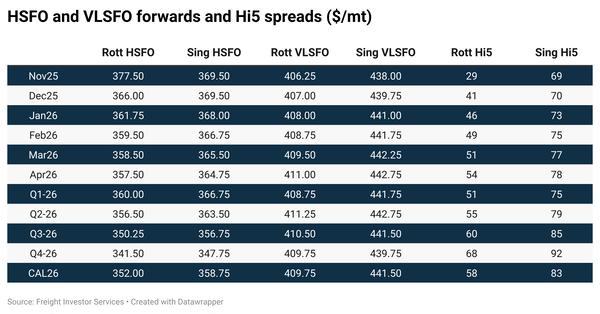

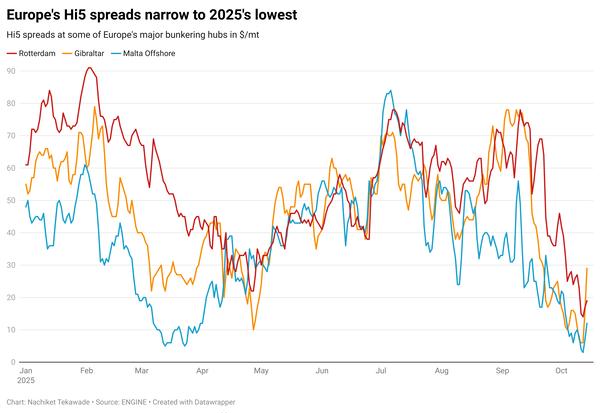

At Rotterdam, the price of VLSFO has gained, while that of HSFO has declined, widening the Hi5 spread at the port by around $15/mt, in a single day.

Prompt supplies in the ARA hub remain difficult - LSMGO availability is especially tight and requires around a week of lead time. VLSFO and HSFO can be delivered with a notice of 5-7 days, a trader told ENGINE.

Meanwhile, the nationwide strike in Belgium as well as the strike by the Belgian pilot associations have both been suspended, as of today morning. Maritime traffic to and from Antwerp has resumed, shipping agency VertomCory Antwerp said.

Congestion has increased following the disruption, with more than 200 vessels currently waiting at the ports of Antwerp, Zeebrugge and Ghent as well as in the North Sea, VertomCory said.

Bunkering in the ports is likely to be affected until the congestion eases, a source told ENGINE.

Brent

The front-month ICE Brent contract has gained by $0.36/bbl on the day, to trade at $62.31/bbl at 09.00 GMT.

Upward pressure:

Brent crude’s price has rebounded amid signs of easing trade tensions between the world's two largest oil consumers – the US and China.

US President Donald Trump is set to meet his Chinese counterpart, Xi Jinping, in South Korea later this month, Reuters reported, citing US Treasury Secretary Scott Bessent.

Both countries are expected to work towards easing tensions following recent tariff threats and export controls, the report added.

“Trump struck a conciliatory tone towards China on Sunday, after threatening to apply an additional 100% of tariffs,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Downward pressure:

Brent has remained under pressure after the International Energy Agency (IEA) cut its global oil demand growth forecast again.

The Paris-based agency now expects oil demand to increase by 700,000 b/d in 2025 and 2026, about 40,000 b/d lower than its previous estimate – and well below projected oil production levels, the IEA said.

“Sentiment wasn’t helped by warnings of a record surplus in the oil market,” Hynes said.

Additionally, global oil supply rose in September to a record 108 million b/d, up by a massive 5.6 million b/d compared with the same period last year, the IEA noted.

The agency projects global oil supply to grow by 3 million b/d to average 106.1 million b/d in 2025 and rise by another 2.4 million b/d in 2026.

“The projected surplus is up roughly 18% from last month’s estimate, as the OPEC+ alliance continues to revive output,” he added.

By Nachiket Tekawade and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.