East of Suez Market Update 3 Jun 2025

Prices in most East of Suez ports have moved down, and VLSFO supply has improved in Zhoushan.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Zhoushan ($16/mt), and down in Fujairah ($9/mt) and Singapore ($3/mt)

- LSMGO prices down in Fujairah ($6/mt), Zhoushan ($5/mt) and Singapore ($3/mt)

- HSFO prices up in Zhoushan ($6/mt), and down in Fujairah ($7/mt) and Singapore ($5/mt)

- B24-VLSFO at a $187/mt premium over VLSFO in Singapore

- B24-VLSFO at a $233/mt premium over VLSFO in Fujairah

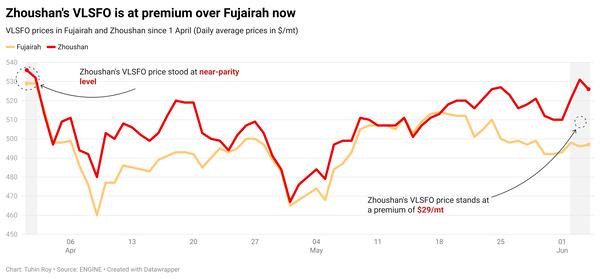

Zhoushan’s VLSFO price has increased by $16/mt over the past day, while prices in Fujairah and Singapore have declined. As a result, Zhoushan’s VLSFO premium over Fujairah has widened by $25/mt to $40/mt, and over Singapore by $19/mt to $26/mt.

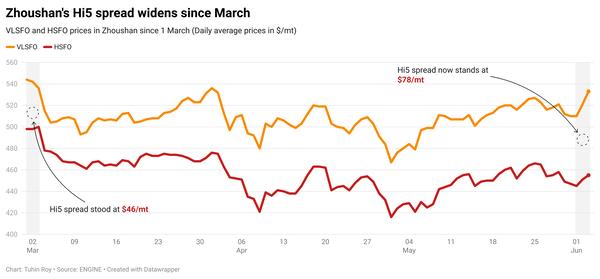

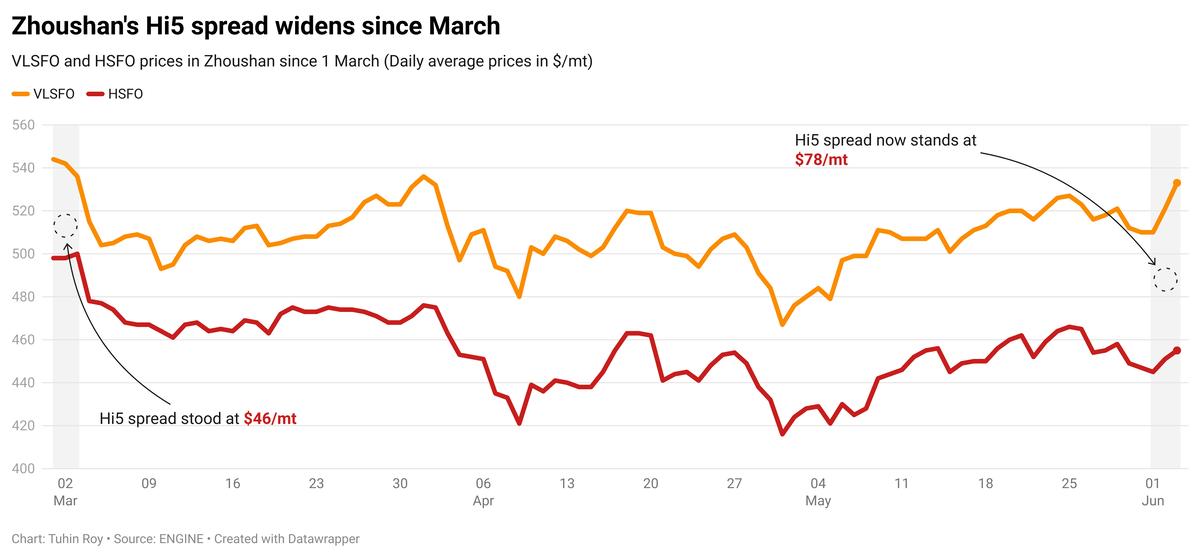

The port’s HSFO benchmark has also risen, though less sharply than VLSFO, leading to an $8/mt increase in Zhoushan’s Hi5 spread, which now stands at $78/mt. This spread remains higher than Singapore’s $64/mt but lower than Fujairah’s $86/mt.

VLSFO supply in Zhoushan has improved, with most suppliers now recommending lead times of 4–7 days, down from 7–10 days last week. HSFO lead times have also shortened, from 5–7 days to 3–5 days. In contrast, LSMGO lead times have increased from 3–5 days to 4–7 days.

In northern China, both Dalian and Qingdao continue to offer good availability of VLSFO and LSMGO, though HSFO remains limited in Qingdao. Tianjin still faces tight supply for both VLSFO and HSFO, while LSMGO is readily available. In Shanghai, VLSFO and HSFO remain under pressure, but LSMGO is well stocked.

Further south, Fuzhou reports healthy inventories of both VLSFO and LSMGO. Xiamen has adequate VLSFO supply, though LSMGO is tight. Prompt delivery of both VLSFO and LSMGO remains challenging in Yangpu and Guangzhou.

Brent

The front-month ICE Brent contract has inched up by $0.14/bbl on the day, to trade at $64.82/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent futures have found support amid escalating geopolitical tensions, as the conflict between Russia and Ukraine has intensified and Iran is reportedly prepared to reject a nuclear deal proposal from the US.

Over the weekend, Ukraine and Russia engaged in one of the largest drone battles of their war. Additionally, Ukraine blew up a Russian highway bridge as a passenger train crossed and launched an attack on nuclear-capable bombers deep inside Siberia, according to Reuters.

"Oil prices were supported by rising geopolitical tensions. Ukraine struck air bases deep in Russia, putting a dent in efforts to reach a peace deal," commented Daniel Hynes, senior commodity strategist at ANZ Bank.

Meanwhile, a senior Iranian diplomat told Reuters on Monday that Iran was set to reject a US proposal to resolve the decades-old nuclear dispute, as the plan does not meet Iran's interests. If the nuclear talks with Iran collapse, ongoing sanctions could continue to restrict Iranian oil supply, thereby supporting global oil prices.

Further support has come from a weak dollar. The dollar index hovered near six-week lows earlier today as investors assessed the potential impact of President Donald Trump's tariff policies, which could slow economic growth and fuel inflation. A weaker dollar typically supports Brent's price, as it makes dollar-priced commodities like oil more affordable for holders of other currencies.

Additionally, eight OPEC+ members agreed to raise their combined oil output by 411,000 b/d in July, compared to June’s levels. This increase was smaller than many in the market had expected, easing concerns about a significant supply surge.

Dollar weakness, growing geopolitical tensions and "a supply hike from OPEC+ that fell short of expectations all provided a boost," two analysts from ING Bank noted.

Downward pressure:

Kazakhstan has informed OPEC that it does not intend to cut its oil production, according to a Thursday report by Russia's Interfax news agency, citing the country’s deputy energy minister, Reuters reported.

This announcement has added some downward pressure on Brent prices.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.