East of Suez Market Update 10 Jun 2025

Prices in East of Suez ports have moved in a narrow range, and VLSFO and LSMGO availability has improved in Singapore.

IMAGE: Cargo ships in Victoria Harbour of Hong Kong, China. Getty Images

IMAGE: Cargo ships in Victoria Harbour of Hong Kong, China. Getty Images

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Fujairah ($1/mt), unchanged in Zhoushan, and down in Singapore ($1/mt)

- LSMGO prices up in Zhoushan ($9/mt) and Fujairah ($2/mt), and unchanged in Singapore

- HSFO prices unchanged in Fujairah, and down in Singapore and Zhoushan ($1/mt)

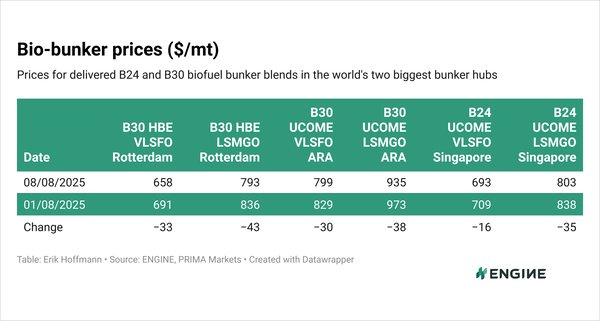

- B24-VLSFO at a $219/mt premium over VLSFO in Singapore

- B24-VLSFO at a $229/mt premium over VLSFO in Fujairah

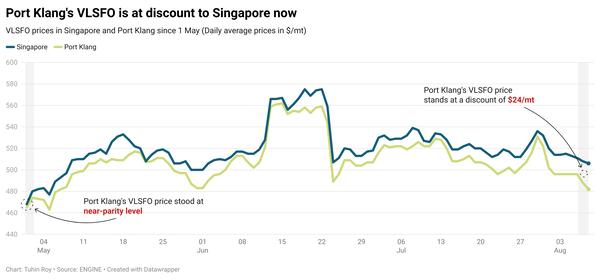

VLSFO benchmarks across the three major Asian bunker ports have remained largely stable over the past day. Singapore’s VLSFO price is currently at a premium of $11/mt over Fujairah and at a discount of $9/mt to Zhoushan.

Lead times for VLSFO in Singapore have decreased to 5–10 days, down from 7–14 days last week. LSMGO availability has also improved, with several suppliers now recommending lead times of 2–6 days, compared to 3–10 days previously. In contrast, HSFO lead times have increased to 7–10 days, up from 2–8 days last week.

Meanwhile, Hong Kong’s VLSFO price is at a slight premium of $6/mt over Singapore.

Lead times for all fuel grades in Hong Kong remain steady at around seven days. However, bad weather is forecast between 10-15 June, which may affect bunker deliveries.

The Hong Kong Observatory reported this morning that a low-pressure area in the central South China Sea is expected to develop into a tropical depression later today or by early Wednesday. Strong winds and heavy rains are anticipated later in the week. If the storm intensifies, it will be named Wutip, and the Observatory may issue a typhoon signal by Wednesday or Thursday, depending on the storm’s progression.

Brent

The front-month ICE Brent contract has gained by $0.68/bbl on the day, to trade at $67.23/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Hopes of a positive outcome from the ongoing US-China trade negotiations have given Brent’s price a leg up for yet another day.

Escalating US-China trade tensions had raised fears of an economic slowdown in two of the world’s largest economies. An economic slowdown can directly impact oil demand through reduced industrial activity, consumer spending and overall consumption. But recent signs of progress in the trade talks have allayed some of these concerns, thereby boosting oil prices.

The stalemate in US-Iran nuclear talks has provided additional support.

Iran produced around 3.43 million b/d of crude oil in April 2025, according to the International Energy Agency’s May oil report. If US sanctions are lifted, a return of these Iranian barrels to the global market could boost supply and weigh on prices. The two countries are still negotiating terms for a nuclear deal.

Downward pressure:

“… the prospect of further hikes in OPEC supply continue to hang over the [oil] market,” ANZ Bank’s senior commodity strategist, Daniel Hynes said in a note.

The group's shift to a “market-driven strategy,” focusing on seasonal demand and limited supply from non-OPEC producers could lead to a significant surplus in the second half of this year, Hynes added.

By Tuhin Roy and Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.