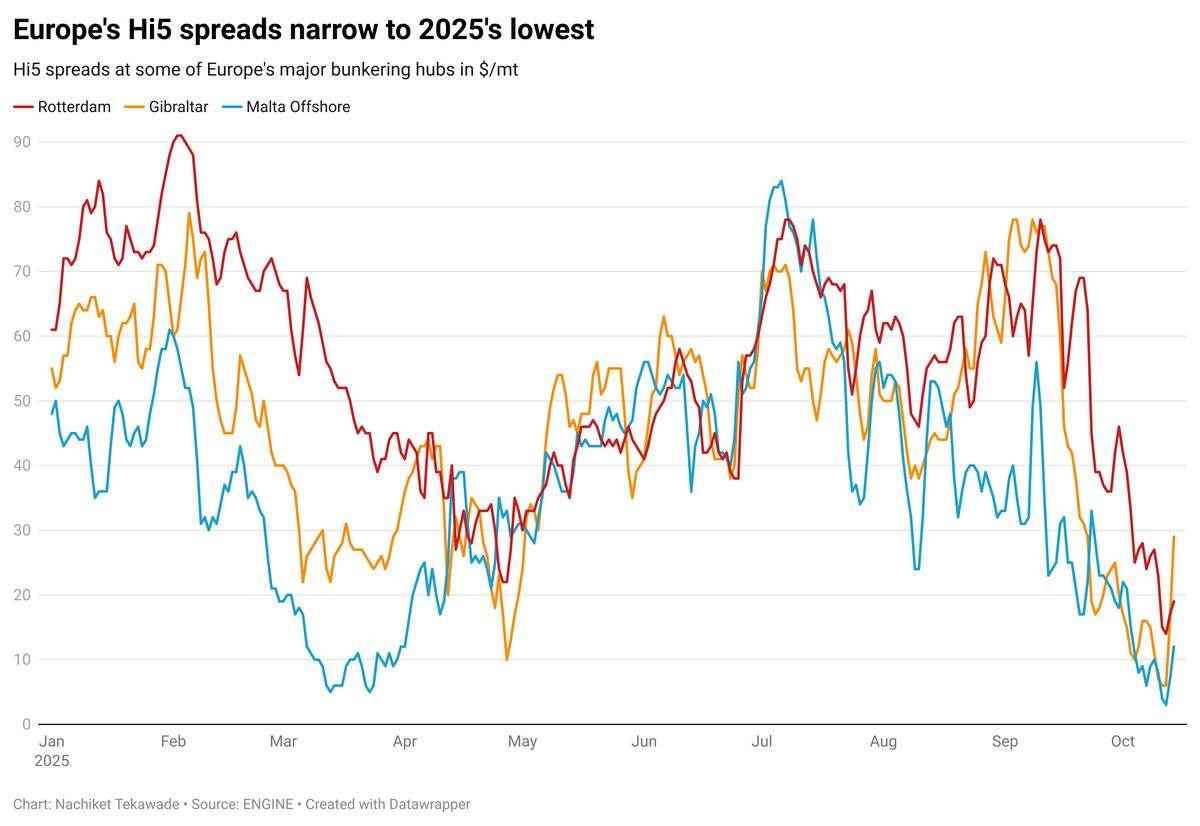

Europe’s Hi5 spreads narrow on supply imbalance

An oversupply of VLSFO, combined with tight HSFO availability in Europe, has pushed Hi5 spreads at Rotterdam, Gibraltar and Malta Offshore to their lowest levels of 2025.

The Hi5 spread, which measures the price difference between VLSFO and HSFO, is a key indicator of scrubber economics. When the spread widens, scrubber-fitted ships gain a price advantage by burning cheaper HSFO, instead of the more expensive VLSFO or LSMGO used by non-scrubber vessels. When the spread narrows, that cost benefit reduces.

There are currently 6,700 scrubber-fitted vessels globally as of 2025, with about 200 more vessels expected to be fitted with scrubbers by 2028, according to DNV's data.

Spreads at the three ports dropped to between $3-14/mt earlier this week, before posting slight recoveries over the past day. However, they remain well below this year’s highs of $80-95/mt.

“The ramp up in U.S HSFO imports in recent months has tightened European HSFO balances. This is in contrast to European VLSFO markets which have seen supply balloon amid limited arbitrage opportunities into Asia," Kpler’s Lead Fuel Oil Analyst Roslan Khasawneh told ENGINE.

VLSFO bunkering has also taken a hit from the recently implemented Mediterranean Emission Control Area (MedECA) sulphur limit of 0.10%, further weighing on prices, Khasawneh added.

VLSFO bunkering has significantly reduced in Mediterranean ports after MedECA was implemented on 1 May, while demand for LSMGO and ULSFO has increased, a recent analysis of ENGINE fuel quality data showed.

“Hi5 spreads are expected to gradually widen as Europe’s excess VLSFO is shipped to Asia with the recent reopening of East-West arbitrage spreads, and as signs of slowing HSFO import demand into the U.S. frees up supply for Europe,” Khaswaneh said.

By Nachiket Tekawade

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.