The Week in Alt Fuels: The methanol momentum

Methanol’s momentum has quietly been building over the past couple of months, and July has brought another wave of activity.

The month kicked off with DNV’s mid-year tally of alternative fuel vessel orders. Four methanol-capable vessels were added in June, pushing the global orderbook to 369 ships scheduled for delivery by 2030. The operational methanol-capable fleet currently stands at 66 vessels.

Some shipowners, like Singapore-based AAL Shipping, are investing in methanol-ready designs. These vessels are not equipped to run on methanol upon delivery but built for future retrofitting. This option may appeal to shipowners waiting for greater clarity around fuel supply or pricing before committing to full methanol propulsion.

With vessel orders rising, more producers are stepping up plans to scale output of greener methanol variants.

US-based engineering firm HyOrc plans to develop a 25,000 mt/year bio-methanol plant in Porto, Portugal, and a 13,000 mt/year plant in Scunthorpe, UK. Both plants will have capacity earmarked for shipping.

In Brazil, GoVerde Energia has announced plans for its second e-methanol plant - a 300 mt/day facility at the Suape Industrial Port Complex. This follows its first proposed plant in Bahia, with portions of output from both expected to go towards bunkering.

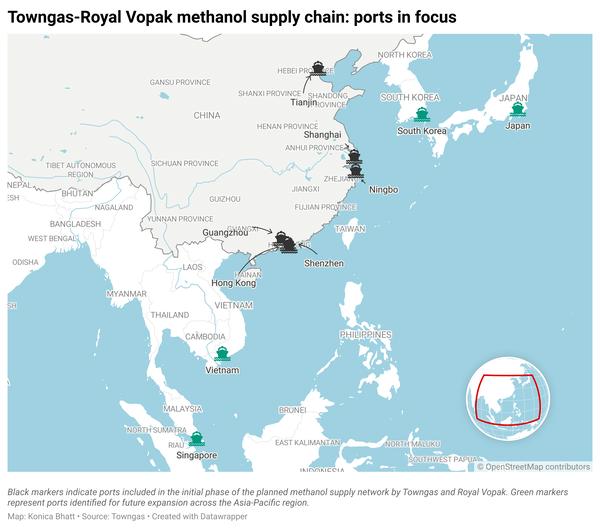

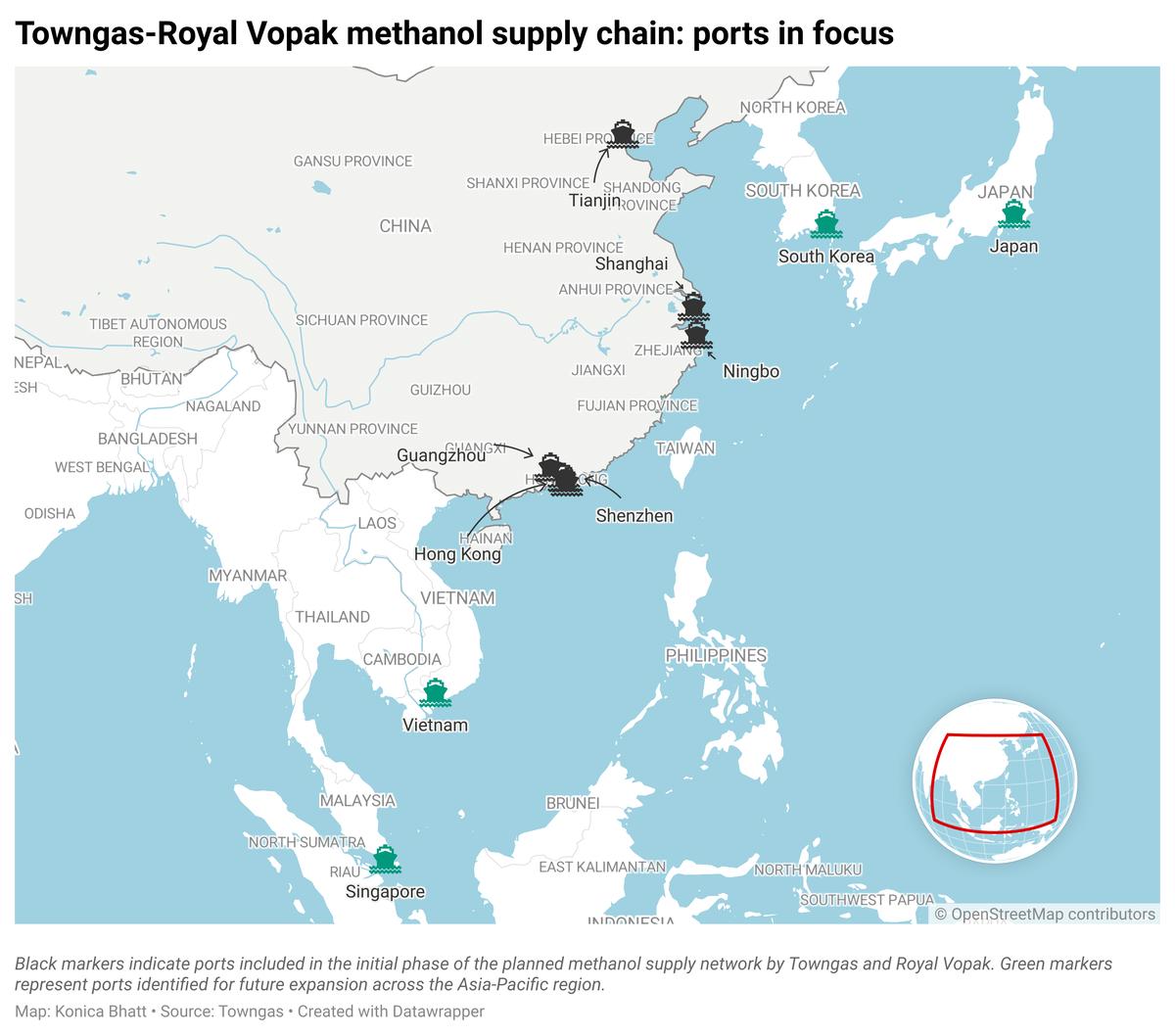

Towngas currently produces 6,000 mt/year of bio-methanol at its Inner Mongolia plant and aims to scale this up to 100,000–150,000 mt/year by end-2025, and 300,000 mt/year by 2028. It is building a full supply chain around this output in partnership with Royal Vopak’s Chinese arm.

The two firms plan to develop a methanol bunkering network across major Asia-Pacific ports, starting with Hong Kong, Guangzhou, Shenzhen, Shanghai, Ningbo and Tianjin. Bio-methanol will be transported from northern China to Vopak’s local storage sites, which will handle bunkering and onward distribution. Expansion to Singapore, Vietnam, Japan and South Korea is also planned.

China Marine Bunker (PetroChina) and PowerChina Beijing Engineering Group are also working to build a methanol supply network across China. The project will include infrastructure for production, transport, storage and bunkering of green methanol, possibly starting with bio-methanol.

Regional policy incentives can also help promote wider adoption and production of methanol.

Hong Kong’s Marine Department has launched an incentive scheme to support domestic bunkering of green methanol and LNG. Suppliers can claim HKD 500,000 (about $63,000) for their first two LNG and two green methanol bunkering operations within one year of completing a risk assessment. Funding is capped at HKD 2 million (about $250,000) per fuel type and will be disbursed on a first-come, first-served basis.

Even the US has offered some breathing room for green methanol and other e-fuels by easing pressure on feedstock producers. Trump’s new bill extends the 45V clean hydrogen production credit to 2027 and the 45Z credit for green transport fuels to 2029. It also leaves the 45Q carbon capture and storage (CCS) credit largely unchanged. Together, these incentives could help lower production costs for e-fuel projects in the US.

Finally, industry voices are adding pressure for faster progress.

The SASHA Coalition has urged policymakers to prioritise e-fuels like e-methanol over biofuels and fossil fuels. “With ReFuelEU Aviation and FuelEU Maritime targets on the horizon, 2025 is the year in which e-fuel projects must get the investment they need to scale production,” the coalition said.

From fleet investments to green supply corridor plans and regional policy nudges, methanol’s position is gradually strengthening. Infrastructure gaps and high green premiums could still pose hurdles to wider global uptake, but the groundwork now being laid across regions suggests that more and more players in the shipping industry is no longer waiting for the perfect moment.

In other news this week, German energy equipment manufacturer eCap Marine will provide hydrogen propulsion systems to four vessels. The order includes two bulk carriers for the Norwegian shipping company Møre Sjø and two short-sea container vessels for the Netherlands-headquartered logistics firm Samskip.

The German government will allocate €400 million (approximately $470 million) towards developing alternative fuel bunkering infrastructure in the country. Specific details, such as which alternative fuels will be supported or which ports will be involved, have not yet been disclosed

Singaporean shipbuilder Pinnacle Marine will trial 100% biofuel (B100) on one of its vessels. The trial will run for 1,000 hours to capture emissions data and engine performance.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.