East of Suez Market Update 18 Jun 2025

Prices in East of Suez ports have moved up, and VLSFO and LSMGO availability is good in Malaysia’s Port Klang.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Fujairah ($10/mt), Singapore ($6/mt) and Zhoushan ($2/mt)

- LSMGO prices up in Singapore ($29/mt), Zhoushan ($16/mt) and Fujairah ($10/mt)

- HSFO prices up in Singapore ($16/mt), Fujairah ($13/mt) and Zhoushan ($11/mt)

- B24-VLSFO at a $194/mt premium over VLSFO in Singapore

- B24-VLSFO at a $213/mt premium over VLSFO in Fujairah

VLSFO prices at the three major Asian bunker ports have increased by $2–10/mt over the past day, with Fujairah seeing the largest gain. Despite this rise, Fujairah’s VLSFO remains discounted by $14/mt to Zhoushan and $8/mt to Singapore.

Singapore’s LSMGO price recorded the steepest increase among the three major East of Suez ports, rising by $29/mt. However, it still stands at significant discounts of $88/mt to Fujairah and $33/mt to Zhoushan.

In Singapore, VLSFO lead times remain stable at 6–10 days, unchanged from last week. LSMGO is widely available, with most suppliers offering lead times of 2–5 days. HSFO lead times also remain consistent at 6–10 days.

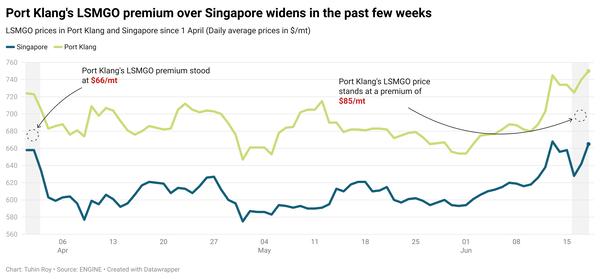

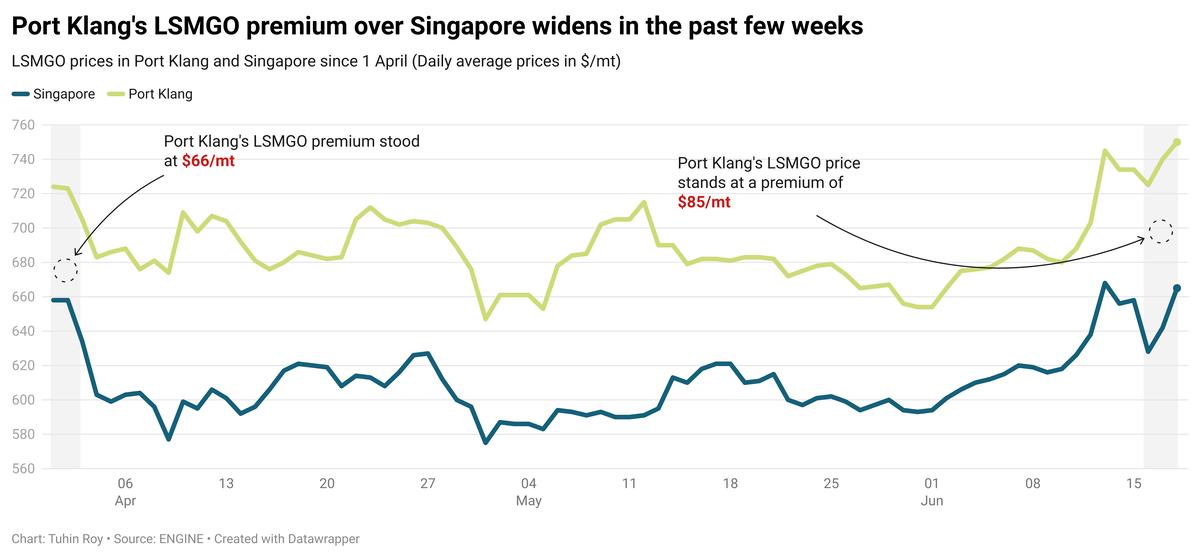

In Malaysia’s Port Klang, LSMGO continues to be priced at a premium of $85/mt over Singapore.

Both VLSFO and LSMGO are readily available in Port Klang, with prompt delivery options for smaller volumes. However, HSFO supply remains tight.

Brent

The front-month ICE Brent contract has gained by $1.12/bbl on the day, to trade at $75.40/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent crude has surpassed the $75/bbl mark as hopes for a swift resolution to the Israel-Iran conflict fade, with the dispute now entering its sixth day.

US President Donald Trump is weighing several options amid rising hostilities in the Middle East, including a possible US airstrike on Iran, the Wall Street Journal reports.

“Crude prices [are] ripping higher on intensifying speculation that the US could soon join Israel in direct military action against Iran,” SPI Asset Management managing partner Stephen Innes remarked.

The conflict has renewed fears about the security of vital oil transit chokepoints in the region, including the Strait of Hormuz, Gulf of Aden and Bab al-Mandab Strait.

“The biggest fear for the oil market is the shutdown of the Strait of Hormuz,” two analysts from ING Bank noted. “This could impact oil flows from the Persian Gulf. Almost a third of global seaborne oil trade moves through this chokepoint,” they said.

Downward pressure:

Concerns related to global oil demand growth have capped some of Brent’s price gains this week.

Paris-based International Energy Agency (IEA) now expects global oil demand to grow by 720,000 b/d in 2025 and by 740,000 b/d in 2026 - both revised down by around 200,000 b/d from its earlier forecasts.

The weakness in US and Chinese oil demand growth in the second quarter will be a major contributor to the downward trend, the agency said.

On the supply side, the IEA projects global oil production to grow by 1.8 million b/d to average 104.9 million b/d in 2025, and by another 1.1 million b/d in 2026.

The energy agency has also projected “an average 1.1 million b/d of supply overhang this year,” VANDA Insights’ founder and analyst Vandana Hari said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.