East of Suez Market Update 19 Jun 2025

Prices in East of Suez ports have tracked Brent’s upward trend, and VLSFO availability is tight in Zhoushan.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Zhoushan ($14/mt), Singapore ($8/mt) and Fujairah ($7/mt)

- LSMGO prices up in Singapore ($17/mt), Fujairah and Zhoushan ($6/mt)

- HSFO prices up in Singapore ($7/mt), Zhoushan ($2/mt) and Fujairah ($1/mt)

- B24-VLSFO at a $182/mt premium over VLSFO in Singapore

- B24-VLSFO at a $216/mt premium over VLSFO in Fujairah

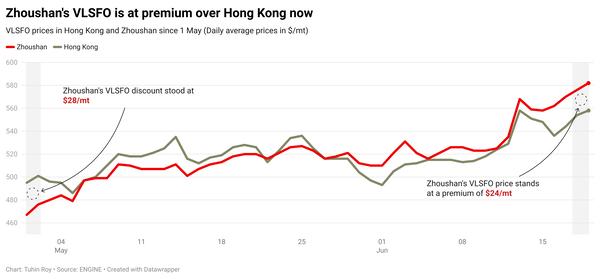

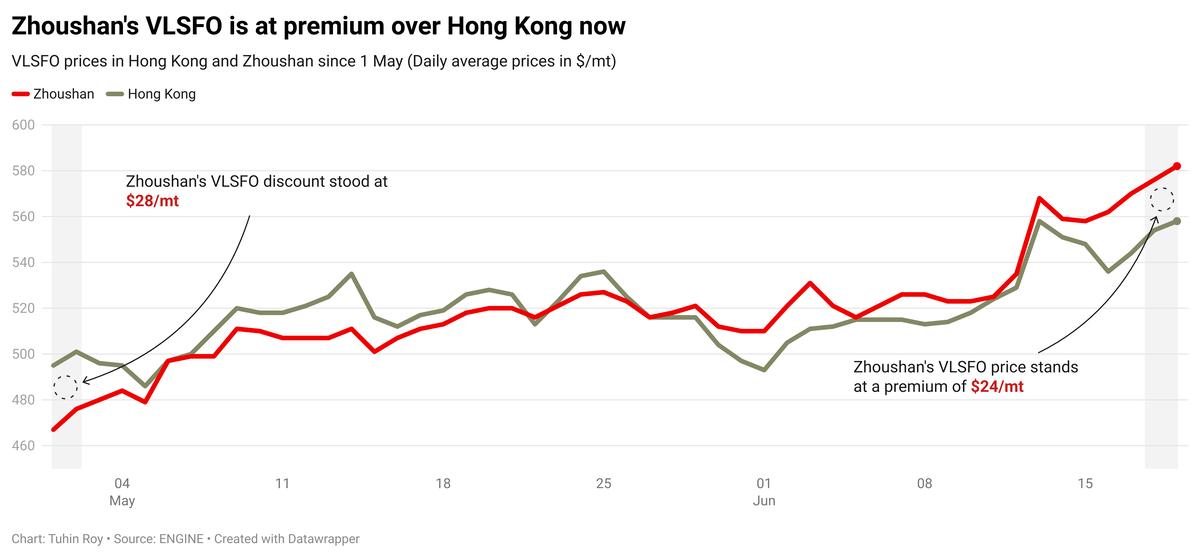

Zhoushan’s VLSFO price has climbed by $14/mt over the past day - the sharpest increase among the three major Asian bunker ports. This rise has been supported by a higher-priced 500-1,500 mt VLSFO stem fixed at the port. As a result, Zhoushan’s VLSFO premiums over Fujairah and Singapore have widened from $14/mt and $6/mt to $21/mt and $12/mt, respectively.

VLSFO supply in Zhoushan has tightened, with several suppliers facing low stock levels and delayed replenishment cargoes, according to a source. Consequently, VLSFO lead times have increased from 4–7 days last week to around 10 days now, further adding upward pressure to the benchmark. LSMGO lead times have also seen a notable rise, jumping from 2-3 days last week to about 10 days now. In contrast, HSFO lead times have improved, decreasing from 4-7 days to 3-5 days.

In Hong Kong, VLSFO is now priced at a $24/mt discount to Zhoushan. Lead times for all fuel grades in Hong Kong remain steady at seven days.

Brent

The front-month ICE Brent contract has gained by $1.53/bbl on the day, to trade at $76.93/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent crude’s price has moved higher as hostilities between Israel and Iran have intensified, with both sides continuing to exchange fire.

Overnight, Israel struck two key Iranian nuclear sites, while Iranian drones hit a hospital in southern Israel, Reuters reports. Oil market participants are on high alert amid heightened speculations that Washington could intervene in the war.

“The market is being held in suspense over US President Donald Trump’s next move on the Israel-Iran conflict, more specifically whether he would authorise a direct US attack on the Islamic Republic,” Vanda Insights’ founder and analyst Vandana Hari notes.

On the demand side, oil got a boost after the US Energy Information Administration (EIA) reported a massive 11.5 million-bbl draw of commercial US crude oil inventories for the week ending 13 June.

Following the EIA report, ANZ Bank’s senior commodity strategist Daniel Hynes remarked that global oil demand “looks robust.” A decline in US crude stockpiles generally signals stronger demand and can support Brent.

Downward pressure:

Brent has had some downward pressure from a steady rise in OPEC+ production in recent months.

According to the group’s latest oil market report, total crude output from OPEC+ members averaged 41.23 million b/d in May, an increase of 180,000 b/d from April.

Saudi Arabia, the group’s de facto leader, boosted production by 177,000 b/d to reach 9.18 million b/d in May.

Eight members of the group will collectively raise their output by another 411,000 b/d in July, marking the fourth consecutive month of consistent supply increases.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.