East of Suez Market Update 2 Jul 2025

Prices in East of Suez ports have moved up, and VLSFO availability improves in Fujairah.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Fujairah ($10/mt), Singapore ($9/mt) and Zhoushan ($1/mt)

- LSMGO prices up in Singapore ($16/mt), Zhoushan ($7/mt) and Fujairah ($5/mt)

- HSFO prices up in Singapore and Zhoushan ($1/mt), and unchanged in Fujairah

- B24-VLSFO at a $182/mt premium over VLSFO in Singapore

- B24-VLSFO at a $193/mt premium over VLSFO in Fujairah

Fujairah’s VLSFO price has increased by $10/mt over the past day, marking the sharpest rise among the three major Asian bunker ports. Despite the uptick, Fujairah’s VLSFO is discounted by $11/mt to Zhoushan and $7/mt to Singapore.

Market conditions in Middle Eastern ports have stabilised following a US-brokered ceasefire between Iran and Israel, which has helped ease recent volatility. “Conditions have stabilised, and things are running much more smoothly now,” a source noted.

VLSFO availability in Fujairah has improved, with lead times shortening to around six days, down from about nine days last week. LSMGO and HSFO lead times are steady on the week, at 5–6 days.

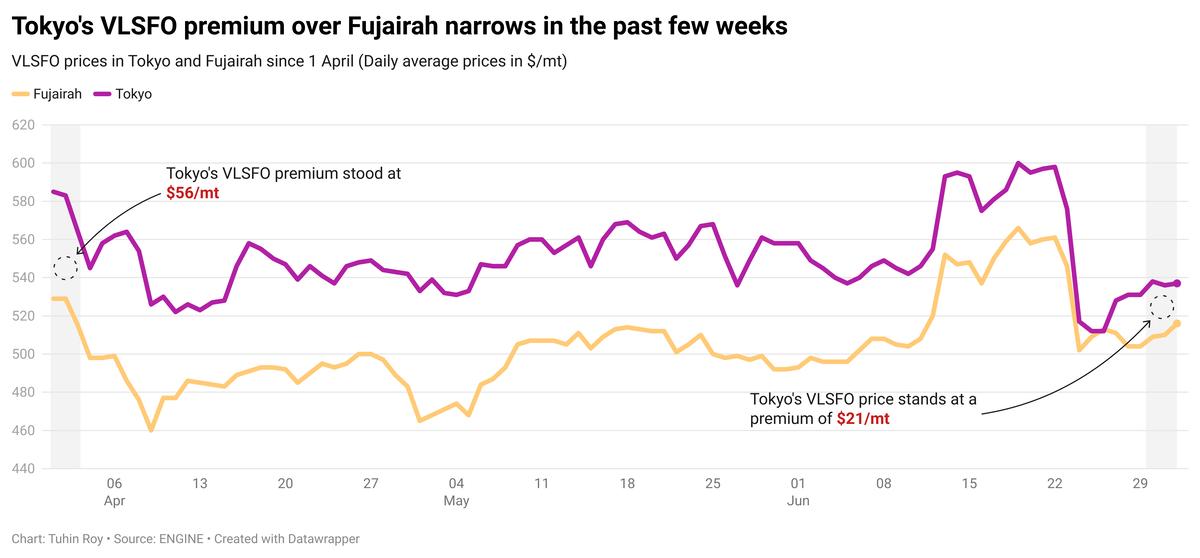

In Japan, Tokyo's VLSFO premium over Fujairah has narrowed sharply over the past 2-3 weeks, and suppliers in the two ports have even priced the grade at parity for a brief period.

Supply remains ample in major Japanese ports including Tokyo, Chiba, Yokohama and Kawasaki. Meanwhile, prompt availability is limited in Osaka, Kobe, Sakai and Mizushima, and remains particularly tight in Nagoya and Yokkaichi.

LSMGO is well stocked across Japan, but prompt deliveries are challenging in Osaka, Kobe, Sakai, Nagoya, Yokkaichi and Mizushima. HSFO supply is stable overall, though prompt availability remains restricted in these ports. In Oita, availability across all fuel grades continues to be tight.

Brent

The front-month ICE Brent contract has gained by $0.61/bbl on the day, to trade at $67.39/bbl at 17.00 SGT (09.00 GMT) today.

Upward pressure:

Brent crude’s price has moved higher as lingering geopolitical risks continue to influence market sentiment.

Last week, Iran halted access to the International Atomic Energy Agency (IAEA) for inspections. Iranian nuclear-safety regulators have also stopped taking calls from the UN watchdog, Bloomberg reports.

“The blackout raises the spectre that Iran is using silence as a way to obscure international understanding of the status of its nuclear program,” remarked ANZ Bank senior commodity strategist Daniel Hynes.

The news has prompted market speculation of a potential cold war-like standoff, with the US possibly intensifying oil sanctions on Tehran.

“President Trump said the US will be there unless Iran backs away from its nuclear program,” Hynes added.

Downward pressure:

Brent’s gains have been capped after the American Petroleum Institute (API) reported a surprise build in commercial US crude stocks.

US crude oil inventories rose by 680,000 bbls in the week ending 27 June, according to the API. Market analysts expected a draw of 2.26 million bbls.

The data was “bearish on balance with a modest build in crude,” said Vanda Insights founder Vandana Hari.

An increase in US crude stockpiles can signal weaker demand and can dampen Brent's price.

The closely followed official data from the US Energy Information Administration (EIA) is due for release later today.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.