East of Suez Market Update 10 Jul 2025

Prices in East of Suez ports have moved down, and Zhoushan's bunkering operations resume after a four-day suspension due to bad weather.

Changes on the day to 17.00 SGT (09.00 GMT) today:

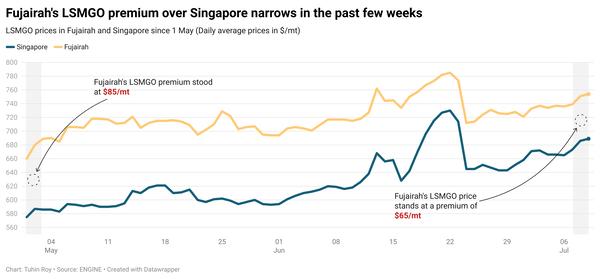

- VLSFO prices down in Singapore ($15/mt), Fujairah ($12/mt) and Zhoushan ($4/mt)

- LSMGO prices down in Fujairah ($18/mt), Singapore ($10/mt) and Zhoushan ($6/mt)

- HSFO prices down in Fujairah ($11/mt), Zhoushan ($8/mt) and Singapore ($5/mt)

- B24-VLSFO at a $179/mt premium over VLSFO in Singapore

- B24-VLSFO at a $198/mt premium over VLSFO in Fujairah

VLSFO benchmark prices at the three main Asian bunker ports dropped by $4–15/mt over the past day, with Singapore seeing the sharpest decline. The fall was partly driven by two lower-priced 500–1500 mt VLSFO stems fixed in Singapore. Currently, Singapore’s VLSFO stands at a $10/mt premium over Fujairah and at a $16/mt discount to Zhoushan.

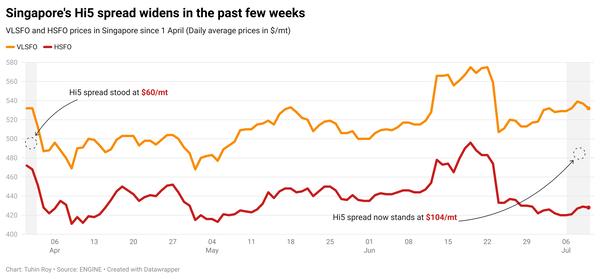

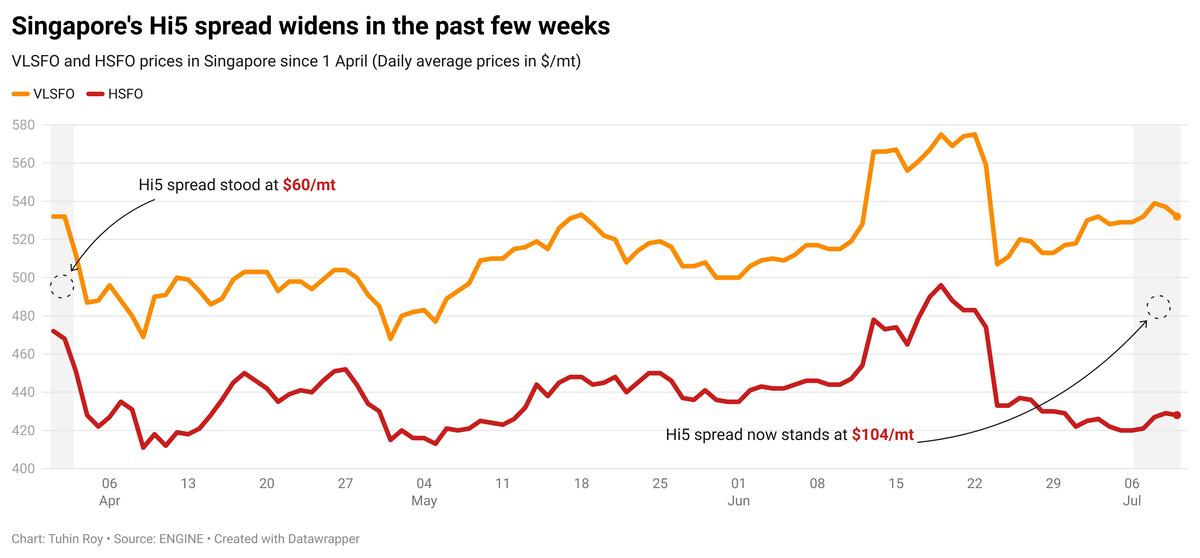

Zhoushan’s HSFO benchmark also declined, though by less than VLSFO, narrowing the port’s Hi5 spread by $4/mt to $104/mt. This remains below Fujairah’s Hi5 spread of $107/mt, but above Zhoushan’s $98/mt.

VLSFO lead times in Singapore remain inconsistent. Some suppliers are offering as few as six days, while others recommend booking up to two weeks ahead due to long-term nominations, which are typically contract-based and take precedence over spot orders. Tight loading schedules at certain terminals have also added to the delays.

Lead times for LSMGO in Singapore have risen, with most suppliers now advising 6–9 days, up from 2–8 days last week. HSFO lead times continue to vary widely, ranging from 3–12 days, compared to 9–14 days the previous week.

Meanwhile, bunkering operations at Zhoushan’s outer and inner anchorages resumed today after a four-day suspension caused by bad weather from Typhoon Danas, a source said. All anchorages in Zhoushan are now fully operational.

Brent

The front-month ICE Brent contract has moved $0.66/bbl lower on the day, to trade at $69.99/bbl at 17.00 SGT (09.00 GMT) today.

Upward pressure:

The US Department of the Treasury’s Office of Foreign Assets Control (OFAC) has sanctioned 22 entities based in Hong Kong, the UAE and Türkiye for facilitating the sale of Iranian oil that benefits the Islamic Revolutionary Guard Corps-Qods Force (IRGC-QF). This move has supported Brent futures.

“Crude oil prices rallied in early trading amid renewed efforts to crimp Iranian oil exports. The US Treasury designated 22 foreign entities based in Hong Kong, the United Arab Emirates and Turkey [Türkiye] for their roles in facilitating the sale of Iranian oil,” said Daniel Hynes, senior commodity strategist at ANZ Bank.

Meanwhile, the US dollar has weakened following a sharp drop in Treasury yields after Wednesday’s 10-year note auction saw strong demand, according to a Reuters report.

The weaker dollar added further support to oil prices.

Downward pressure:

Market watchers remain concerned about the potential impact of US President Donald Trump’s latest tariff announcements on global economic growth.

On Wednesday, Trump threatened Brazil with a 50% tariff on exports to the US following a public dispute with his Brazilian counterpart Luiz Inacio Lula da Silva. He also announced plans to impose new tariffs on copper, semiconductors and pharmaceuticals, and issued tariff notices to countries including the Philippines, Iraq, South Korea and Japan, according to Reuters.

US commercial crude inventories rose sharply, adding further downward pressure to Brent futures.

According to the US Energy Information Administration (EIA), crude stockpiles surged by 7.1 million barrels to 426 million barrels for the week ending 4 July.

Oil’s "gains were reversed after government data showed a larger than expected rise in oil inventories in the US. Commercial stockpiles of crude rose by 7.1mbbls last week, the biggest gains since January,” Hynes said.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.