Americas Fuel Availability Outlook 7 Aug 2025

HSFO tight in Houston

Bunker demand static in Los Angeles

Demand improves in Panama

IMAGE: Oil refinery in Texas City, located just south of Houston. Getty Images

IMAGE: Oil refinery in Texas City, located just south of Houston. Getty Images

North America

Bunker demand remains steady in Houston, with fuel availability at the port considered normal. VLSFO and LSMGO can be delivered with a recommended lead time of around five days.

"In Houston, a lead time of around five days is recommended. Deliveries within a shorter window are possible, but options become more limited, and pricing tends to be less competitive," a bunker trader told ENGINE.

HSFO is a bit tight, and the port of Houston is experiencing a few bunker barge delays.

Suppliers are quoting prompt pricing for deliveries within five days, with a general lead time recommendation of 6–7 days.

The port has been experiencing thunderstorms and heavy showers in the early mornings, but weather conditions usually tend to stabilize by the evening.

In New Orleans, Louisiana (NOLA), all three fuel grades are available with a recommended lead time of 6–7 days, amid steady demand.

The shortest time HSFO and VLSFO can be delivered in NOLA is under five days.

In NOLA, the recommended maximum draft for loading is 50 feet for vessels.

In Bolivar Roads, VLSFO and LSMGO can be delivered in lead times of 7-8 days.

Fuel availability is good at the Galveston Offshore Lightering Area (GOLA), where several suppliers can offer HSFO and LSMGO with lead times of 3–4 days.

VLSFO is also available at the anchorage and requires a longer lead time of around 5–6 days.

Amid the ongoing hurricane season, a spell of rough weather is expected to impact Bolivar Roads and the Galveston Offshore Lightering Area (GOLA) the most.

Currently operations are underway at both the bunkering locations, a source confirmed.

In New York, bunker fuel demand is normal, and fuel availability is good for all three grades at the port.

Lead times for HSFO have shortened this week, with suppliers now recommending 3–4 days, down from the previously advised lead time of at least five days. VLSFO and LSMGO can also be supplied within the same lead times at the port.

Easterly winds at the port of New York are currently blowing at 10–15 knots, with wave heights around 2 feet. Winds are forecast to ease to 5–10 knots by Thursday night, with waves subsiding to 1 foot or less.

These conditions are expected to hold through Friday night, a ship agent informed.

On the West Coast, Los Angeles and Long Beach have recorded static demand.

Container vessels at the port of Los Angeles dropped to 21 this week from 27, the week before. The port noted it is expected a further decline to 20 vessels in the upcoming week from 10-14 August.

Bunker fuel availability conditions are normal, and suppliers have recommended lead times of just under a week to 7-8 days for HSFO and LSMGO.

VLSFO can be delivered within shorter lead times at the port, a source said.

Latin America and the Caribbean

In Panama, bunker fuel demand has been healthier than the previous weeks, and availability is good at both the ports of Balboa and Cristobal.

"Panama, in particular, has been noticeably busier than in prior weeks. HSFO supply is tighter, so would recommend allowing for more lead time there," according to a source.

VLSFO and LSMGO can both be supplied within lead times of 3-6 days. HSFO requires longer lead times and can be delivered between 7-8 days of time.

The shortest time two suppliers can deliver VLSFO at Balboa is in 1-2 days.

VLSFO and LSMGO remain readily available across Colombia’s Cartagena, Santa Marta, and Barranquilla, with prompt delivery windows of 3–4 days.

In Freeport, Bahamas, HSFO and LSMGO can typically be supplied within 5–6 days, though some suppliers may be able to deliver in as little as 2–3 days.

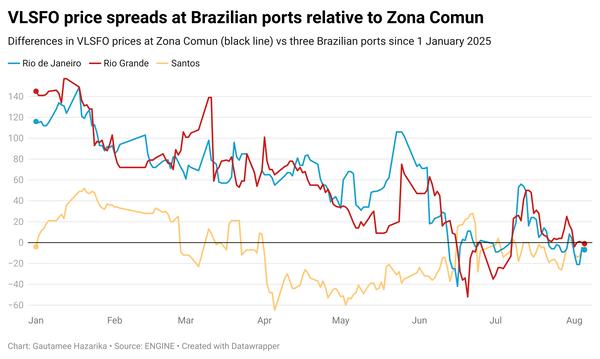

Bunker fuel availability continues to be good in Brazil, with demand reported as steady.

Lead times in Brazilian hubs such as Rio Grande and Rio de Janeiro are generally around 5–6 days.

Santos looks congested over the next 7 days, and lead times would be around 7–8 days for VLSFO and LSMGO.

In Argentina’s Zona Comun, both VLSFO and LSMGO have good availability. Prices are holding largely steady this week.

Suppliers are recommending around 5–7 days lead time for deliveries.

Overall availability is good, with a few spots reporting tightness.

"Demand has held steady across most ports in the Americas, and availability looks decent across all ports at the moment," a bunker trader told ENGINE.

By Gautamee Hazarika

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.