Europe & Africa Market Update 30 Jun 2025

Conventional fuel prices in European and African ports have dipped over the weekend, and bunker availability is good in Las Palmas.

Changes on the day from Friday to 09.00 GMT today:

- VLSFO prices down in Gibraltar ($8/mt), Rotterdam ($5/mt) and Durban ($3/mt)

- LSMGO prices down in Gibraltar ($9/mt) and Rotterdam ($7/mt)

- HSFO prices down in Rotterdam ($7/mt), Gibraltar ($5/mt) and Durban ($2/mt)

- Rotterdam B30-VLSFO premium over VLSFO up by $24 at $262/mt

Barring Rotterdam’s B30-VLSFO price, prices of all fuel grades in Rotterdam, Gibraltar and Durban have declined, tracking Brent’s downward movement.

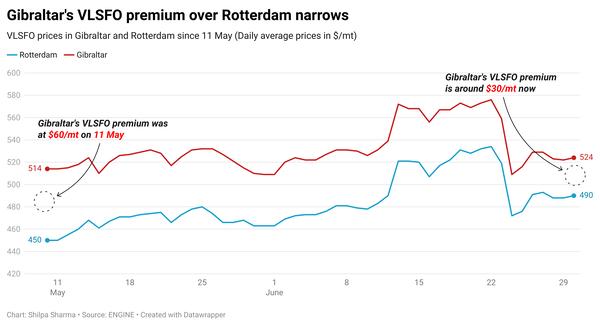

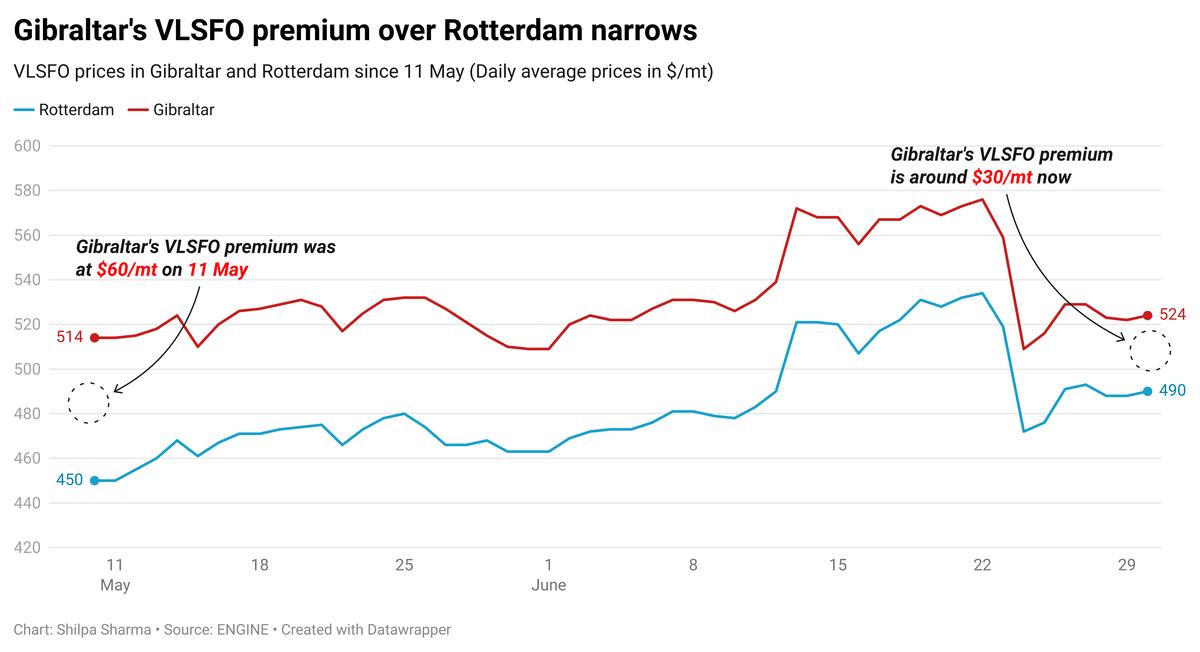

Since the beginning of May, Rotterdam’s VLSFO price has steadily increased, narrowing Gibraltar’s premium over the benchmark from almost $60/mt to around $30/mt today.

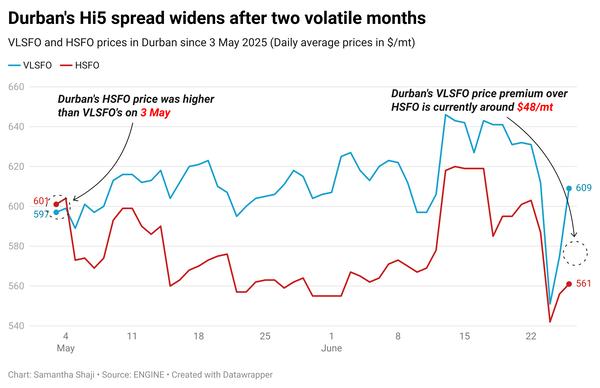

The fall in Gibraltar's VLSFO price has surpassed the drop in its HSFO price, narrowing the port’s Hi5 spread by $3/mt to $51/mt.

Gibraltar has reported an increase in congestion over the weekend, with eight vessels awaiting bunkers at the port today, according to port agent MH Bland. Some suppliers at the port are running 3-10 hours behind schedule, the agent added.

Bunkering operations continue as usual at Ceuta, though one supplier is delayed by 10-12 hours at the anchorage, MH Bland noted.

Las Palmas is forecast to face wind gusts of up to 22 knots today, which could possibly disrupt bunkering operations, according to MH Bland. Some suppliers are running 6-8 hours late, the agent added. Bunker availability is good in Las Palmas, with 5-7 days of lead times advised.

Bunker availability off Walvis Bay is good, with recommended lead times of 3-6 days, consistent with last week.

Brent

The front-month ICE Brent contract has lost by $0.53/bbl on the day from Friday, to trade at $67.84/bbl at 09.00 GMT.

Upward pressure:

The global market’s attention is now shifting from geopolitical tensions in the Middle East to demand growth factors. This has supported Brent crude’s price recently.

The US Federal Reserve (Fed) will hold its upcoming interest rate meeting in July, where officials are largely expected to cut US interest rates in September, according to market analysts.

Lower interest rates in the US can boost demand, making dollar-denominated commodities like oil cheaper for holders of other currencies.

“The [oil] market is punch drunk on rate cut euphoria. Futures are fully loaded for a September cut and even pricing a 20% chance for July,” SPI Asset Management managing partner Stephen Innes remarked.

Downward pressure:

Oil’s brief rally has lost momentum as supply glut concerns have overshadowed optimism about demand growth.

The eight OPEC+ members currently unwinding supply cuts are expected to raise their combined output in August by another 411,000 b/d, Reuters reports. This news has put downward pressure on Brent.

“What’s really spooking the tape now is OPEC+ playing offense,” Innes remarked.

The Saudi Arabia-led group will again meet on 6 July to decide August production levels, the group said earlier.

“Rumours are swirling that the cartel is eyeing another 411,000 bpd hike for August, which would make it four straight months of aggressive taps-turning,” Innes added.

By Samantha Shaji and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.