East of Suez Market Update 27 Jun 2025

Bunker fuel prices across the major East of Suez ports have largely tracked Brent’s upward move, and prompt availability is tight in Fujairah.

IMAGE: Bunker barge at berth in Fujairah, UAE. Port of Fujairah

IMAGE: Bunker barge at berth in Fujairah, UAE. Port of Fujairah

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Fujairah ($8/mt), Singapore ($5/mt) and Zhoushan ($4/mt)

- LSMGO prices up in Fujairah ($10/mt) and Zhoushan ($5/mt), and down in Singapore ($1/mt)

- HSFO prices up in Singapore ($6/mt), Fujairah ($3/mt), and unchanged in Zhoushan

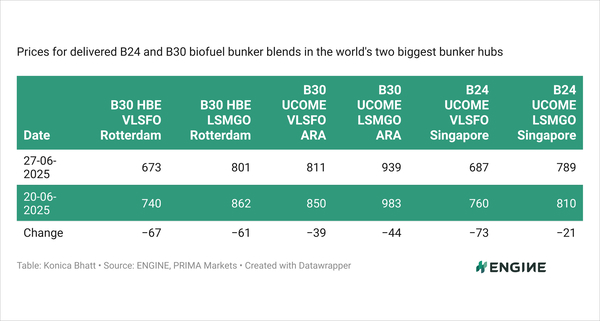

- B24-VLSFO at a $188/mt premium over VLSFO in Singapore

Fujairah’s LSMGO price has increased by $10/mt in the past day, recording the steepest gains among the three major Asian bunker hubs.

Fujairah’s LSMGO price now stands at a premium of $81/mt over Singapore and $58/mt over Zhoushan.

Bunker fuel availability across all grades in Fujairah is currently on the tighter side. VLSFO requires lead times of around nine days, up from 5–7 days last week. LSMGO and HSFO require lead times of about seven days. Some suppliers can offer prompt deliveries; these are typically priced at a premium.

Most suppliers in the Middle Eastern region remain cautious amid ongoing market volatility, driven by the Israel-Iran conflict and limited cargo availability.

Jebel Ali, a key UAE port, is also vulnerable to regional disruptions due to its strategic location and heavy traffic, making it subject to increased risk premiums. Meanwhile, stocks of all three conventional bunker grades are nearly depleted in Egypt’s Suez port, according to a trader.

Brent

The front-month ICE Brent contract has gained by $0.82/bbl on the day, to trade at $68.37/bbl, at 17.00 SGT (09.00 GMT) today.

Upward pressure:

Oil has rebounded from earlier losses amid signs of strengthening demand in the US.

Commercial US crude oil inventories have plunged by about 5.8 million bbls to touch 415 million bbls for the week ending 20 June, according to data from the US Energy Information Administration (EIA).

“The Energy Information Administration reported stunning numbers,” Price Futures Group’s senior market analyst Phil Flynn remarked.

A draw in US crude stockpiles signals stronger demand and can provide some support to Brent's price.

Brent has gained additional support following news that Washington and Beijing have reached an agreement to expedite rare earth shipments to the US, Reuters reports. The news is “constructive for the [oil] market, particularly ahead of the reciprocal tariff deadline of 9 July,” ING Bank analysts said.

Downward pressure:

Brent’s price has come under pressure as the ceasefire agreement between Iran and Israel appears to hold, according to market analysts.

Besides, delegates from the US and Iran are set to resume talks next week in a renewed effort to reach an agreement on Tehran’s nuclear enrichment program.

“The oil market’s attention is shifting back to tariffs and other risks,” analysts from ING Bank noted.

Another key focus is OPEC+’s upcoming meeting on 6 July to decide August production levels. Market analysts expect the Saudi Arabia-led group to continue unwinding supply cuts by another 411,000 b/d in August – the same as July.

“These supply hikes should ensure that the oil market moves into a large surplus towards the end of the year,” ING Bank analysts added.

By Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.