East of Suez Market Update 26 Jun 2025

Most prices in East of Suez ports have moved up, and VLSFO and LSMGO availability is good in Malaysia’s Port Klang.

IMAGE: An old wooden cargo ship setting out from Port Klang. Getty Images

IMAGE: An old wooden cargo ship setting out from Port Klang. Getty Images

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Singapore ($10/mt), Zhoushan ($5/mt) and Fujairah ($1/mt)

- LSMGO prices up in Zhoushan ($15/mt), Singapore and Fujairah ($8/mt)

- HSFO prices up in Zhoushan ($1/mt), unchanged in Singapore, and down in Fujairah ($2/mt)

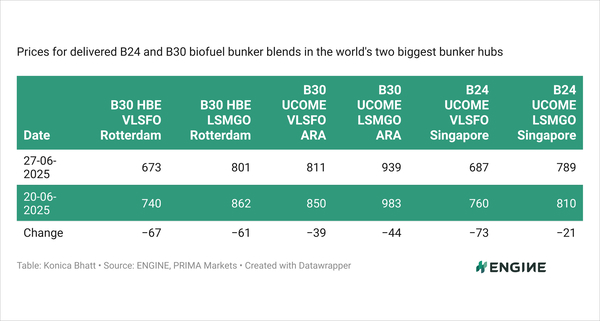

- B24-VLSFO at a $184/mt premium over VLSFO in Singapore

- B24-VLSFO at a $195/mt premium over VLSFO in Fujairah

Singapore’s VLSFO price has increased by $10/mt in the past day—the steepest gains among the three major Asian bunker ports. This has shifted Singapore’s VLSFO from near price parity with Fujairah to a $9/mt premium, while its slight discount to Zhoushan has nearly disappeared.

VLSFO lead times in Singapore remain highly variable. Some suppliers are advising as few as five days, while others recommend booking up to three weeks in advance due to tight delivery schedules. Last week, typical lead times ranged between 6–10 days.

LSMGO supply remains stable, with most suppliers now recommending lead times of 4–6 days—slightly higher than the 2–5 days advised the previous week.

HSFO lead times have also increased, now ranging from 7–12 days, compared to 6–10 days last week.

In Malaysia’s Port Klang, both VLSFO and LSMGO remain readily available, with prompt deliveries possible for smaller quantities. However, HSFO supply continues to be limited.

Brent

The front-month ICE Brent contract lost by $0.47/bbl on the day, to trade at $67.55/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent crude’s price regained some value after the US Energy Information Administration (EIA) released crude stocks data.

Commercial US crude oil inventories plunged 5.8 million bbls lower to touch 415 million bbls for the week ending 20 June, according to data from the EIA.

The EIA report was “bullish”, Vanda Insights’ founder and analyst Vandana Hari remarked.

A drop in US crude stockpiles generally signals stronger demand and can provide some support to Brent's price.

“US government [EIA] data showed the US driving season is in full swing after a slow start,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Downward pressure:

Brent has continued to decline following the US-brokered ceasefire deal between Israel and Iran, which came into effect on Monday.

The news has wiped out the Mideast geopolitical risk premium from the market, according to analysts. It has “sent oil prices tumbling this week, as traders and investors bet the bombing campaigns are over,” analysts from ING Bank noted.

US President Donald Trump is confident that the ceasefire will remain in place, he told reporters at the recent NATO summit in the Netherlands,

Oil is down due to “lingering concerns over the stability of the Israel-Iran truce,” Hari said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.