LNG Bunker Snapshot: Singapore’s LNG price flips to discount to Rotterdam

Rotterdam's LNG bunker price has fallen due to milder weather, while Singapore's price has declined in response to weak demand across the wider Asian LNG market.

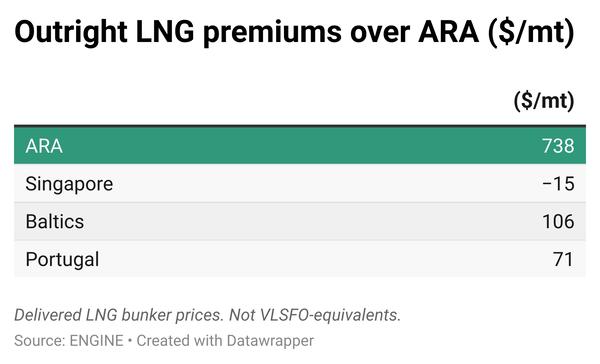

Weekly changes in LNG bunker prices:

- Rotterdam down by $15/mt to $738/mt

- Singapore down by $58/mt at $723/mt

Rotterdam

Rotterdam’s LNG bunker price has dropped by $15/mt, settling at $738/mt. This weekly decline is primarily attributed to a 3% decrease in the front-month Dutch TTF Natural Gas contract, a key benchmark for European gas prices.

The fall in prices has come amid milder weather, which has reduced demand for air conditioning.

“European gas futures also fell as milder weather eases demand for air conditioning,” said Daniel Hynes, senior commodity strategist at ANZ Bank.

“Forecasts for cooler weather in the coming weeks will soften demand from air conditioning,” he added.

“Donald Trump’s new tariff threats against the EU should trigger a reaction,” commented Mind Energy, formerly known as Energi Danmark. This development is likely contributing to downward pressure in the broader LNG market in Europe.

Singapore

Singapore’s LNG bunker price has dropped sharply by $58/mt over the past week, settling at $723/mt. This decline mirrors a $1.12/MMBtu drop in the NYMEX Japan/Korea Marker (JKM) price over the week, the key benchmark for Asian LNG prices, which brought the front-month contract down to $12/MMBtu ($624/mt).

As a result, Singapore’s LNG bunker price, which had carried a $28/mt premium over Rotterdam a week ago, has now flipped to a $15/mt discount.

The price drop was driven by weak demand.

“Asian LNG prices weakened as summer buying slipped across the Asian region,” Hynes said.

LNG demand in price sensitive Asian markets, particularly in India and China, turned negative in the first half of 2025 due to relatively high prices during the period, said Greg Molnár, gas analyst at the International Energy Agency (IEA).

LNG bunker sales in Singapore climbed for the fourth straight month, reaching a record 55,000 mt in June—surpassing the previous high of 52,000 mt recorded in June last year. Total LNG bunker sales for the first half of the year reached 244,000 mt, approximately 1.15 times higher than the 212,000 mt sold during the same period in 2024, according to preliminary data from the port authority.

Other LNG bunker news

Taiwan’s container shipping firm Yang Ming has placed an order for seven LNG dual-fuel container vessels with South Korean shipbuilder Hanwha Ocean. In Japan, bunker supplier Keys Bunkering West Japan (KEYS) recently supplied an unspecified quantity of LNG to a cruise ship at Hakata port.

Meanwhile, US-based Crowley has expanded its fleet with the addition of a new LNG-capable vessel named Tiscapa. In Poland, Baltic energy company Elenger has delivered approximately 62 mt of LNG to a RoPax newbuild under construction at the J. Piłsudski Shipyard in Gdańsk.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.