Europe & Africa Market Update 13 Jun 2025

Prices of fuels in European and African ports have significantly gained, while congestion persists in Gibraltar.

IMAGE: The Europoort area in the Port of Rotterdam. Getty Images

IMAGE: The Europoort area in the Port of Rotterdam. Getty Images

Changes on the day to 09.00 GMT today:

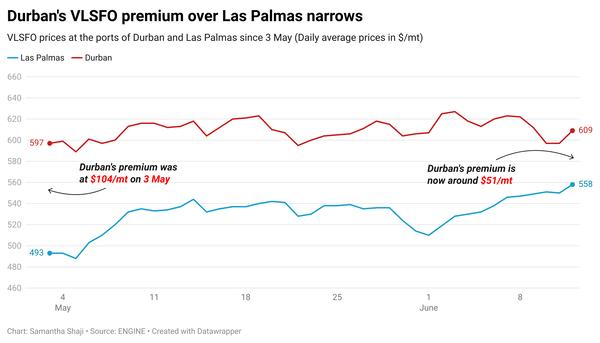

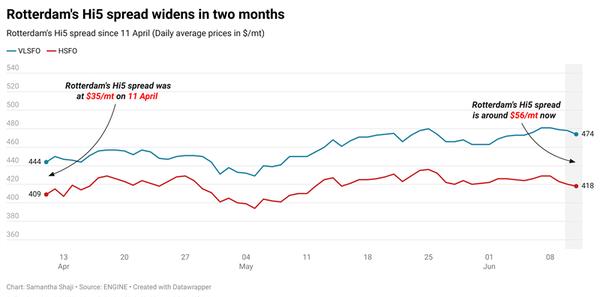

- VLSFO prices up in Durban ($47/mt), Rotterdam ($37/mt) and Gibraltar ($36/mt)

- LSMGO prices up in Gibraltar ($49/mt) and Rotterdam ($47/mt)

- HSFO prices up in Durban ($44/mt), Gibraltar ($36/mt) and Rotterdam ($34/mt)

- Rotterdam B30-VLSFO premium over VLSFO up by $28 at $274/mt

Tracking Brent's upward swing amid growing geopolitical tension in the Middle East, prices of bunker fuels have surged in most ports. All fuel grades in Rotterdam, Durban and Gibraltar have recorded gains in the range of $30-50/mt, a substantial increase compared to the past few sessions.

Prompt bunker supply remains tight in the ARA hub, with recommended lead times of 7-8 days. The region has imported 87,000 b/d of fuel oil in June so far, according to Vortexa data. It has exported 346,000 b/d of fuel oil in the same period.

The ARA's independently held fuel oil stocks have fallen by 6% in June so far to 6.74 million barrels, according to Insights Global data.

Slight congestion is reported in Gibraltar today, with four vessels currently awaiting bunkers, according to port agent MH Bland. The congestion has been caused by a lack of space for vessels to bunker and limited barge availability. The weather at the port is forecast to be suitable for bunkering through the weekend. Some suppliers continue to be delayed by about 2-6 hours, the port agent added.

Eleven vessels are expected to arrive for bunkers in Ceuta today, shipping agent Jose Salama & Co said. One supplier is running 4-6 hours behind schedule, port agent MH Bland said.

Off Malta is suitable for bunkering through the weekend, according to MH Bland.

Brent

The front-month ICE Brent contract has moved $5.21/bbl higher on the day, to trade at $74.24/bbl at 09.00 GMT.

Upward pressure:

Brent crude’s price has rallied over 7% following reports that Israel struck a major nuclear facility in Natanz, Iran earlier today.

Israel has targeted Iran’s nuclear facilities, ballistic missile factories and military personnel in the recent attack, the country’s military said.

“This has elevated geopolitical uncertainty significantly and requires the oil market to price in a larger risk premium for any potential supply disruptions,” ING Bank’s head of commodities strategy Warren Patterson remarked.

The news comes ahead of the sixth round of US-Iran talks in Oman later this week. The US has denied any involvement in these strikes.

“This follows threats from Iran that it will target US military bases in Iraq if a conflict breaks out,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Downward pressure:

The risk to supply disruptions was partly offset by OPEC+ decision to ramp up production hikes.

Earlier this month, the oil producers’ group decided to collectively increase their supply by 411,000 b/d in July again – a move the coalition has stuck to for three months now. It’s leader Saudi Arabia wants to increase oil supply to regain market share, according to market analysts.

“Crude tanker loadings from OPEC nations rose 24% w/w last week to 2.28mb/d [2.28 million b/d], the highest weekly loadings since April 2023,” Hynes said citing data from global shipping association Baltic and International Maritime Council (BIMCO).

By Samantha Shaji and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.