Biofuel Bunker Snapshot: UCOME prices surge in Rotterdam and Singapore

Rotterdam’s B30-VLSFO premium rises to $200/mt

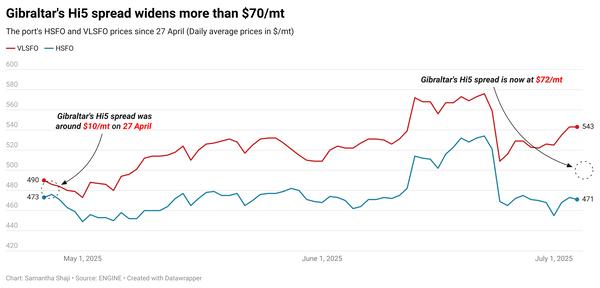

ARA UCOME switches to premium over Gibraltar

Singapore’s B24 benchmarks gain on pricier feedstocks

Rotterdam

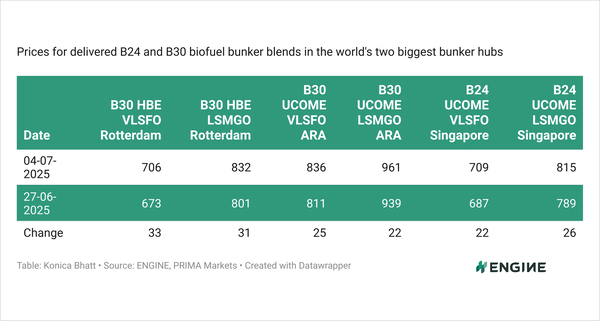

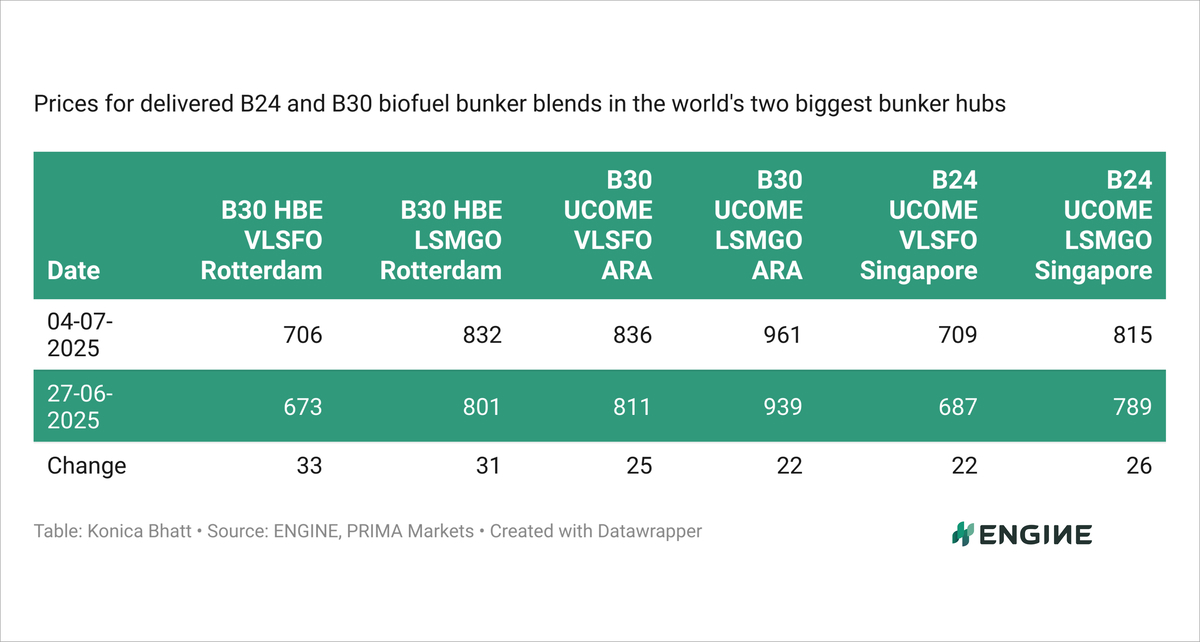

B30-VLSFO (HBE) and B30-LSMGO (HBE) prices in Rotterdam have gained $33/mt and $31/mt, respectively, over the past week.

The increases have been bolstered by a sharp $52/mt rise in the Prima-assessed POMEME CIF ARA barge price, along with gains in ENGINE’s pure VLSFO (+$14/mt) and LSMGO (+$10/mt) benchmarks.

An $8/mt drop in the Prima-assessed marine HBE rebate for B30 has added further upward price pressure.

Rotterdam’s bio-bunker premiums over conventional fuels have widened by $19–21/mt, to $203/mt over VLSFO and $150/mt over LSMGO.

Prima’s POMEME price has roughly tracked a $52/mt increase in its UCOME FOB ARA barge price, which has also driven up UCOME-based B30-VLSFO and B30-LSMGO prices in the region by $22-25/mt.

B30-VLSFO (UCOME) prices in Algeciras and Gibraltar were at parity with one another earlier this week, both indicated around $750/mt. This marks a drop of about $32/mt from the week before.

B30-VLSFO (UCOME) is priced around $66/mt lower in Gibraltar than in the ARA, up from $29/mt a week ago.

Singapore

B24-VLSFO UCOME and B24-LSMGO UCOME prices in Singapore have gained $22–26/mt over the past week. The increases have been supported by a $40/mt rise in the Prima-assessed UCOME China FOB cargo price and by gains of $16–31/mt in Singapore’s pure VLSFO and LSMGO benchmarks.

Fresh UCO import demand from the US has supported the UCOME China FOB cargo price assessment, Prima says. Pending US tariffs on Chinese UCO can price out these imports, and there are clear signs of front-loading UCO imports now to avoid tariffs later.

Hong Kong’s B24-VLSFO price premium over Singapore has narrowed by $50/mt to $56/mt, after it was indicated at $749/mt in Hong Kong this week.

Other bio-bunker news

Bunker suppliers serving Norway’s domestic shipping sector must ensure that biofuel makes up at least 7% of all sales in 2026 and 8% in 2027, the Norwegian Environment Agency said. While it does not cover international shipping, the mandate includes fuel used for vessels, aquaculture facilities and installations on the Norwegian shelf.

Japanese shipping company Mitsui O.S.K. Lines (MOL) recently trialled a B30 blend on its coal carrier Hokulink - a first for a Japanese electric power company. Details about the delivery, including the supplier, have not been disclosed.

The European Biodiesel Board (EBB) has forecast EU FAME (biodiesel) production to stagnate, and hydrotreated vegetable oil (HVO) to rise slightly over the next two years.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.