Fuel Switch Snapshot: B100 pooling value surges

Conventional fuel prices slump on Brent’s drop

Estimated B100 pooling value nears $750/mt

Rotterdam LNG bunker delivery premium falls

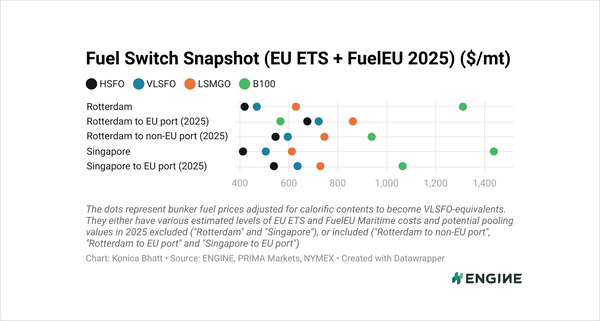

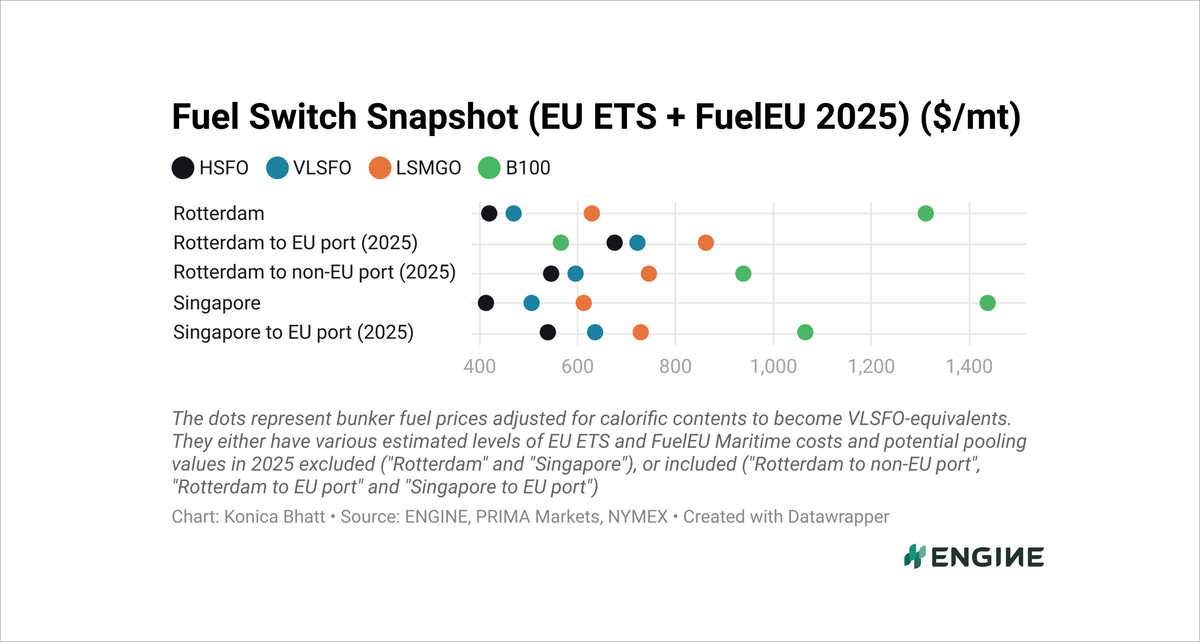

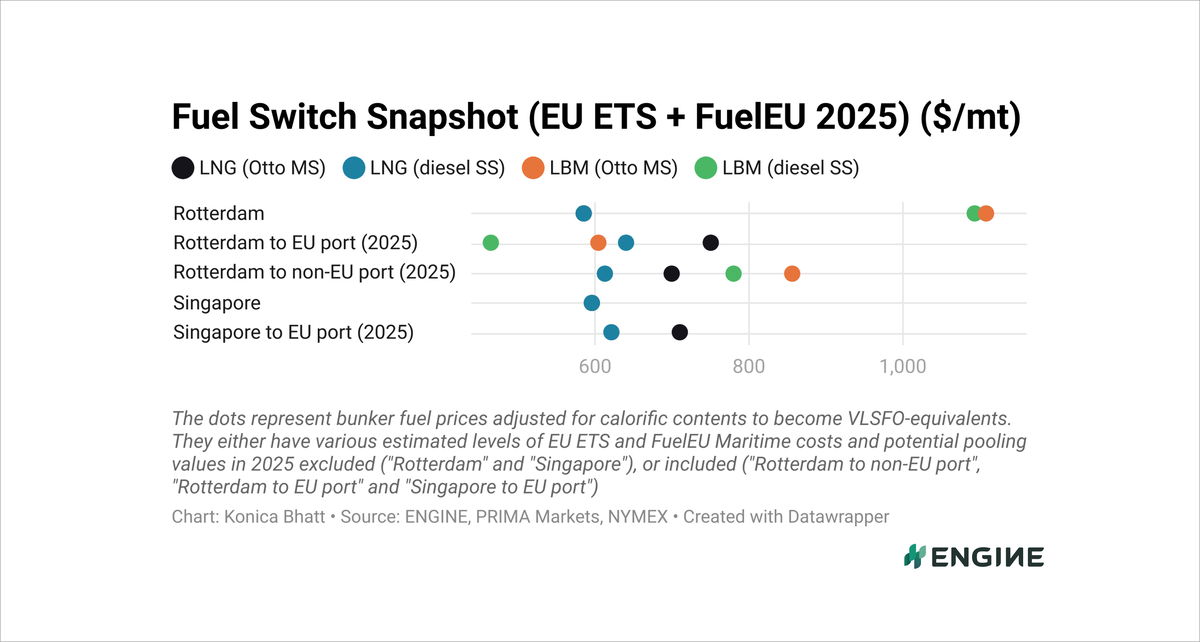

All bunker prices mentioned below have been adjusted for calorific contents to make them VLSFO-equivalent. They have estimated EU-EU voyage compliance costs included for Rotterdam, and non-EU-EU compliance costs included for Singapore. These account for EU ETS costs and FuelEU Maritime penalties, and our estimated compliance surplus values for FuelEU pooling. Rotterdam's B100 and LBM prices also factor in Dutch HBE rebates for advanced liquid and gaseous biofuels sold in the Netherlands.

All bunker prices mentioned below have been adjusted for calorific contents to make them VLSFO-equivalent. They have estimated EU-EU voyage compliance costs included for Rotterdam, and non-EU-EU compliance costs included for Singapore. These account for EU ETS costs and FuelEU Maritime penalties, and our estimated compliance surplus values for FuelEU pooling. Rotterdam's B100 and LBM prices also factor in Dutch HBE rebates for advanced liquid and gaseous biofuels sold in the Netherlands.

Rotterdam’s B100 is now at a $159/mt discount to VLSFO, almost unchanged from the week prior.

Dutch-rebated B100 remains the cheapest compliance option for conventional-fuelled vessels in Rotterdam when factoring in EU regulations. The theoretical FuelEU pooling benefit for vessels sailing between EU ports and selling their compliance surplus from using B100 has climbed by $51/mt in the past week to an estimated $748/mt.

In Singapore, the picture is very different. B100 remains far more expensive, holding a $431/mt premium over VLSFO even after narrowing by $34/mt in the past week.

For dual-fuel vessels in Rotterdam, the cheapest option depends on engine type. B100 is the lowest-cost compliance fuel for ships with Otto medium-speed engines, priced at a $40/mt discount to liquefied biomethane (LBM).

LBM becomes the more economical choice for vessels with diesel slow-speed engines, with B100 carrying a $99/mt premium over it.

Liquid fuels

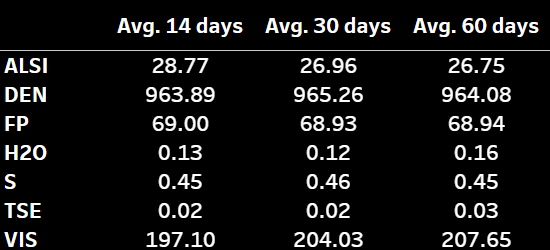

A sharp $3/bbl ($22/mt) slide in front-month ICE Brent futures has knocked down conventional fuel prices over the past week. Rotterdam’s VLSFO has taken a heavy hit, falling $32/mt, while Singapore’s VLSFO has seen a milder $13/mt drop.

Conventional fuel availability remains stable in the ARA bunkering hub, but prompt deliveries are tight, a trader told ENGINE.

In Singapore, VLSFO delivery schedules vary widely depending on the supplier. Some can deliver within three days, while others require bookings up to three weeks in advance. This marks a tightening from last week’s range of 9–11 days.

B100 benchmarks in Rotterdam and Singapore have dropped by $34–47/mt and outpaced $28-39/mt declines in their respective LSMGO prices.

Liquid gases

Rotterdam’s LBM prices have fallen by $19–38/mt over the past week, depending on engine type, exceeding fossil LNG’s $13–17/mt drops.

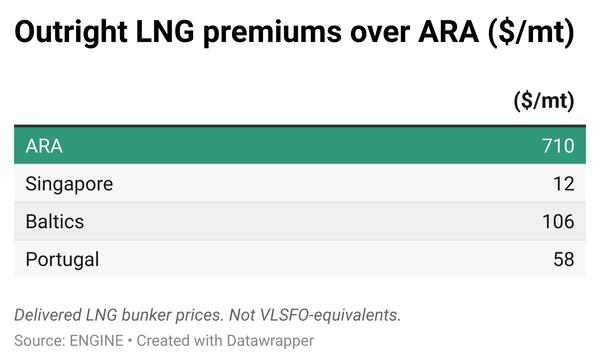

The declines in Rotterdam’s LNG bunker prices have come amid a 3% drop in the front-month Dutch TTF Natural Gas contract and a 4% fall for ENGINE’s LNG bunker delivery premium, which is now at $127/mt.

In Singapore, LNG bunker prices have held mostly steady, edging up by $3/mt on the week. This is in line with a stable front-month NYMEX Japan/Korea Marker (JKM), which typically guides Asian LNG bunker prices.

One supplier told ENGINE that LBM feedstock prices in the ARA region have nearly doubled in recent months because of high bunker demand. This trend is reflected in Rotterdam’s ENGINE-assessed LBM price, which has risen about $41/mt over the past three months.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.