Americas Market Update 5 Aug 2025

Fuel prices in the Americas have mostly moved downwards, and high wind gusts are expected in New York starting tomorrow.

Changes on the day to 08.00 CDT (13.00 GMT) today:

- VLSFO prices up in Zona Comun ($9/mt), and down in Houston ($17/mt), New York and Balboa ($4/mt) and Los Angeles ($3/mt)

- LSMGO prices up in Zona Comun ($27/mt), and down in Los Angeles ($38/mt), Balboa ($23/mt), Houston ($16/mt) and New York ($5/mt)

- HSFO prices down in Houston ($9/mt), Balboa ($8/mt), New York and Los Angeles ($3/mt)

Both fuel grades in Zona Comun have recorded price increases in the past session, while all other key ports in the Americas have seen price declines.

According to a source in Argentina, the anchorage location has had smooth weather conditions, and suppliers are asking for 5–7 days of lead time for deliveries.

"Everything is normal here, prices are stable (low)," the source said.

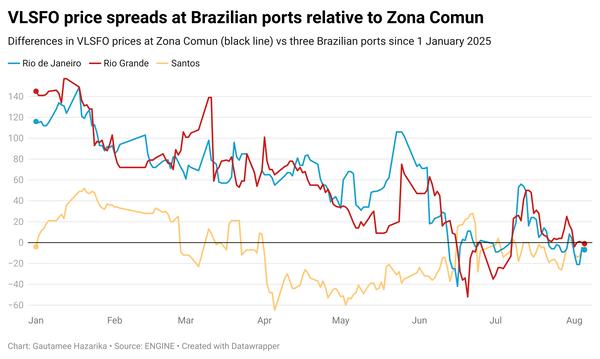

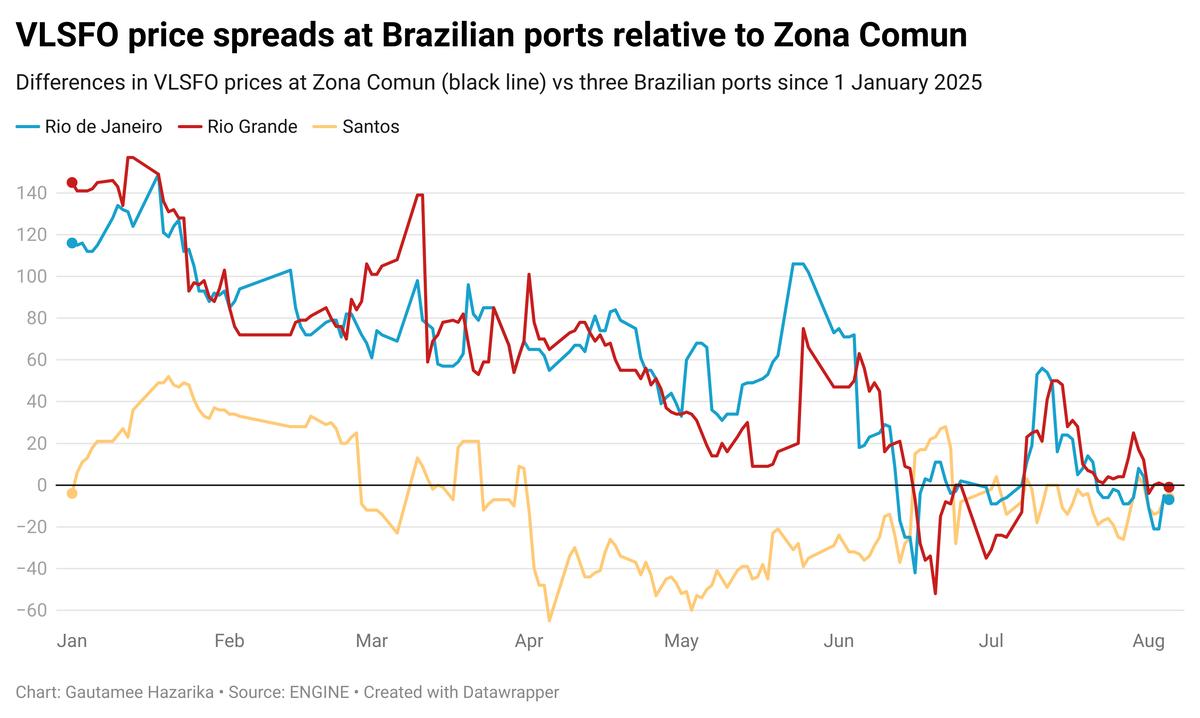

At the start of the year, Rio de Janeiro and Rio Grande held strong VLSFO premiums over Zona Comun, while Santos was priced just $4/mt lower. The spread has since narrowed, with all three ports nearing parity with Zona Comun now.

New York's LSMGO price benchmark declined by $5/mt and is currently at a premium of $85/mt to Houston, up from $49/mt a month ago.

The port is currently experiencing wind gusts between 5–10 knots and waves under 1 foot. However, beginning tomorrow, wind gusts are expected to increase up to 20 knots with waves rising to 2 feet, which could lead to slight delays in bunker operations, a source said.

Brent

The front-month ICE Brent contract has lost $0.28/bbl, to trade at $67.92/bbl at 08.00 CDT (13.00 GMT).

Upward pressure:

Oil market watchers are closely monitoring the escalating geopolitical tensions that could significantly disrupt global trade and cut a major chunk of Russian oil supply from the market.

Yesterday, US President Donald Trump renewed his threat to impose higher tariffs on imported goods from India, if New Delhi continues its Russian oil purchase, Reuters reports.

In response, the Indian government has dismissed Washington’s stance as “unjustified and unreasonable,” widening the rift between the two trade partners. These developments have provided some support to Brent, according to market analysts.

“India has become a major buyer of the Kremlin’s oil since the 2022 invasion of Ukraine,” said ANZ Bank’s senior commodity strategist Daniel Hynes. “Any disruption to those purchases would force Russia to find alternative buyers from an increasingly small group of allies,” he added.

Downward pressure:

Brent crude has continued to slide following OPEC’s latest announcement to accelerate its planned output hikes.

Over the weekend, eight members of the Organization of the Petroleum Exporting Countries and its allies (OPEC+) have agreed to collectively increase their supply by 547,000 b/d in September, accelerating the group’s plan to boost crude production.

“This completes the unwinding of the 2.2mb/d [2.2 million b/d] production cuts that eight producers implemented last year to help stabilise the market,” Hynes claimed.

However, there was little clarity on the future of the production cuts introduced by the broader group two years ago, which still keeps 1.66 million b/d of crude oil offline.

By Gautamee Hazarika and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.