Europe & Africa Market Update 25 Jun 2025

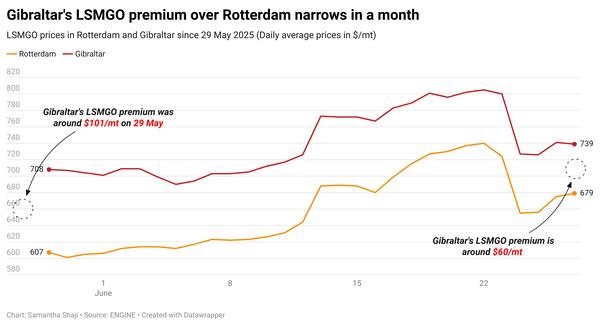

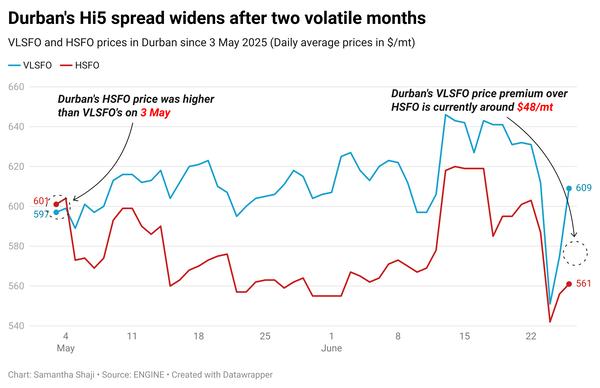

Bunker benchmarks in European and African ports have moved in mixed directions, and prompt supply of all fuel grades is currently tight in Gibraltar.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Gibraltar ($5/mt) and Rotterdam ($1/mt), and down in Durban ($8/mt)

- LSMGO prices down in Gibraltar ($11/mt) and Rotterdam ($10/mt)

- HSFO prices up in Durban ($23/mt), Rotterdam ($12/mt), and down in Gibraltar ($6/mt)

- Rotterdam B30-VLSFO premium over VLSFO down by $5 at $211/mt

Rotterdam’s Hi5 spread has narrowed by more than $10/mt, to $28/mt in the past session.

According to the Antwerp-Bruges Port Authority, the national strike in Belgium has caused some disruptions to vessel movements at the port today.

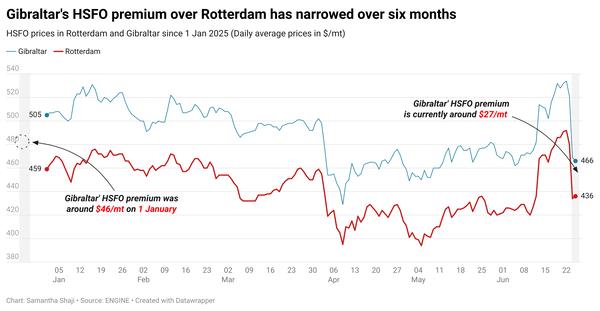

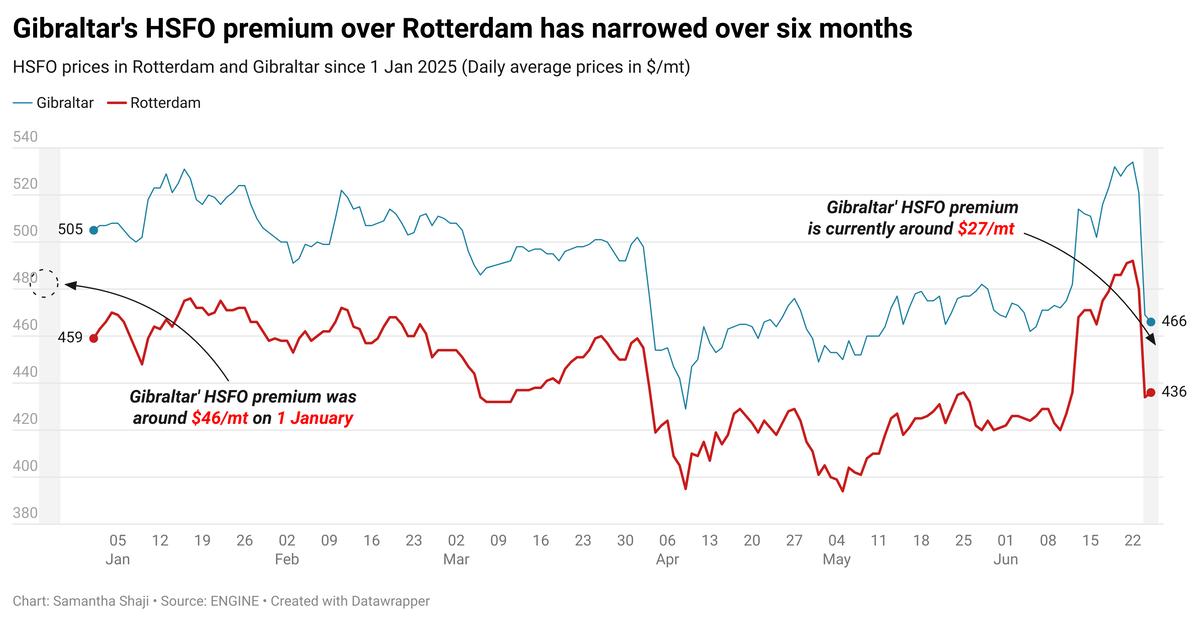

Rotterdam's HSFO price has increased, while the grade's price in Gibraltar has declined. The price moves have narrowed Gibraltar’s HSFO premium over Rotterdam to $22/mt, recording the smallest premium the benchmark has maintained so far this year.

Gibraltar has two vessels awaiting bunkers today due to limited bunker barge availability, according to port agent MH Bland. Two suppliers are running up to 6 hours behind schedule.

In Algeciras, suppliers are running anywhere between two to 24 hours behind schedule, the port agent said.

One supplier at Ceuta is delayed by 20 hours at the anchorage. The port is expected to face wind gusts of up to 19 knots today.

Brent

The front-month ICE Brent contract has moved $1.16/bbl lower on the day, to trade at $68.02/bbl at 09.00 GMT.

Upward pressure:

Brent futures have gained some support following the American Petroleum Institute's (API) weekly oil inventory report.

US crude oil inventories declined by 4.28 million bbls in the week ending 20 June, according to API estimates.

The decline in crude stocks surprised market analysts, who expected a much smaller draw of 600,000 bbls. The numbers were “significantly above the anticipated decrease of around 0.6 million barrels,” two analysts from ING Bank noted.

A decrease in US crude stockpiles generally signals stronger demand and can provide some support to Brent's price.

Market participants now await the US Energy Information Administration’s (EIA) crude inventory report, scheduled for release later today.

Downward pressure:

Brent’s price has plunged as some geopolitical risk premiums have been priced out of the oil market, according to analysts.

US President Donald Trump said on Truth Social yesterday that China can continue purchasing oil from Iran, following the successful implementation of a ceasefire between Israel and Iran, according to a Reuters report. Meanwhile, the White House clarified that the statement did not indicate a relaxation of US sanctions against Iran.

“With the Israel-Iran ceasefire holding steady, oil’s risk bid collapsed,” SPI Asset Management managing partner Stephen Innes said.

Given that the tensions between Israel and Iran remain contained in the upcoming weeks, market attention is expected to shift back to the anticipated supply surplus later this year.

“The latest slump in prices brings the market back to where it was before Israel attacked Iran on 12 June,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

“OPEC is scheduled to ramp up output in July faster than originally agreed,” he added. The group is due to meet on 6 July to discuss a further supply boost in August.

By Samantha Shaji and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.