Fuel Switch Snapshot: B100 and LNG sharpen price edge in Singapore

B100’s premium over VLSFO drops in Singapore

Rotterdam LBM sales hit 2,000 mt in Q2

LNG-VLSFO spread shifts across engine types

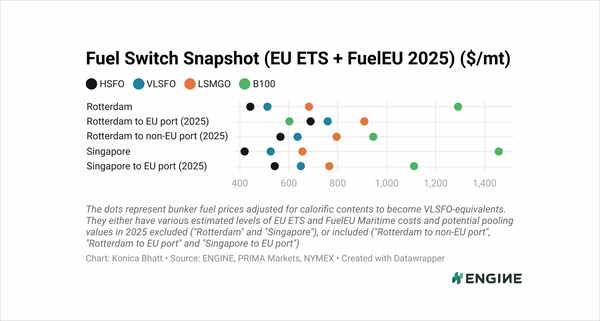

All bunker prices mentioned below have been adjusted for calorific contents to make them VLSFO-equivalent. They have estimated EU-EU voyage compliance costs included for Rotterdam, and non-EU-EU compliance costs included for Singapore. These account for EU ETS costs and FuelEU Maritime penalties, and our estimated compliance surplus values for FuelEU pooling. Rotterdam's B100 and LBM prices also factor in Dutch HBE rebates for advanced liquid and gaseous biofuels sold in the Netherlands.

In Rotterdam, B100’s discount to VLSFO has narrowed by $15/mt over the past week to $158/mt.

On the other hand, B100 has become slightly less expensive than VLSFO in Singapore, with its premium falling by $56/mt to $463/mt after accounting for estimated pooling values on voyages between Singapore and EU ports.

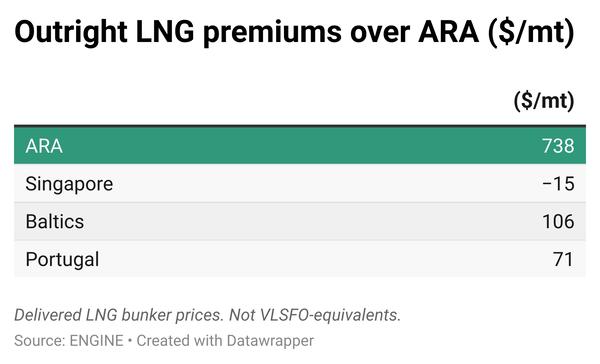

Rotterdam LNG's premium over VLSFO for dual-fuel vessels with Otto medium-speed (Otto MS) engines has narrowed by $15/mt to $69/mt. For vessels with diesel slow-speed (diesel SS) engines, LNG is now $14/mt cheaper than before, widening its discount to $97/mt below VLSFO.

LNG’s premium over liquefied biomethane (LBM) in Rotterdam has remained largely unchanged over the past week, ranging between $152-201/mt depending on engine type.

In Singapore, LNG’s premium over VLSFO for dual-fuel vessels with Otto MS engines has nearly halved to $57/mt. For vessels with diesel SS engines, LNG has flipped to a $26/mt discount over VLSFO in the past week, from a $25/mt premium the week prior.

Liquid fuels

Rotterdam’s VLSFO price has remained unchanged over the past week. Prompt supply continues to be tight in the ARA hub, a trader told ENGINE, with recommended lead times of 5–6 days.

B100 (HBE) price in Rotterdam has increased by $15/mt. The port’s bio-blended bunker sales reached 171,000 mt in the second quarter of this year, a 56% rise from the first quarter.

Singapore’s VLSFO price has remained almost steady in the past week, edging higher by $3/mt.

VLSFO lead times remain highly inconsistent in Singapore. While some suppliers can deliver within seven days, others advise booking up to four weeks in advance due to long-term nominations. These are typically contract-based orders that take precedence over spot inquiries. Limited stock availability and pending replenishments are also contributing to delays.

Singapore’s B100 (UCOME) price has fallen by $54/mt, largely due to weaker feedstock prices. The port’s total bio-blended bunker sales surged by 12% in June to 155,000 mt, while its B100 sales reached 1,000 mt.

Liquid gases

Rotterdam’s LNG bunker price has declined by $15/mt in the past week, slightly greater than the $12/mt decline in the port’s LBM benchmark.

The port's LBM sales reached a record 2,000 mt in the second quarter of 2025, following a lull in the first quarter.

Singapore’s LNG price has seen a deeper cut at $49/mt in the past week. The port’s LNG sales rose for the fourth consecutive month, reaching a record 55,000 mt in June.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.