East of Suez Market Update 25 Jul 2025

Prices in East of Suez ports have moved in mixed directions, and prompt VLSFO availability is tight in Japan.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Singapore ($1/mt), and down in Zhoushan ($11/mt) and Fujairah ($2/mt)

- LSMGO prices down in Zhoushan ($6/mt), Fujairah ($3/mt) and Singapore ($2/mt)

- HSFO prices up in Singapore ($2/mt), and unchanged in Fujairah and Zhoushan

- B24-VLSFO at a $176/mt premium over VLSFO in Singapore

- B24-VLSFO at a $193/mt premium over VLSFO in Fujairah

Zhoushan’s VLSFO price has fallen by $11/mt in the past day, while prices in Singapore and Fujairah have remained steady. This has brought Zhoushan’s VLSFO price to near parity with Singapore, erasing the earlier premium. However, it still holds an $11/mt premium over Fujairah.

VLSFO supply in Zhoushan remains steady, with suppliers maintaining lead times of 6–7 days, nearly unchanged from last week's six days.

However, bunkering at Zhoushan’s inner anchorages, Xiushandong and Mazhi, has been suspended since yesterday due to rough weather caused by Tropical Storm Dante. Bunker operations at the outer anchorages of Tiaozhoumen and Xiazhimen have been suspended since Monday due to adverse weather conditions. Most suppliers expect full resumption of bunkering operations in Zhoushan after 28 July, according to a source.

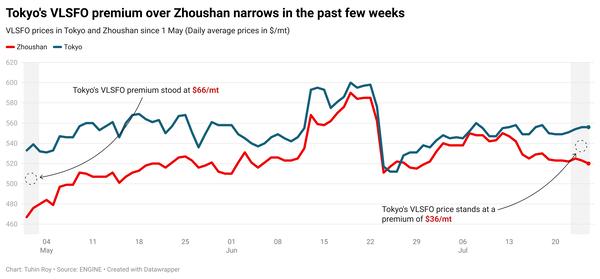

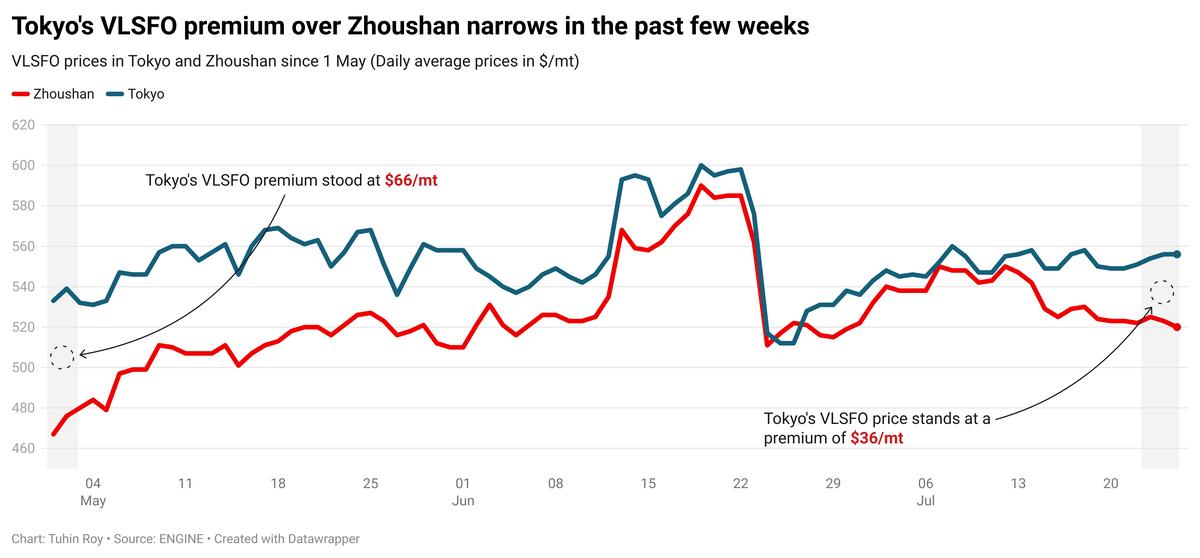

Meanwhile, Tokyo's VLSFO price remains at a $36/mt premium over Zhoushan.

Prompt VLSFO availability in Tokyo is tight, while LSMGO and HSFO supply remains adequate.

Brent

The front-month ICE Brent contract has gained by $0.33/bbl on the day, to trade at $69.40/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent crude’s price has gained amid market optimism over trade talks between the US and the European Union (EU), following closely on the heels of a recent US-Japan deal.

Both trade partners are expected to come to an agreement that could boost trade and support demand growth for commodities like oil, analysts say. “The main upward impetus [to oil] was coming from market optimism that the US and the European Union are closing in on a trade deal,” said VANDA Insights’ founder Vandana Hari.

Earlier this week, the US and Japan reached a deal under which Japan’s auto sector will face a reduced tariff of 15%, down from the previously imposed 27.5%.

“The US says it has managed to conclude several trade-deals this week, including with Japan and the Philippines,” two analysts from ING Bank noted.

Duties on Japanese goods that were scheduled to come into effect from 1 August will also be lowered to 15% from 25%.

“These deals should help reduce uncertainty and also ease some of the demand concerns that have been lingering in the oil market,” ING analysts added.

Downward pressure:

The US administration has reportedly allowed US oil company Chevron to resume operations in Venezuela. This news has put some downward pressure on Brent today.

Washington is preparing to announce new authorisations to Chevron’s key-oil partner - Venezuela’s state-run oil company PDVSA, Reuters reported, citing five sources.

Earlier this year, US President Donald Trump had revoked a license given to Chevron to operate in Venezuela. The new authorisation will allow both companies to resume joint operations and conduct oil-for-debt swaps in the sanctioned OPEC country.

“This reversal coincides with the release of some Americans detained in the South American country,” ING Bank analysts said.

If approved, this move could see Venezuelan oil exports rise by about 200,000 b/d, the analysts remarked. “Welcome news to US refiners that will ease some tightness in the heavier crude market,” they added.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.