East of Suez Market Update 9 Jul 2025

Prices in East of Suez ports have moved up, and VLSFO availability has improved slightly in Fujairah.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Fujairah ($10/mt), Singapore ($9/mt) and Zhoushan ($1/mt)

- LSMGO prices up in Fujairah ($13/mt), Singapore ($12/mt) and Zhoushan ($10/mt)

- HSFO prices up in Singapore ($10/mt), Fujairah ($9/mt) and Zhoushan ($7/mt)

- B24-VLSFO at a $174/mt premium over VLSFO in Singapore

- B24-VLSFO at a $203/mt premium over VLSFO in Fujairah

Fujairah’s VLSFO price has increased by $10/mt in the past day—the sharpest rise among the three major Asian bunker ports. Despite this uptick, Fujairah’s VLSFO remains discounted by $18/mt to Zhoushan and $13/mt to Singapore.

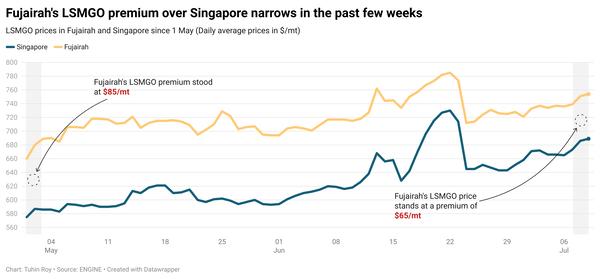

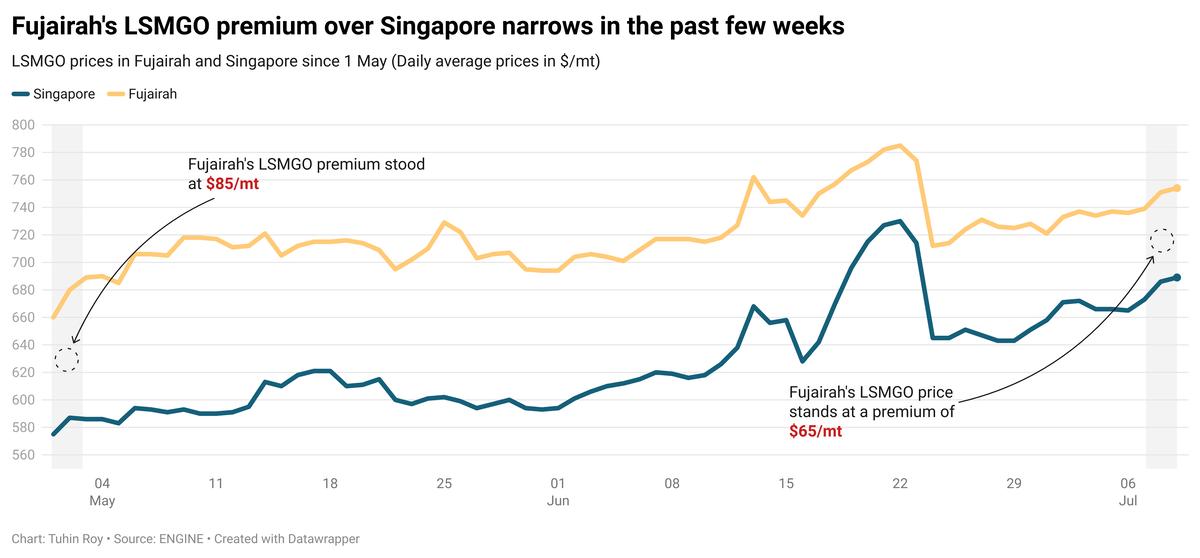

The port’s LSMGO price has also climbed by $13/mt, marking the largest gain among the three East of Suez ports. Fujairah’s LSMGO holds a premium of $65/mt over Singapore and $52/mt over Zhoushan.

VLSFO in Fujairah now requires lead times of around 5–7 days, a slight improvement from last week’s estimate of approximately 6 days. Lead times for LSMGO and HSFO remain steady at 5–7 days, with little change from the previous week.

In Basrah, Iraq, both VLSFO and LSMGO are readily available, while HSFO supply remains limited. In Jeddah, Saudi Arabia, availability of both VLSFO and LSMGO is currently tight.

Brent

The front-month ICE Brent contract has moved $1.38/bbl higher on the day, to trade at $70.65/bbl at 17.00 SGT (09.00 GMT) today.

Upward pressure:

Renewed Houthi attacks on commercial ships in the Red Sea have contributed to a rise in Brent crude futures.

Yemen-based Houthi militants launched a drone and speedboat assault on the Liberian-flagged bulk carrier Eternity C off the coast of Yemen—the second such incident in a single day, ending a period of relative calm. The attack resulted in the deaths of three crew members and injuries to two others. Just a day earlier, the Houthis attacked the Greek-operated vessel Magic Seas.

These incidents have revived concerns over the safety of shipping through the Red Sea, a key route for global trade, thereby pushing up oil prices. Last year, similar attacks forced oil, LNG and other energy carriers to reroute around the region, increasing transportation distances and driving up energy costs.

“Crude oil prices gained amid renewed tensions in the Middle East,” said Daniel Hynes, senior commodity strategist at ANZ Bank.

“Increased tensions in the Middle East, in the form of Houthi attacks on vessels in the Red Sea, will provide some support [to oil prices],” two analysts from ING Bank shared this view.

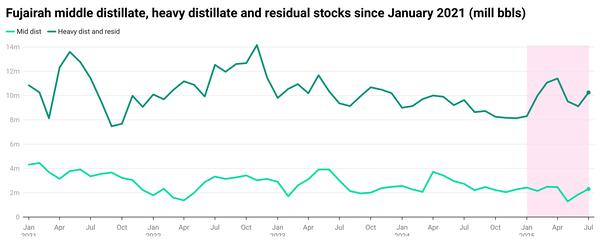

Oil prices are also being buoyed by a tightening middle distillates market.

“Distillate inventories are currently at their lowest point since 1996,” noted Phil Flynn, senior market analyst at Price Futures Group.

Downward pressure:

US President Donald Trump has extended the deadline to impose higher tariffs on multiple countries to 1 August—a date he called final—stating, “No extensions will be granted.” He also announced plans to impose a 50% tariff on imported copper and to soon introduce long-threatened levies on semiconductors and pharmaceuticals, broadening a trade war that has unsettled global markets, according to Reuters.

Market watchers are increasingly concerned that these tariffs could dampen sentiment across sectors and put downward pressure on oil prices.

Adding to the bearish sentiment, US crude oil inventories rose by 7.1 million bbls in the week ending 4 July, according to estimates from the American Petroleum Institute (API) cited by Trading Economics. A rise in US crude stockpiles typically signals weaker demand and can weigh on Brent futures.

“Numbers from the API overnight were bearish for oil,” commented analysts from ING Bank.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.