Europe & Africa Market Update 10 Jun 2025

Most bunker benchmarks in European and African ports have declined, and congestion at Gibraltar port has cleared up.

IMAGE: Passenger ships in the Port of Piraeus. Getty Images

IMAGE: Passenger ships in the Port of Piraeus. Getty Images

Changes on the day to 09.00 GMT today:

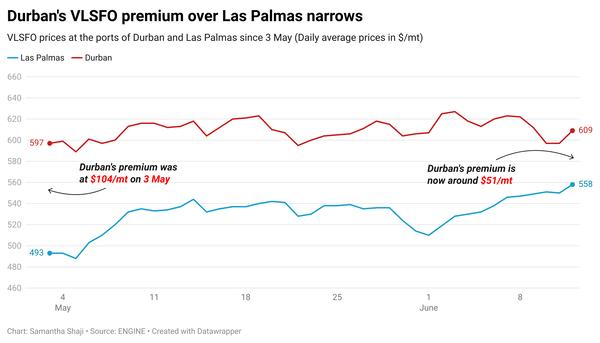

- VLSFO prices unchanged in Rotterdam, and down in Durban ($28/mt) and Gibraltar ($5/mt)

- LSMGO prices up in Gibraltar ($14/mt) and Rotterdam ($9/mt)

- HSFO prices down in Rotterdam ($7/mt) and Gibraltar ($2/mt)

- Rotterdam B30-VLSFO premium over VLSFO up by $9 at $293/mt

Prices of most fuel grades in Rotterdam, Durban and Gibraltar have recorded losses.

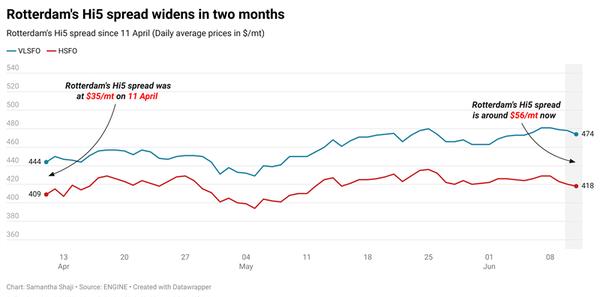

A lower-priced 150-500 mt HSFO stem fixed at $415/mt in Rotterdam has contributed to the drop in the port’s benchmark. Rotterdam's VLSFO price has held steady. The price moves have widened the port's Hi5 spread by $7/mt to $60/mt.

Rotterdam's HSFO price discount to Gibraltar has widened by $5/mt, to $53/mt now.

LSMGO, VLSFO and ULSFO grades are readily available in Istanbul, according to a trader.

No vessels are awaiting bunkers in Gibraltar today, after several days of oscillating congestion, according to port agent MH Bland. However, some suppliers continue to report delays of more than 12 hours.

Possible disruptions due to bad weather conditions are expected at the Greek port of Piraeus this entire week, starting today, according to a trader. Istanbul is also expected to face weather-induced disruptions this week.

Brent

The front-month ICE Brent contract has gained by $0.68/bbl on the day, to trade at $67.23/bbl at 09.00 GMT.

Upward pressure:

Hopes of a positive outcome from the ongoing US-China trade negotiations have given Brent’s price a leg up for yet another day.

Escalating US-China trade tensions had raised fears of an economic slowdown in two of the world’s largest economies. An economic slowdown can directly impact oil demand through reduced industrial activity, consumer spending and overall consumption. But recent signs of progress in the trade talks have allayed some of these concerns, thereby boosting oil prices.

The stalemate in US-Iran nuclear talks has provided additional support.

Iran produced around 3.43 million b/d of crude oil in April 2025, according to the International Energy Agency’s May oil report. If US sanctions are lifted, a return of these Iranian barrels to the global market could boost supply and weigh on prices. The two countries are still negotiating terms for a nuclear deal.

Downward pressure:

“… the prospect of further hikes in OPEC supply continue to hang over the [oil] market,” ANZ Bank’s senior commodity strategist, Daniel Hynes said in a note.

The group's shift to a “market-driven strategy,” focusing on seasonal demand and limited supply from non-OPEC producers could lead to a significant surplus in the second half of this year, Hynes added.

By Samantha Shaji and Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.