East of Suez Market Update 20 Jun 2025

Prices in East of Suez ports have moved in mixed directions, and LSMGO availability is tight in Singapore.

IMAGE: Container ship with working crane bridge in shipyard in Singapore. Getty Images

IMAGE: Container ship with working crane bridge in shipyard in Singapore. Getty Images

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Zhoushan ($3/mt), and down in Singapore ($2/mt) and Fujairah ($1/mt)

- LSMGO prices up in Singapore ($36/mt), Fujairah ($18/mt) and Zhoushan ($3/mt)

- HSFO prices up in Zhoushan ($5/mt) and Singapore ($3/mt), and down in Fujairah ($2/mt)

- B24-VLSFO at a $179/mt premium over VLSFO in Singapore

- B24-VLSFO at a $222/mt premium over VLSFO in Fujairah

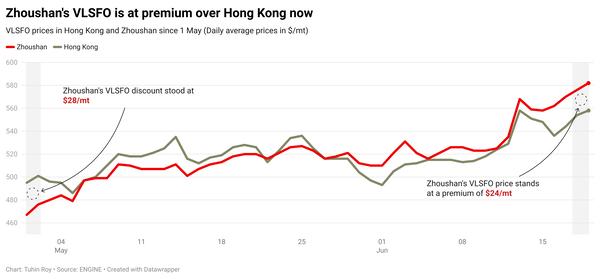

VLSFO prices across the three major Asian bunker ports have remained largely stable over the past day, showing no significant fluctuations. Zhoushan continues to hold a VLSFO premium of $25/mt over Fujairah and $17/mt over Singapore.

Singapore’s LSMGO price has surged by $36/mt in the past day—the sharpest increase among the major East of Suez ports. This rise was supported by a higher-priced 150–500 mt LSMGO stem fixed in the port. As a result, Singapore’s previous LSMGO discount of $22/mt to Zhoushan has flipped to a $11/mt premium, while its discount to Fujairah has narrowed by $18/mt to $59/mt.

The price increase is partly driven by supply-side concerns linked to the Israel-Iran conflict, which has raised the risk of supply disruptions from the Middle East.

LSMGO lead times in Singapore have risen from 2–5 days last week to around 4–10 days now. Zhoushan has also seen a sharp increase, with lead times jumping from 2–3 days to about 10 days.

In Fujairah, prompt supply remains tight, with lead times of 5–7 days advised. Meanwhile, Omani ports—Sohar, Salalah, Muscat, and Duqm—continue to maintain stable LSMGO availability.

Brent

The front-month ICE Brent contract has gained by $0.15/bbl on the day, to trade at $77.08/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Oil market participants remain on edge as the Israel-Iran conflict has entered its second week, with both countries continuing to exchange airstrikes on critical infrastructures.

Israel has struck more of Iran’s nuclear sites and warned its attacks could bring down the Islamic Republic’s government, according to media reports. The news has supported Brent crude’s upward move.

“Satellite images also show that Iran is racing to get its oil out, filling storage tanks and sending as much onto the global market as it can,” ANZ Bank’s senior commodity analyst Daniel Hynes remarked.

Market analysts fear that Iran may retaliate by disrupting oil flows through critical chokepoints including the Strait of Hormuz and the Bab al-Mandab Strait in the Red Sea.

“This could trigger action by Israel’s allies, including stricter sanctions on Iran. Energy export infrastructure in Iran and other regional states could be targeted,” Hynes added.

Downward pressure:

US President Donald Trump said he would take up to two weeks to decide on any potential US military action against Iran, US press secretary Karoline Leavitt said yesterday.

There is a “substantial chance” of negotiations with Tehran, Leavitt quoted Trump as saying. This news has eased some supply concerns in the market, as it has re-opened window for a US-Iran nuclear deal.

This news has capped some of Brent’s price gains, “reducing speculation that the US is planning to imminently join Israel in attacking Iran’s nuclear facilities,” Hynes added.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.