East of Suez Market Update 23 May 2025

Most prices in East of Suez ports have moved up, and supply of VLSFO and LSMGO is tight across several Indian ports.

Changes on the day to 17.00 SGT (09.00 GMT) today:

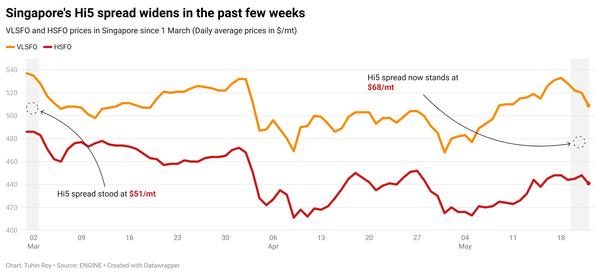

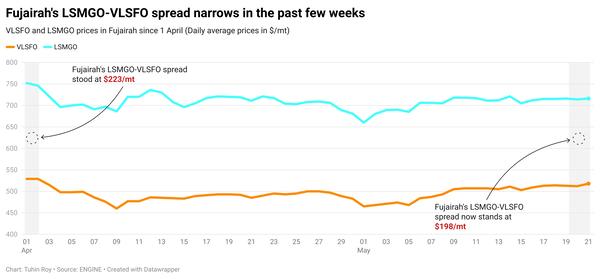

- VLSFO prices up in Zhoushan ($6/mt), Singapore ($4/mt) and Fujairah ($2/mt)

- LSMGO prices up in Zhoushan ($5/mt) and Fujairah ($4/mt), and down in Singapore ($11/mt)

- HSFO prices up in Zhoushan ($6/mt), Singapore ($5/mt) and Fujairah ($3/mt)

- B24-VLSFO at a $201/mt premium over VLSFO in Singapore

- B24-VLSFO at a $214/mt premium over VLSFO in Fujairah

VLSFO benchmarks in East of Suez ports have remained largely stable over the past day, with no significant price fluctuations. In Zhoushan, VLSFO is priced at a premium of $16/mt over Fujairah and $8/mt over Singapore. Lead times for VLSFO in Zhoushan are steady at 4–7 days amid subdued demand.

LSMGO lead times in Zhoushan have shortened from around seven days last week, to 3–5 days. HSFO lead times have also improved, now at 3–5 days, down from roughly seven days.

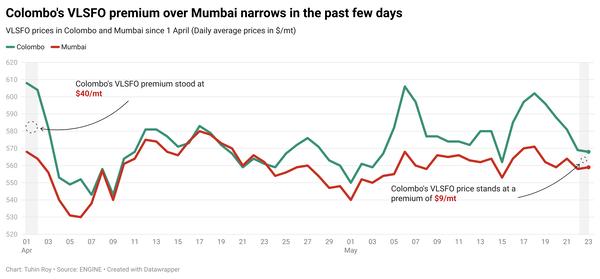

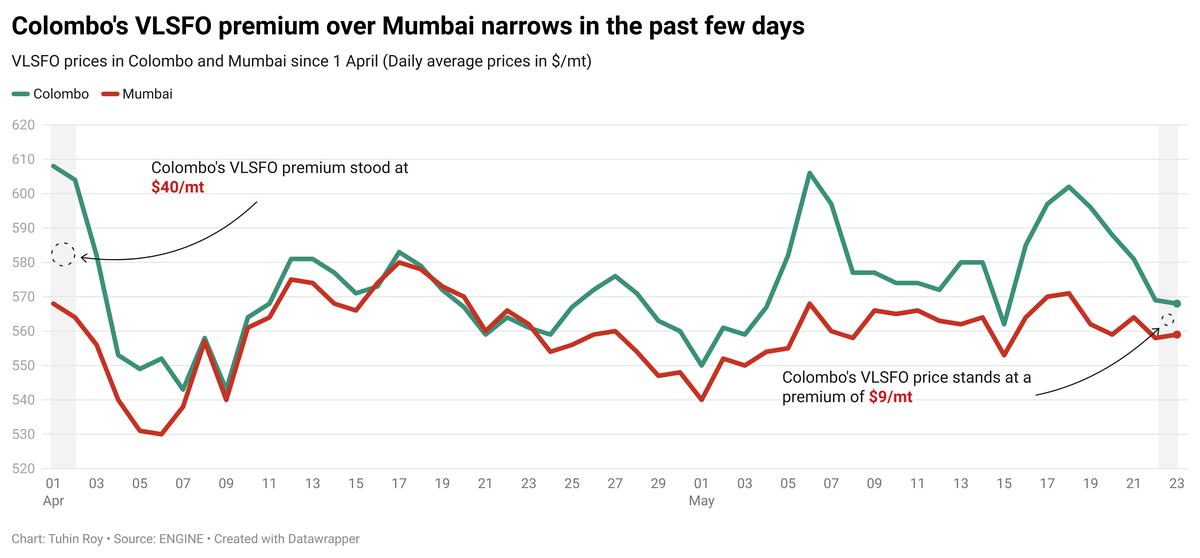

In Sri Lanka, Colombo’s VLSFO price stands at a slight premium of $9/mt over Mumbai.

Availability of all grades remains stable at both Colombo and Hambantota ports, with lead times of around four days, nearly unchanged from last week. However, bad weather is forecast in Colombo between 26 May-1 June, which may disrupt bunker deliveries.

VLSFO supply continues to be tight at several Indian ports, including Mundra, Kandla, Mumbai, Tuticorin, Chennai, Visakhapatnam and Cochin, consistent with recent trends. A supplier in Haldia and Paradip is reportedly close to depleting its stock.

LSMGO availability at most Indian ports remains subject to enquiry. Adverse weather is expected to affect bunker operations at Kandla from 24 May–1 June, Sikka between 24–31 May, and Kochi from 26 May–1 June.

Brent

The front-month ICE Brent contract has inched $0.07/bbl lower on the day, to trade at $64.05/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price has felt some upward pressure following renewed pressure on Russian oil exports.

The European Union (EU) has adopted a 17th sanctions package against Moscow, targeting its shadow fleet of nearly 200 oil tankers carrying Russian crude oil.

“The EU has listed 189 additional vessels that are part of the shadow fleet of oil tankers or contribute to Russia's energy revenues, bringing the total number of listings to 342,” the European Commission said in a statement.

“The EU is throwing around the idea of lowering the G7 price cap for Russian oil,” two analysts from ING Bank said.

Meanwhile, finance ministers and central bankers of the G7 group of developed nations condemned Russia’s aggression in Ukraine at a summit in Canada yesterday. They threatened to “maximize pressure such as further ramping up sanctions” if no progress is made towards a peace deal with Ukraine.

Downward pressure:

Brent has slipped following reports of oversupply in the global oil market.

The Saudi Arabia-led OPEC+ alliance is considering a third consecutive output hike of 411,000 b/d in July, according to a Bloomberg report.

“What it does indicate is that leaders, including Saudi Arabia, are serious in their efforts to force members, who are overproducing against their quotas, to rein in supply,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

Oil market analysts currently await the 1 June OPEC+ meeting, where the group is expected to finalise output levels for July.

“The oil market is under renewed pressure as noise builds around what OPEC+ will do with their July output levels,” ING Bank analysts said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.