East of Suez Market Update 21 May 2025

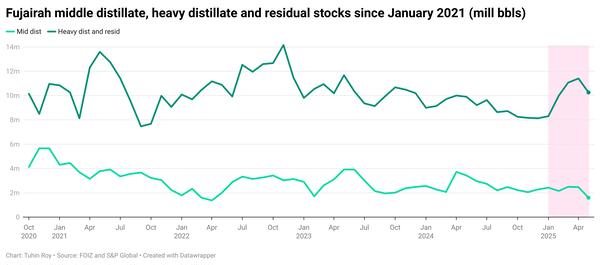

Most prices in East of Suez ports have moved up, and prompt availability of all grades is tight in Fujairah.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Singapore ($6/mt), Fujairah and Zhoushan ($3/mt)

- LSMGO prices up in Singapore ($9/mt) and Zhoushan ($4/mt), and down in Fujairah ($5/mt)

- HSFO prices up in Zhoushan ($6/mt), Fujairah and Singapore ($5/mt)

- B24-VLSFO at a $208/mt premium over VLSFO in Singapore

- B24-VLSFO at a $225/mt premium over VLSFO in Fujairah

VLSFO prices in East of Suez ports have increased some, rising by $3–6/mt over the past day. Fujairah's VLSFO is at a $9/mt discount to Singapore and a $7/mt discount to Zhoushan.

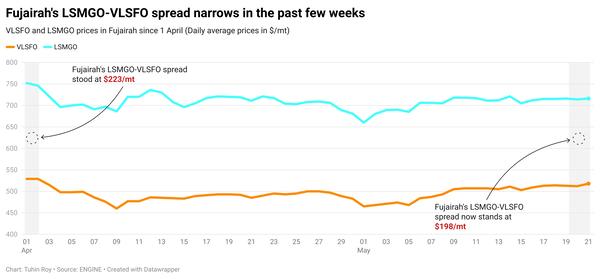

Fujairah’s LSMGO price has dipped, while prices in Singapore and Zhoushan have edged up. The drop in Fujairah is partly due to a lower-priced 50–150 mt LSMGO deal, which pulled the benchmark down. Despite this decline, Fujairah’s LSMGO remains at a $97/mt premium over Singapore and a $67/mt premium over Zhoushan.

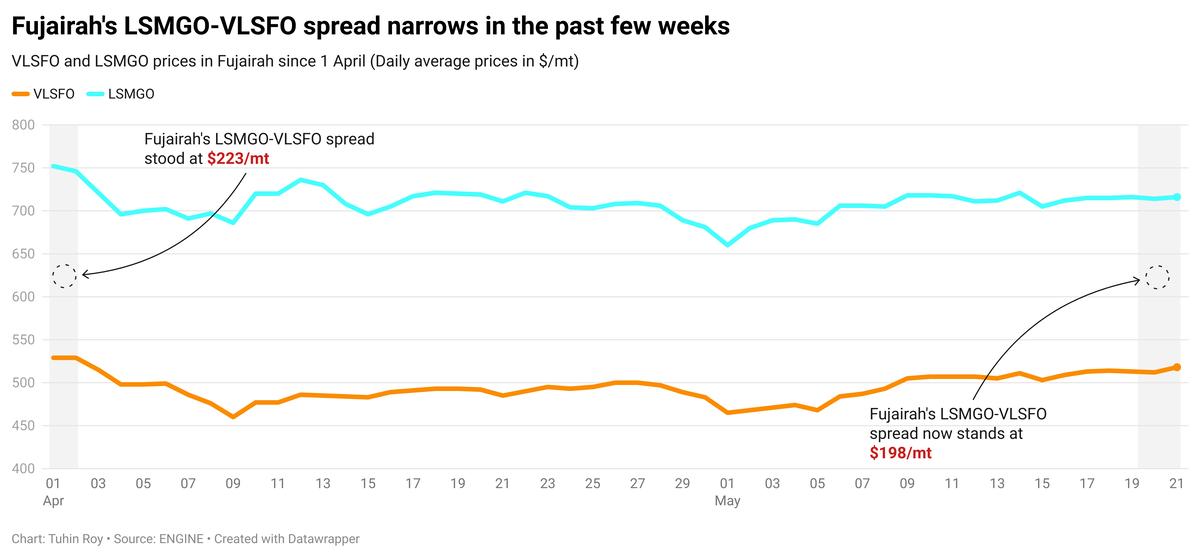

The differing price trends in Fujairah have narrowed its LSMGO–VLSFO spread by $4/mt, to $198/mt now, down from a high of $223/mt in early April.

Prompt bunker availability in Fujairah remains tight, with lead times for all fuel grades holding steady at 5–7 days. Suppliers in Khor Fakkan also require similar lead times.

In contrast, Omani ports—Sohar, Salalah, Muscat and Duqm—continue to offer strong LSMGO availability.

Brent

The front-month ICE Brent contract has pushed $0.74/bbl higher on the day, to trade at $66.20/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent has gained following reports that Israel could soon be targeting Iran’s nuclear facilities. US intelligence suggests that Israel is actively preparing to strike Iran, according to a CNN report citing officials familiar with the matter.

“The news, based on US intelligence, may signal a significant escalation, prompting the oil market to price in a larger geopolitical risk premium for the region,” two analysts from ING Bank note.

Iran, an OPEC+ member, currently produces around 3.3 million b/d of oil, according to OPEC's latest oil market report.

“Such an escalation would not only put Iranian supply at risk, but also in large parts of the broader region,” the ING Bank analysts argue.

Downward pressure:

Brent has felt some downward pressure after the American Institute of Petroleum (API) reported another rise in US crude stocks, which could signal weaker oil demand. Commercial US crude oil inventories rose by about 2.5 million bbls in the week ending 16 May, according to API estimates.

The change in crude stocks was not as constructive as changes in gasoline and distillate inventories, ING Bank analysts said.

Official US government crude stocks data from the US Energy Information Administration (EIA) is due for release later today.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.