Europe & Africa Market Update 11 Jun 2025

Most European and African bunker benchmarks have recorded losses in the past session, and prompt supply of all grades is tight in Rotterdam.

Changes on the day to 09.00 GMT today:

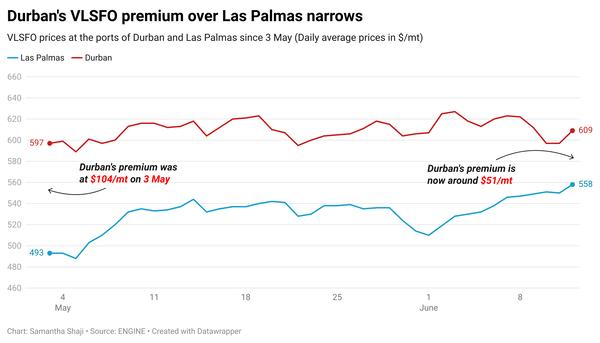

- VLSFO prices down in Durban ($17/mt), Rotterdam and Gibraltar ($3/mt)

- LSMGO prices down in Gibraltar ($11/mt) and Rotterdam ($6/mt)

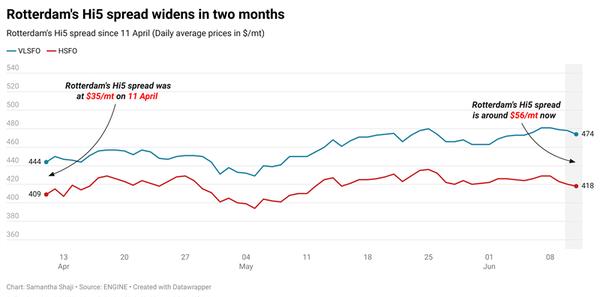

- HSFO prices up in Rotterdam ($2/mt), and down in Durban ($10/mt) and Gibraltar ($3/mt)

- Rotterdam B30-VLSFO premium over VLSFO down by $66 at $227/mt

A 500-1,500 mt HSFO stem fixed in Rotterdam at $422/mt has helped to push the benchmark higher, making it the only fuel grade to record a gain in the past session.

In the ARA hub, prompt delivery of HSFO, VLSFO and LSMGO remains challenging, with lead times steady at 7-8 days, according to a trader.

According to port agent MH Bland, two vessels are currently awaiting bunkers in Gibraltar - one due to limited barge availability, and the other due to a lack of space. Some suppliers are reporting delays of more than 12 hours. Though operations were halted last night due to a lightning storm, they have since resumed and are underway now, MH Bland clarified.

Suppliers in Algeciras are running about 2-12 hours behind schedule, it added.

Across the Strait, eleven vessels are expected to arrive for bunkers in Ceuta today, shipping agent Jose Salama & Co said. According to MH Bland, wind gusts at the port are expected to reach up to 23 knots by tomorrow.

Weather conditions in Las Palmas are forecast to be suitable for bunkering in the coming week, according to a trader.

Brent

The front-month ICE Brent contract has fallen by $0.40/bbl on the day, to trade at $66.83/bbl at 09.00 GMT.

Upward pressure:

Brent crude’s price has found some support as market participants await the final outcome of US-China trade talks.

Representatives from the two countries, who met in London this week, have agreed on a framework to ease trade tensions. However, the deal is yet to be reviewed and approved by US President Donald Trump and his Chinese counterpart Xi Jinping.

“From a market sentiment perspective, it’s a light nod toward de-escalation, but let’s not kid ourselves —this wasn’t a breakthrough,” SPI Asset Management managing partner Stephen Innes remarked.

Downward pressure:

Brent’s price has moved lower, shedding yesterday’s gains, after the US Energy Information Administration trimmed its projection for 2025 global oil demand to 103.5 million b/d, noting an annual growth of about 800,000 b/d, down from the 1 million b/d projected last month.

Lower oil consumption is expected to raise inventories by more than 800,000 b/d this year, Hynes said.

A slowdown in global oil demand growth will automatically push oil prices lower, according to market analysts.

By Samantha Shaji and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.