Biofuel Bunker Snapshot: Dutch rebates climb higher

Dutch HBE rebate for B100 gains over $25/mt

EU bio-market could turn bullish this year – PRIMA

China’s UCOME price gains after 2-week losses

Rotterdam

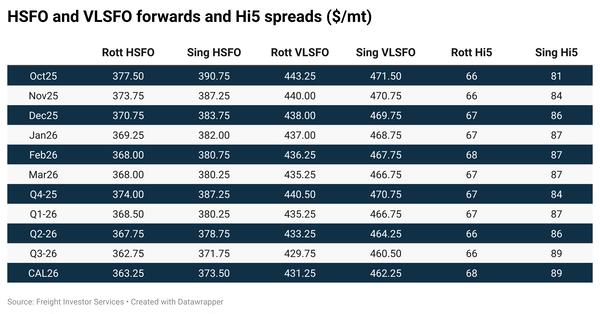

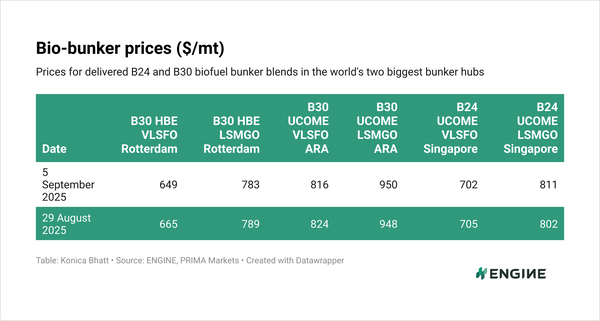

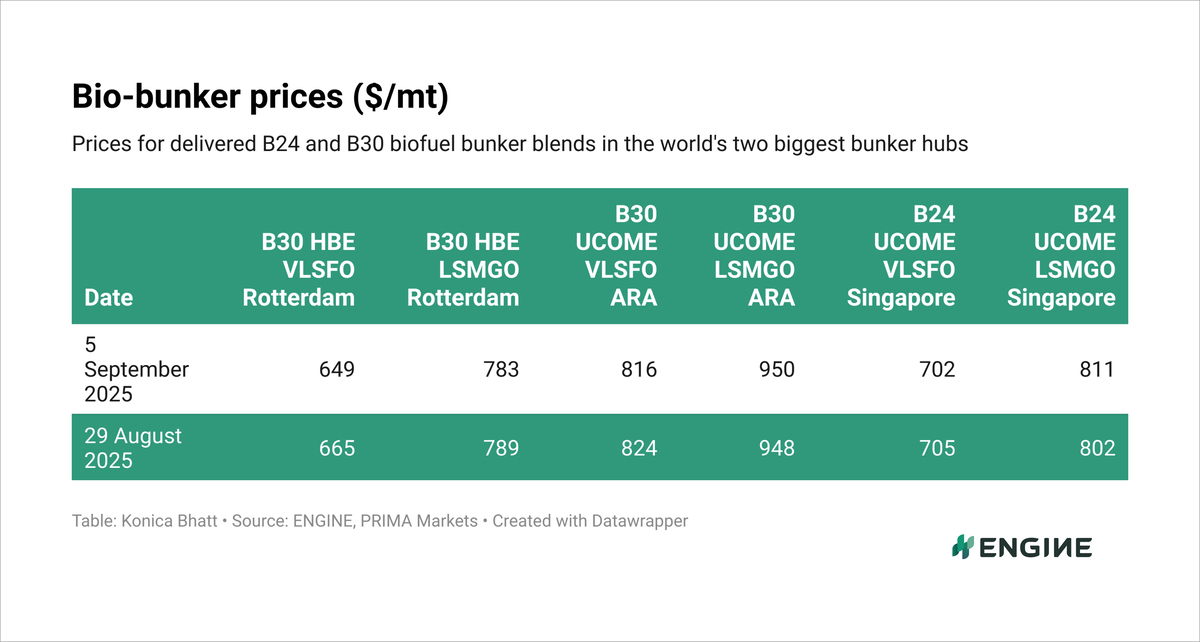

The HBE-rebated B30-VLSFO price in Rotterdam has fallen by $16/mt over the past week. The drop reflects a $12/mt decline in ENGINE’s pure VLSFO benchmark, combined with an $8/mt increase in the HBE rebate for B30 marine biofuels.

Rotterdam’s HBE-rebated B30-LSMGO has eased lower by a smaller $6/mt, primarily influenced by Dutch rebates.

The HBE rebate for B100 has risen by $27/mt in the past week to apply downward pressure on B100 bunker prices in Dutch ports.

Prima Markets’ POMEME CIF ARA barge price has held mostly steady, inching up by $2/mt over the week and adding slight upward pressure to Dutch biofuel bunker prices. The POMEME price has tracked a similar gain for Prima’s UCOME FOB ARA barge price.

Across the wider ARA region, UCOME-based B30-VLSFO has declined by $8/mt following VLSFO’s decline. B30-LSMGO has edged $2/mt higher and mirrored a $2/mt uptick in ENGINE’s LSMGO benchmark.

PRIMA expects the biodiesel market to turn more bullish this year as demand rises across the road, aviation and marine fuel sectors, the reporting agency said in a recent webinar. On the supply side, a higher risk profile for imports could push domestic feedstocks in the EU and UK to €30–75/mt ($35–87/mt) premiums over imports, Prima added.

Together, these factors could add upward pressure to bio-feedstock prices in the ARA bunker market.

Singapore

Singapore's B24-VLSFO UCOME price has edged $2/mt lower in the past week. An $8/mt fall in Singapore’s VLSFO benchmark has pulled down the price, but a $15/mt rise in Prima’s UCOME FOB China cargo benchmark has partially offset it.

Singapore’s B24-LSMGO price has gained $9/mt, driven by a $6/mt rise in LSMGO on top of the UCOME price rise.

China’s UCOME prices have bounced back over the past week after muted demand and limited buying activity pushed them lower for two weeks in a row. "Fresh trades, offers and bids" ranging between $1,165-1,180/mt have fuelled the gains, Prima reported on Thursday.

Other bio-bunker news

Shell Nederland Raffinaderij will not restart construction of its planned 820,000 mt/year biofuels facility in Rotterdam. The company has attributed adverse market dynamics and high completion costs that would make the project economically unviable as reasons for its decision.

The Maritime and Port Authority of Singapore (MPA) has released a circular with interim guidance on the carriage of biofuel blends in the port. For blends above 30%, bunker suppliers and craft operators must obtain approval from MPA’s Standards & Investigation – Marine Fuels (SIMF) department before conducting pilot trials or making deliveries to shipowners, managers and operators.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.