Europe & Africa Market Update 26 Jun 2025

Bunker prices in European and African ports have mostly moved up, and securing prompt fuel deliveries can be difficult in the ARA hub.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Durban ($60/mt), Rotterdam ($14/mt) and Gibraltar ($13/mt)

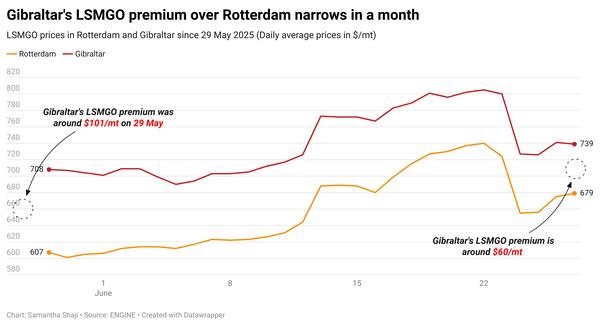

- LSMGO prices up in Gibraltar ($19/mt) and Rotterdam ($16/mt)

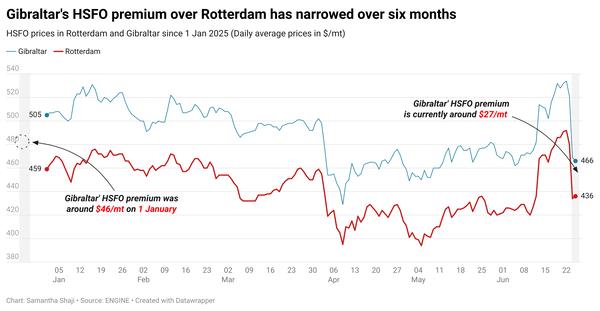

- HSFO prices up in Durban and Gibraltar ($3/mt), and down in Rotterdam ($8/mt)

- Rotterdam B30-VLSFO premium over VLSFO up by $9 at $220/mt

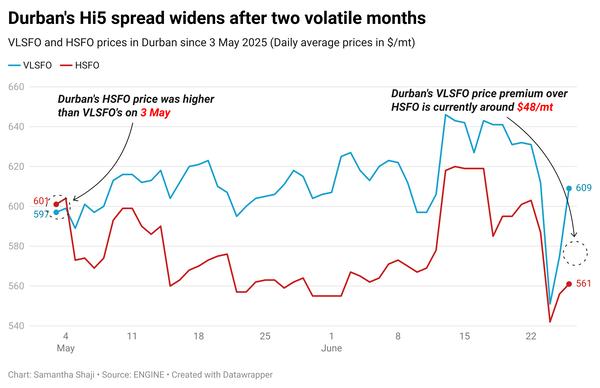

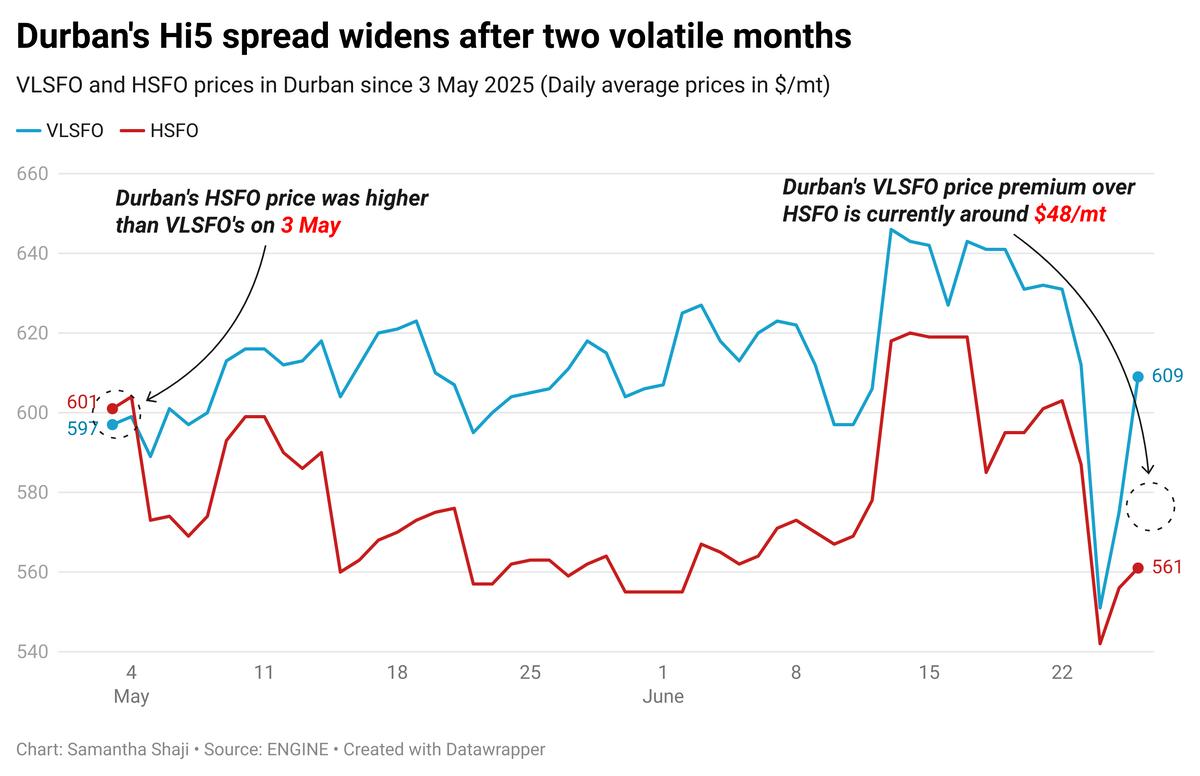

Durban’s VLSFO price has risen sharply in the past session, while its HSFO benchmark has edged up. The price moves have widened its Hi5 spread to $49/mt.

In Rotterdam, the price of VLSFO has increased while that of HSFO has recorded some losses, almost doubling the port's Hi5 spread from $28/mt yesterday to $50/mt today. Fuel availability in the ARA hub is strained, with lead times ranging from 7-10 days, according to a trader.

As of yesterday afternoon, more than 55 vessels were left waiting in Antwerp due to the national strike in Belgium.

There are four vessels awaiting bunkers in Gibraltar today, according to port agent MH Bland. This congestion has been caused due to a lack of space for vessels to bunker, the agent added. Two suppliers continue to run up to six hours behind schedule.

One supplier in Ceuta is running late by up to 24 hours at the anchorage, according to MH Bland. The port is expecting six vessels to arrive today, according to shipping agent Jose Salama & Co.

Brent

The front-month ICE Brent contract lost by $0.47/bbl on the day, to trade at $67.55/bbl at 09.00 GMT.

Upward pressure:

Brent crude’s price regained some value after the US Energy Information Administration (EIA) released crude stocks data.

Commercial US crude oil inventories plunged 5.8 million bbls lower to touch 415 million bbls for the week ending 20 June, according to data from the EIA.

The EIA report was “bullish”, Vanda Insights’ founder and analyst Vandana Hari remarked.

A drop in US crude stockpiles generally signals stronger demand and can provide some support to Brent's price.

“US government [EIA] data showed the US driving season is in full swing after a slow start,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Downward pressure:

Brent has continued to decline following the US-brokered ceasefire deal between Israel and Iran, which came into effect on Monday.

The news has wiped out the Mideast geopolitical risk premium from the market, according to analysts. It has “sent oil prices tumbling this week, as traders and investors bet the bombing campaigns are over,” analysts from ING Bank noted.

US President Donald Trump is confident that the ceasefire will remain in place, he told reporters at the recent NATO summit in the Netherlands,

Oil is down due to “lingering concerns over the stability of the Israel-Iran truce,” Hari said.

By Samantha Shaji and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.