Singapore’s fuel oil inventories increase by 6% in July

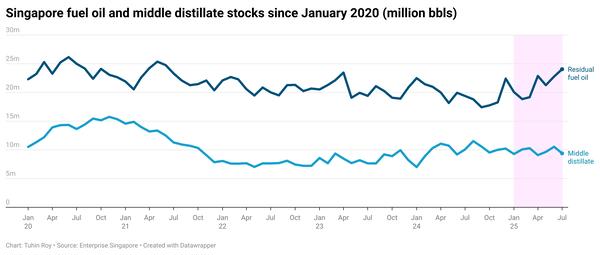

Singapore’s residual fuel oil stocks have averaged 6% higher so far in July than across June, according to Enterprise Singapore.

Changes in monthly average Singapore stocks from June to July (so far):

- Residual fuel oil stocks up 1.27 million bbls to 24.05 million bbls

- Middle distillate stocks down 1.15 million bbls to 9.40 million bbls

Singapore's fuel oil inventories have risen above 24 million bbls, marking multi-year highs.

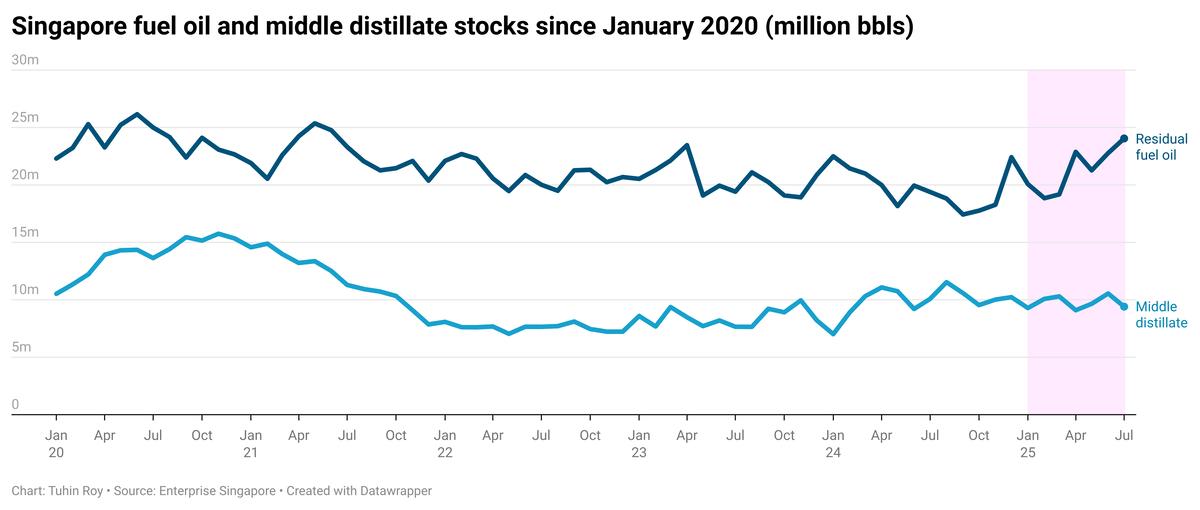

In July so far, the port has seen a 21% increase in net fuel oil imports, with imports up by 1.52 million bbls—significantly outpacing the 1 million-bbl rise in exports.

Most of the fuel oil imports came from Russia (22%), followed by the UAE and the US (14% each). On the export front, Singapore primarily shipped fuel oil to China (37%), Malaysia (16%), and South Korea (14%), data from cargo tracker Vortexa shows.

Meanwhile, middle distillate stocks at the port have averaged 11% lower in July compared to June.

Changes in monthly average Singapore fuel oil trade from June to July (so far):

- Fuel oil imports up 1.52 million bbls to 6.06 million bbls

- Fuel oil exports up 1 million bbls to 3.01 million bbls

- Fuel oil net imports up 521,000 bbls to 3.05 million bbls

VLSFO lead times in Singapore remain highly inconsistent. While some suppliers can deliver within seven days, others recommend placing orders up to four weeks in advance due to long-term nominations. Supply delays are also being driven by limited stock and pending replenishments.

In contrast, lead times for LSMGO have improved, with most suppliers now recommending 4–7 days, down from 6–9 days the previous week. HSFO requires 4–9 days of lead time, a narrower and more stable range compared to last week’s 3–12 days.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.