East of Suez Market Update 3 Jul 2025

Prices in East of Suez ports have moved up, and LSMGO availability is tight across several South Korean ports.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Zhoushan ($14/mt), Singapore ($9/mt) and Fujairah ($4/mt)

- LSMGO prices up in Zhoushan ($14/mt), Fujairah ($8/mt) and Singapore ($2/mt)

- HSFO prices up in Zhoushan ($6/mt), Fujairah ($2/mt) and Singapore ($1/mt)

- B24-VLSFO at a $187/mt premium over VLSFO in Singapore

- B24-VLSFO at a $204/mt premium over VLSFO in Fujairah

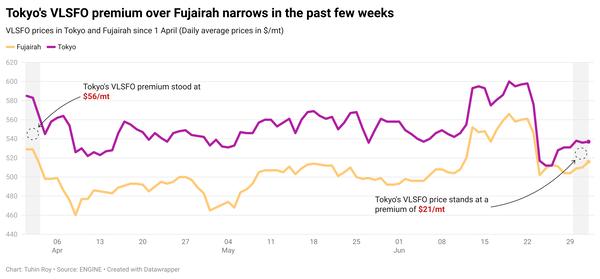

VLSFO benchmarks at the three major Asian bunker ports have risen for the second straight day, with Zhoushan recording the largest gain. Zhoushan’s VLSFO price now carries a premium of $21/mt over Fujairah and $9/mt over Singapore.

Its LSMGO price has also climbed by $14/mt in the past day—the steepest increase among the three main East of Suez ports. Zhoushan’s LSMGO is priced at a $16/mt premium to Singapore but remains at a $50/mt discount to Fujairah.

VLSFO availability in Zhoushan remains stable amid subdued demand, with lead times unchanged from last week at around 5–7 days. HSFO lead times are currently about 4–6 days, slightly down from five days last week. LSMGO supply has improved, with lead times shortening to 2–4 days, compared to around five days previously.

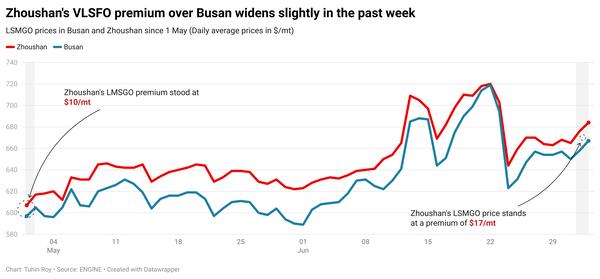

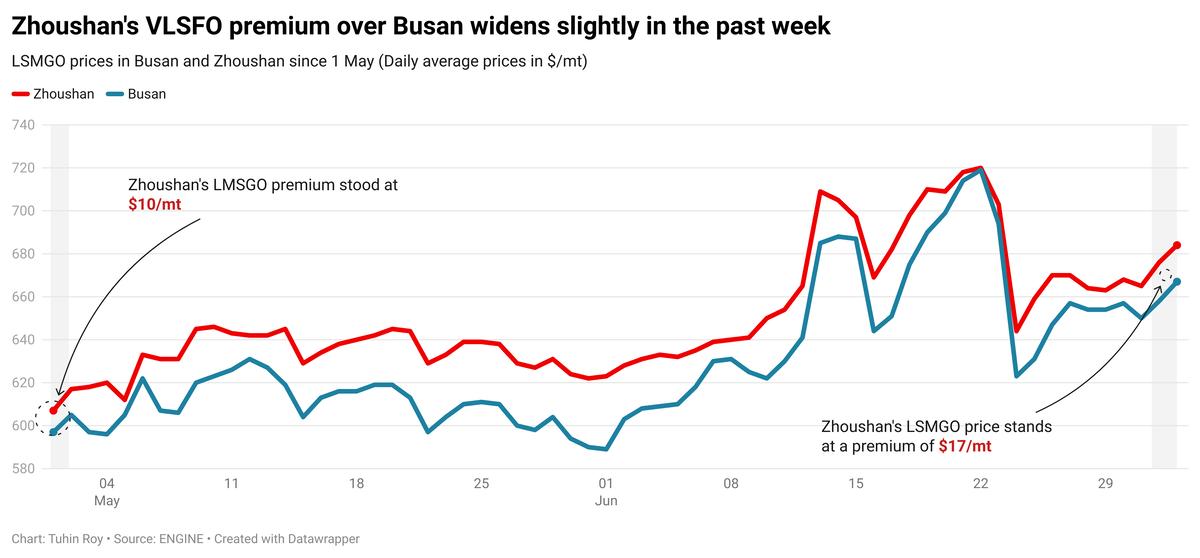

In South Korea, LSMGO availability has tightened as more bunker buyers shift to Korean ports, where prices are lower than in nearby Chinese ports. Busan’s LSMGO price is currently $17/mt cheaper than Zhoushan’s.

Lead times for LSMGO in South Korea now range widely between 4–10 days, up from the 5–6 days seen last week. VLSFO lead times remain stable at 4–6 days, while HSFO continues to require about five days—nearly unchanged week-on-week.

However, bunkering operations in Ulsan, Onsan, and Yeosu may face disruptions due to high waves forecast between 7–9 July. Adverse weather is also expected to impact bunker operations in Daesan and Taean on 4 July and 9 July, and in Busan between 8–9 July.

Brent

The front-month ICE Brent contract has gained by $1.24/bbl on the day, to trade at $68.63/bbl at 17.00 SGT (09.00 GMT) today.

Upward pressure:

Brent’s price has gained on renewed geopolitical tensions in the Middle East. Iran has suspended cooperation with the International Atomic Energy Agency (IAEA) – a United Nations' nuclear watchdog.

The news has sparked market speculation about a cold war-like standoff, with the US possibly intensifying oil sanctions on Tehran.

Additionally, the US has reached a trade deal with Vietnam and will impose 20% tariffs on some of the country’s exports.

“The risk-on tone triggered by the Vietnam trade deal helped boost sentiment across the energy complex,” said ANZ Bank’s senior commodity strategist Daniel Hynes.

The set tariff rate is much lower than previously decided, market analysts said.

“Brent crude oil rose… as investors priced in tentative optimism that more deals will be reached ahead of the 9 July deadline,” Hynes said.

Downward pressure:

Brent’s price gains were capped after the US Energy Information Administration (EIA) reported a surge in US crude stocks.

Commercial US crude oil inventories have surged by 3.8 million bbls to touch 419 million bbls for the week ending 27 June, according to data from the EIA.

“The increase was the largest in three months,” Hynes said.

An increase in US crude stockpiles generally signals weaker demand and can dampen Brent's price.

“The build was driven by a large decline in US crude oil exports,” two analysts from ING Bank said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.