East of Suez Market Update 24 Jul 2025

Prices in East of Suez ports have moved up, and bunkering has been suspended in Zhoushan’s OPL area since Monday due to adverse weather conditions.

IMAGE: Aerial view of Zhoushan, Zhejiang, China. Getty Images

IMAGE: Aerial view of Zhoushan, Zhejiang, China. Getty Images

Changes on the day to 17.00 SGT (09.00 GMT) today:

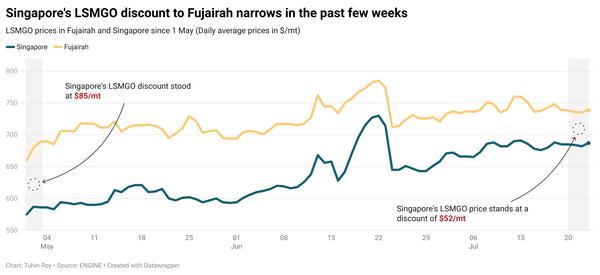

- VLSFO prices up in Zhoushan ($10/mt), Singapore ($9/mt) and Fujairah ($6/mt)

- LSMGO prices up in Fujairah ($12/mt), Zhoushan ($9/mt) and Singapore ($7/mt)

- HSFO prices up in Zhoushan ($11/mt), Fujairah ($5/mt) and Singapore ($4/mt)

- B24-VLSFO at a $175/mt premium over VLSFO in Singapore

- B24-VLSFO at a $193/mt premium over VLSFO in Fujairah

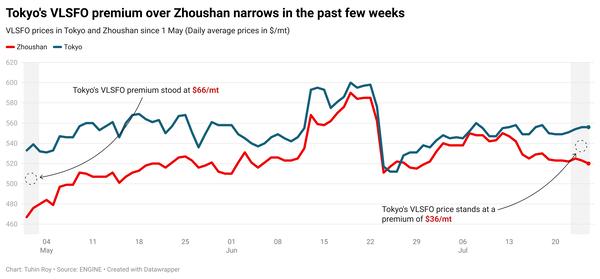

VLSFO prices in East of Suez ports have climbed for the second consecutive day, with Zhoushan recording the steepest increase. Zhoushan’s VLSFO currently stands at premiums of $20/mt and $11/mt over Fujairah and Singapore, respectively.

In Zhoushan, VLSFO supply remains steady amid subdued demand, with suppliers maintaining lead times of 6–7 days—largely unchanged from last week's six days. HSFO delivery times are also holding at around 6–7 days, similar to the previous week. LSMGO lead times remain stable as well, at approximately 6–7 days.

Bunker deliveries at Zhoushan’s Tiaozhoumen and Xiazhimen outer anchorages have been suspended since Monday due to rough weather caused by Typhoon Wipha, according to a source.

Meanwhile, bunkering continues smoothly at the more sheltered Xiushandong anchorage and the inner anchorage at Mazhi. However, operations at these locations may get suspended tomorrow due to worsening weather conditions associated with Tropical Storm Dante.

Brent

The front-month ICE Brent contract has gained by $0.57/bbl on the day, to trade at $69.07/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price has moved higher on the back of demand-side optimism.

Commercial US crude oil inventories have declined by 3.2 million bbls to touch 419 million bbls for the week ending 18 July, according to data from the US Energy Information Administration (EIA).

A drop in US crude stocks typically indicates higher demand and can lend some support to Brent's price.

“US EIA report showing a weekly slump of 3.2 million barrels in crude inventories helped erase earlier intraday losses,” VANDA Insights’ noted Vandana Hari.

Besides, oil gained amid optimism over the ongoing US-EU trade talks that could boost oil demand growth.

“News emerged that the two sides were working towards a deal that would set a 15% tariff for most goods,” ANZ Bank’s senior commodity strategist Daniel Hynes noted.

Downward pressure:

Rising output from the OPEC+ coalition has fuelled concerns of an impending oil surplus later this year, analysts say, pressuring market sentiment. This news has put downward pressure on Brent crude’s price in the recent days.

The Saudi Arabia-led alliance’s crude production averaged 41.56 million b/d last month, marking an increase of 349,000 b/d from May.

Meanwhile, eight members of the group have agreed to collectively increase their supply by 548,000 b/d in August, accelerating the group’s plan to boost crude production.

The planned production increase next month is four times higher than their original plan to unwind output cuts by 137,000 b/d each month between April 2025 and September 2026.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.