Americas Market Update 2 Jun 2025

Bunker benchmarks in the Americas have tracked Brent’s upward movement, and hurricane season has begun in the Atlantic basin.

IMAGE: Cargo operations underway at a port in United States. Getty Images

IMAGE: Cargo operations underway at a port in United States. Getty Images

Changes on the day from Friday, to 08.00 CDT (13.00 GMT) today:

- VLSFO prices up in New York ($26/mt), Balboa ($20/mt), Houston and Los Angeles ($18/mt)

- LSMGO prices up in New York ($26/mt), Balboa ($23/mt), Houston ($17/mt) and Los Angeles ($9/mt)

- HSFO prices up in Balboa ($32/mt), New York ($24/mt), Los Angeles ($11/mt) and Houston ($7/mt)

New York's LSMGO price, which saw the one of the highest price increases in the past session, is currently trading at a small premium of $10/mt to Philadelphia, and at a discount of $45/mt to Norfolk.

Both VLSFO and LSMGO are readily available at the port, with suppliers recommending lead times of 3–5 days for prompt deliveries.

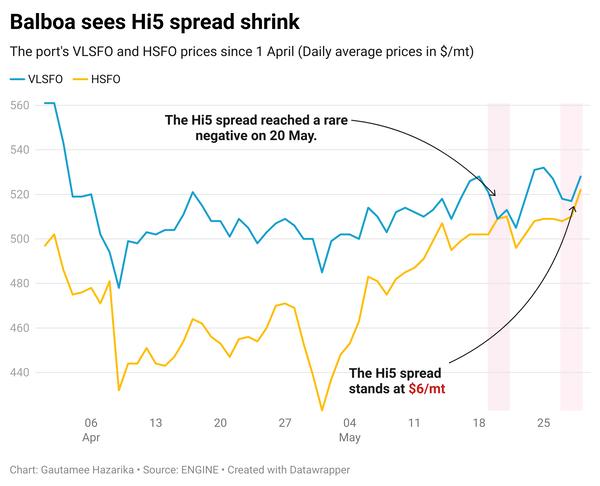

Balboa's Hi5 spread reached $32/mt today, steadily gaining after having shrunk over the past 2-3 weeks. Suppliers report that bunker demand in Panama has remained subdued.

The hurricane season for the Atlantic basin is now in effect and could disrupt bunkering operations at key ports across the Americas. Adverse weather conditions, especially along the US Gulf Coast and Caribbean regions, are known to typically cause port closures, reduced availability, and delays in bunker fuel deliveries.

Brent

The front-month ICE Brent contract has gained $1.65/bbl on the day from Friday, trading at $65.42/bbl at 08:00 CDT (13:00 GMT).

Upward pressure:

Brent futures have found some support after eight OPEC+ members—Saudi Arabia, Russia, Iraq, the UAE, Kuwait, Kazakhstan, Algeria and Oman—agreed to increase their combined oil supply by 411,000 b/d in July, compared to June's production levels. This move came as a relief to market participants who had anticipated a larger supply boost.

“Crude futures were trading… higher early Monday… after the OPEC/non-OPEC Group of 8 on Saturday decided to raise their combined production target by 411,000 b/d for July, avoiding a more bearish course of action,” said Vandana Hari, founder and analyst at Vanda Insights.

“The latest increase is in line with our expectations,” two analysts from ING Bank commented.

Meanwhile, data from the US Energy Information Administration (EIA) showed that US fuel oil production in May averaged 8% less per day compared to April.

This decline, along with low US fuel inventories and concerns about an above-average hurricane season, has added to market supply jitters and contributed to upward pressure on prices.

Downward pressure:

Kazakhstan has notified OPEC that it does not plan to cut its oil production, according to a Thursday report by Russia's Interfax news agency, citing Kazakhstan's deputy energy minister, Reuters reported.

The announcement has put some downward pressure on Brent's price.

By Gautamee Hazarika and Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.